Avendus Wealth and Hurun India's Uth Series 2025 features 36 women, with the average age across both men and women standing at 35

FinTech BizNews Service

Mumbai, India 21 January 2026: Avendus Wealth and Hurun India today unveiled the Avendus Wealtun India Uth Series 2025, recognising 436 young and exceptional, established young and experienced leaders making a significant impact across Indian industry. The Uth Series offers insights from the U30, U35 and U40 Lists, providing a comprehensive view of India’s young top leaders.

1 Bengaluru tops the Uth Series 2025; Mumbai and New Delhi round out India’s leading startup hubs.

Bengaluru leads the Uth Series with 109 entrepreneurs across all three age cohorts, driven largely by its strong showing in the U35 (54) and U40 (48) lists. This geographic concentration echoes the evolution of Bengaluru as India's primary technology hub. In 2025 alone, Karnataka announced INR 1 lakh cr in infrastructure investments, including the development of a dedicated AI city and policies to attract Global Capability Centers (GCCs).

Bengaluru’s dominance is a reflection of its structural advantages: The country’s highest concentration of venture capital firms, networks of angel investors and three decades of accumulated maturity of the startup ecosystem that creates self-reinforcing momentum in attracting talent, capital and founding teams seeking established networks and proven exit pathways.

Mumbai follows with 87 entrants, driven by a strong U40 cohort (43), while New Delhi stands third with 45 entrants.

Gurugram contributes 36 entrants, led largely by its notable base of U40 entrepreneurs (24). San Francisco adds an international dimension with 18 entrants, reflecting the global footprint of India’s growing pool of business leaders.

Across other major cities, Noida, Hyderabad, Ahmedabad, Kolkata and Chennai show consistent participation across the three cohorts.

2 IIT Kharagpur leads the Uth Series with 27 entrants, securing the top position as a top contributor to India’s next generation of leaders.

IIT Delhi follows closely with 26 entrants, while IIT Madras ranks third with 22 entrants. IIT Bombay takes the fourth spot with 20 entrants, supported by strong representation in the U35 (9) and U40 (9) cohorts. IIT Roorkee rounds out the top five with 16 entrants. Together, the IITs continue to shape India’s talent landscape, producing a steady stream of influential founders and business leaders.

------------------------------------------------------------------------------------

Uth Series at a Glance

· Companies founded by Avendus Wealth – Hurun India Uth Series 2025 entrepreneurs collectively command a valuation exceeding USD 950 bn (INR 83 lakh crore), surpassing the GDP of Switzerland

· The Avendus Wealth Hurun – India Uth Series companies collectively employ over 1.2 mn people

· With a workforce of 247,782, Reliance Retail, led by the U35 entrant Isha Ambani (33), ranks as the largest employer in the Uth Series 2025

· With 349 entrants, accounting for nearly 80% of the 436 entrants, first-generation entrepreneurs dominate the Avendus Wealth – Hurun India Uth Series 2025

· With 37 entrants, the second generation emerges as the strongest contributor among family business leaders, outpacing all older generations

· The Uth Series 2025 features 36 women, with the average age across both men and women standing at 35

· IIT Kharagpur led with the highest representation of entrants (27) in the Avendus Wealth – Hurun India Uth Series 2025, ahead of IIT Delhi (26) and IIT Madras (22)

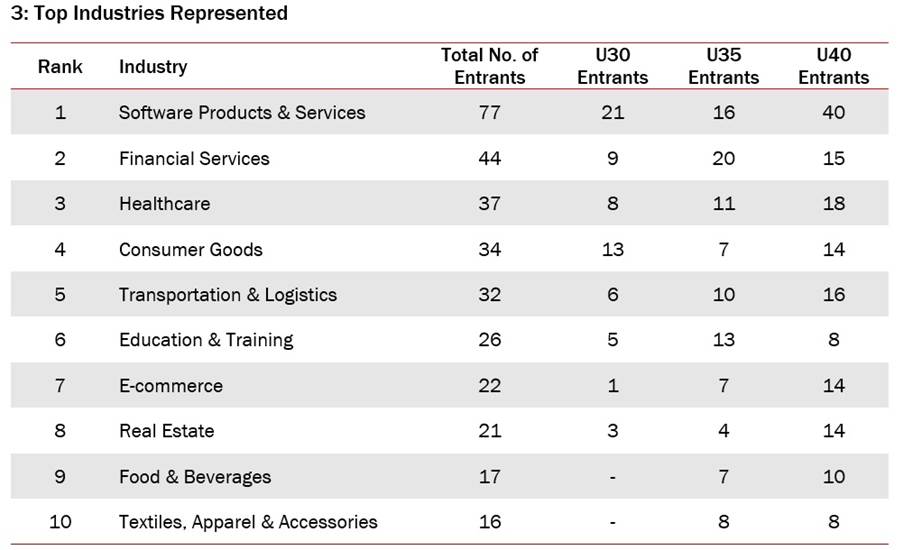

Software Products & Services dominates as the most represented industry, contributing 77 entrants, followed by Financial Services and Healthcare with 44 and 37 entrants, respectively

