Inclusion of domestic sovereign bonds in global indices, coupled with strong macro-economic fundamentals and widening interest rate differential between the US and India, should keep foreign inflows strong.

Prerna Singhvi, CFA

Vice President – Economic Policy and Research

National Stock Exchange of India Limited (NSE)

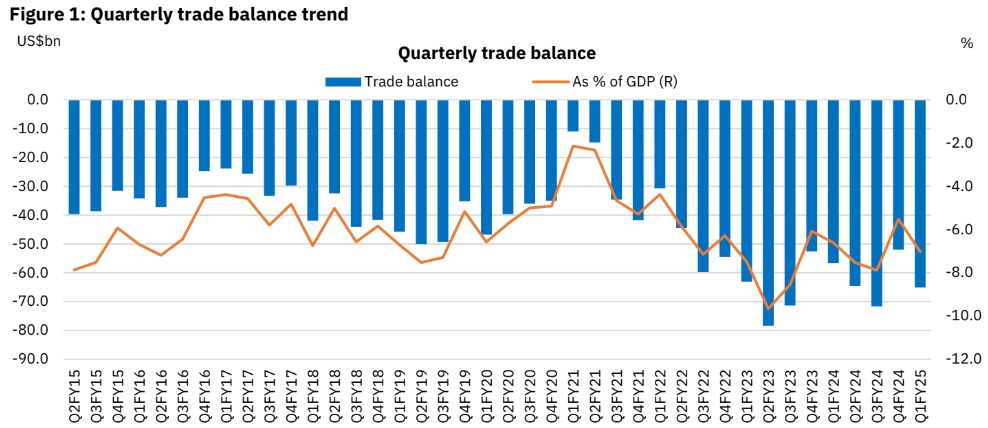

Mumbai, 1 October, 2024: India’s current account deficit slipped back into deficit of US$ 9.7bn (1.1% of GDP) in Q1FY25 after registering a downwardly revised surplus of US$ 4.6bn (0.5% of GDP) in the previous quarter. This is primarily on the back of widening of merchandise trade deficit (+25.2% QoQ) and lower net service receipts (four-quarter low). While growth in merchandise imports came in at a modest 1.5% QoQ, merchandise exports witnessed a sequential contraction of 8.6%, reflecting weak global demand and geopolitical tensions translating into longer shipping routes. Invisibles also declined marginally on a QoQ basis, even as the YoY growth came in at a robust 16%, higher than the last 20-year average growth of 12.5% (excluding the COVID year). Strong YoY growth in software services was partly offset by net outflows from travel-related services. The surplus in capital account nearly halved to US$ 14.4 bn, thanks to lower banking capital inflows and foreign portfolio outflows from Indian equities, weighed down by geopolitical tensions and election-led uncertainty. This was partly offset by recovery in foreign direct investment (FDI), that rose to an eight-quarter high of US$ 6.3bn. Consequently, the overall BOP surplus moderated to US$ 5.2bn in Q1, almost one-sixth of the figure reported in the previous quarter.

Notwithstanding the lingering geopolitical tensions and its implications for India’s exports, the overall BOP position is likely to remain broadly stable led by buoyant services exports, benign crude oil prices, renewed foreign portfolio inflows (particularly in debt markets) and revival in FDI flows. Higher imports in this fiscal thus far (+7.1% in Apr-Aug’24), however, may see further upside led by festive season demand, even as benign crude and commodity prices is likely to keep the deficit contained. Inclusion of domestic sovereign bonds in global indices, coupled with strong macro-economic fundamentals and widening interest rate differential between the US and India, should keep foreign inflows strong. Record level of foreign exchange reserves at US$ 692.3bn as of September 20th, 2024, provides a strong buffer against external vulnerabilities. This, along with proactive intervention by the RBI, should reduce unwarranted rupee volatility amidst unfavourable global cues.