· The Uth Series 2025 entrepreneurs are leading India’s AI race, with 37 entrants in the sector and a cumulative valuation of INR 2.55 lakh cr

· Bengaluru emerges as India’s undisputed “Uth entrepreneurial” capital, contributing 109 entrants, followed by Mumbai with 87 and New Delhi with 45

· Nikhil Kamath is India’s most followed Uth entrepreneur on LinkedIn with 1.39 mn followers, closely followed by Ritesh Agarwal at 1.32 mn followers

· Ghazal Alagh remains the most followed woman entrepreneur on the list, with 633K followers

--------------------------------------------------------------------------------------

3 Sectors Shaping India’s Uth Series at a Glance

Software Products & Services dominate the Uth Series with 77 entrants, representing 18% of the total entrants, and are particularly strong among the U30 founders. This mirrors India's booming SaaS market, projected to grow at 27.3% CAGR to reach USD 62.93 bn by 2032.

Financial Services follows with 44 entrants, supported primarily by a strong U35 cohort. India's fintech sector, now the world's third-largest ecosystem, which raised USD 1.6 bn in just the first nine months of 2025, with early-stage startups attracting a disproportionate share of capital. Meanwhile, healthcare ranks third with 37 entrants, driven by AI-powered diagnostics and regional digital health solutions serving underserved markets. The sector has raised USD 828 mn in the first half of 2025 alone, making it the second-most funded vertical after Software Products & Services here.

Consumer Goods contributes 34 entrants, followed by Transportation & Logistics with 32 and Education & Training with 26. E-commerce, Real Estate, Food & Beverages and Textiles, Apparel & Accessories together add 76 entrants, highlighting the wide industry diversity of entrepreneurs featured across the Uth Series.

4 Self-made Leaders and Legacy Holders

India’s entrepreneurial landscape is being reshaped in remarkable ways. Of the 436 entrepreneurs featured in the Uth Series, 349, nearly 80%, are first-generation entrepreneurs, highlighting the growing dominance of self-made founders. This trend highlights a move away from inherited enterprise towards merit, ambition and fresh ideas.

Second-generation leaders account for 37 entrants (8.5%), and third-generation entrepreneurs for 36 (8%). Together, these cohorts reflect the continued evolution of family enterprises alongside a far larger wave of first-generation founders shaping India’s business future.

Fourth- and fifth-generation leaders, with 10 and 4 entrants respectively, contribute a smaller but notable share, pointing to the role legacy business families continue to play alongside India’s self-made founders.

5 Gender Representation: Early Momentum Amid a Persistent Gap

This table reveals that men significantly dominate the list with 400 entrants, distributed across U30 (74), U35 (140) and U40 (186). Conversely, 36 women feature in the Uth Series: U30 (6), U35 (15) and U40 (15), indicating a gradual but discernible increase in female participation as ventures scale and mature. While the gap remains significant, the data points to early momentum that could accelerate as access to capital, mentorship and visibility for women-led enterprises continues to improve.

6 From Boardrooms to Social Feeds: The Most Followed Minds of India’s Uth Entrepreneurs

On LinkedIn, India’s startup leaders are proving that personal brand goes beyond mere vanity. Nikhil Kamath of Zerodha tops the charts with 1.39 mn followers, closely trailed by Ritesh Agarwal of PRISM (OYO) at 1.32 mn and Ghazal Alagh of Mamaearth with 633,000. The scale of engagement around these founders highlights how personal credibility and business momentum increasingly move in tandem.

A visible, credible voice can expand customer reach, signal market understanding to investors and attract top talent, often simultaneously. It is no coincidence therefore that these highly followed entrepreneurs also lead unicorn companies – their credibility online translates directly into business outcomes offline. This growing influence of LinkedIn points to a structural shift in India’s startup ecosystem. Founder credibility is no longer built only in boardrooms or through balance sheets, but rather it is shaped in real time on social platforms, where ideas, vision and leadership are on display for millions to see.

7 The Largest Uth Series Employers

Reliance Retail tops the list with a massive workforce of over 2.48 lakh employees, reflecting its scale and deep penetration across India’s retail landscape. Shahi Exports follows with 1 lakh employees, highlighting its position as one of the country’s largest apparel manufacturers.

Reliance Jio Infocomm, RP-Sanjiv Goenka Group and Apollo Hospitals round out the list, each employing tens of thousands across telecommunication, diversified businesses and healthcare, respectively.

8 Bengaluru Emerges as the Prime Base for India’s Uth Leaders

Bengaluru leads as the top headquarter city with 72 companies, reaffirming its position as India’s foremost hub for innovation, technology, and high-growth enterprises. Mumbai follows closely with 64 companies. Gurugram ranks third with 40 companies, New Delhi ranked fourth with 14 companies, followed by Noida with 13 companies, underscoring a diversified and dynamic business ecosystem.

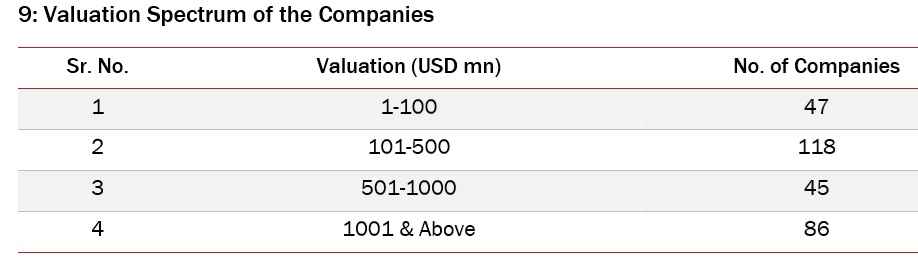

9 Valuation Landscape of Uth Series Companies

This table maps the valuation landscape of Uth series, capturing their journey from early-stage startups to high-growth, high-value businesses. The data underscores how many have crossed critical valuation thresholds, signalling impressive expansion and market validation.

10 India’s Most Funded Uth Series Startups

India’s startup ecosystem is increasingly being shaped by a new generation of founders who are rewriting the rules of entrepreneurship. At the forefront is Ritesh Agarwal, who at 31 has steered PRISM (OYO) to raise USD 3.7 bn, placing it among the most well-capitalised in the ecosystem. Followed by Zepto’s founders, Aadit Palicha and Kaivalya Vohra, barely out of college at 22, yet already commanding USD 1.95 bn in funding. Meesho follows closely, with USD 1.36 bn built under the leadership of its founders Sanjeev Barnwal and Vidit Aatrey, in their mid-thirties.

What unites these companies is not just the quantum of funding, but a broader signal in capital allocation. Investment is increasingly directed towards first-generation founders building category-defining businesses in sectors central to consumption: Mobility, quick commerce and e-commerce.

Beyond the top tier, companies such as ShareChat, CARS24, Uniphore, Improbable Worlds, Perplexity, OfBusiness and Zetwerk, each having raised between USD 850 mn and USD 1.3 bn, reflect the breadth of investor conviction, extending well beyond software into diverse, high-impact industries.

11 Funding Stages of Uth Series Startups

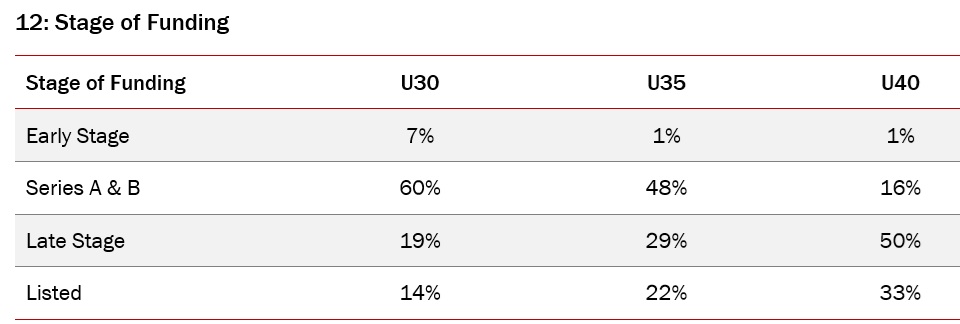

U30 founders’ startups are mostly in the early growth stage, with 60% of their companies at this level and 19% already in the late stage. U35 founders’ ventures, by contrast, show a more balanced distribution across funding stages, with 48% in Series A & B and 29% in late stage, signalling a strong shift toward scaling.

Among U40 founders’ startups, the focus moves further toward maturity, with 50% of their companies in the late stage and 33% already listed, reflecting well-established enterprises approaching or operating in public markets.

Overall, the journey from U30 to U40 demonstrates a natural evolution from early-stage entrepreneurship to more advanced, growth-stage and publicly listed companies.

12 Uth Series Ventures with the Largest Investor Base

A closer look at India’s most heavily backed startups reveals a clear link between the industries they operate in and the kind of investor attention they attract. Deep-tech and infrastructure ventures, whether in Web3, AI-powered search or SpaceTech, are pulling in the largest investor pools, thanks to their strong intellectual property, global scalability and the advantage of being early movers in new markets. Fintech continues to be a magnet as well, offering predictable monetisation models and benefiting from regulatory changes that are steadily pushing the country toward digital-first financial systems. On the consumer side, investors are more discerning. Big funding rounds tend to flow only to those ventures that solve complex operational challenges, like supply-chain or logistics hurdles, rather than relying on branding alone. Taken together, these trends show that investors are increasingly drawn to companies building the foundational digital infrastructure of tomorrow, rather than incremental consumer products of today.

Alchemy, founded by Nikil Viswanathan, leads with a total of 59 investors, signalling strong global confidence in its growth trajectory. Purple Style Labs and Perplexity follow with 50 and 40 investors, respectively, showing broad institutional interest in fashion-tech and AI-driven ventures.

Razorpay and Pixxel share the fourth rank with 34 investors each, reflecting sustained enthusiasm for fintech and space-tech innovations. Saveo, PRISM (OYO), Infra.Market, Zepto, Licious and Wint Wealth complete the list, each backed by a sizeable investor base that highlights robust sectoral interest across consumer tech, logistics and new-age retail.

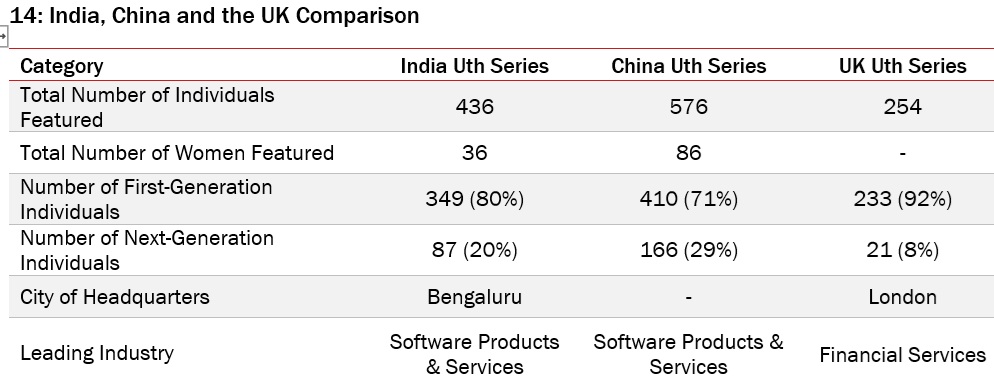

13 India, UK and China: A Comparison of Hurun’s Uth Series

Entrepreneurship takes different shapes across countries. In India, where 80% of founders are first generation entrepreneurs, a young population, expanding middle class, and rapid digital adoption have lowered entry barriers and fuelled a surge in tech-led ventures, with Bengaluru at the centre. China’s entrepreneurship reflects scale and state strategy, with Beijing’s tech dominance driven by a national push for self-reliance and a large urban talent base. In the UK, entrepreneurial activity naturally gravitates toward financial services, with London’s status as a global finance hub supporting strong growth in banking and fintech.

Across India, China and the UK, a total of 1,266 entrepreneurs under the age of 40 have been featured, with 436 from India, 576 from China, and 254 from the UK. The UK leads in first-generation entrepreneurship with 92%, followed by India at 80% and China at 71%, reflecting varied levels of entrepreneurial maturity across these markets.

On gender representation, China features the highest number of women with 86, followed by India with 36. The headquarters of these ventures reflect each country’s innovation hubs: Bengaluru for India and London for the UK. Sector-wise, Software Products & Services dominate both India and China and Financial Services stand out in the UK.

15 Notable Company Developments Across the Uth Series 2025

Uth Series Eligibility for First-Generation Founders and Next-generation Leaders

Employee figures have been obtained through company annual reports, media coverage and reputable data platforms. The cut-off date for the U30 category was 20 March 2025, while the cut-off date for the U35 and U40 categories was 01 September 2025.