Credit quality outlook positive for fiscal 2025, geopolitical events bear watching

FinTech BizNews Service

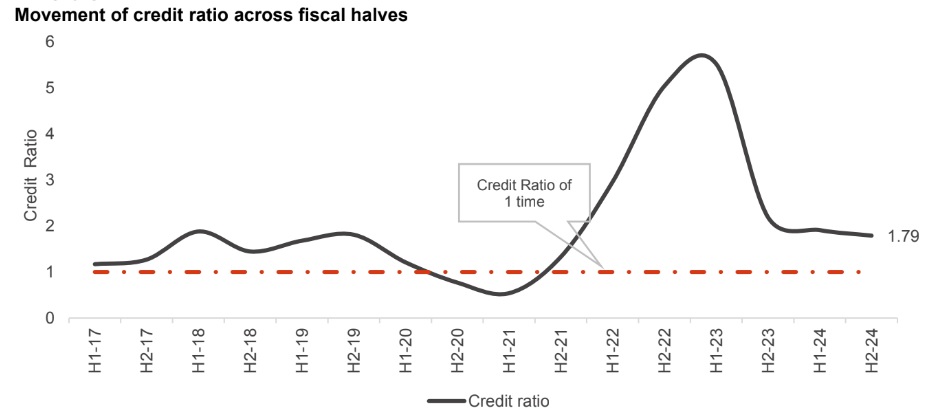

Mumbai, April 1, 2024: In line with our expectations, the CRISIL Ratings credit ratio (rating upgrades to downgrades) moderated in the

second half of fiscal 2024 but remained elevated at 1.79 times compared with 1.91 times in the first half (see chart in

annexure). In all, there were 409 upgrades and 228 downgrades.

For fiscal 2025, the credit quality outlook remains positive with upgrades seen continuing to outpace downgrades,

driven by domestic demand, low corporate debt levels and tailwinds from the ongoing infrastructure build-out.

The upgrade rate dipped a marginal ~70 basis points to 12.0% compared with the first half. Sectors gaining from

strong domestic consumption and government spending dominated the upgrades. The infrastructure and linked

sectors outperformed the CRISIL Ratings portfolio with construction, renewable power and road assets leading the

upgrades.

The downgrade rate, at 6.7%, remains closer to the 10-year average. As expected, some export-linked sectors, such

as textile and seafood saw a higher downgrade rate due to subdued global demand or high-cost inventory that

impacted profitability.

That said, the reaffirmation rate remained steady at ~81%.

Says Gurpreet Chhatwal, Managing Director, CRISIL Ratings, “The three key pillars of India Inc’s credit quality

— deleveraged balance sheets, sustained domestic demand and government-led capex — kept the upgrade

rate elevated in the second half of fiscal 2024. That’s above the 10-year average for the sixth consecutive half-

year. While commodity prices have softened, revenue of upgraded companies grew ~13% in fiscal 2024

largely led by a pick-up in volume. With balance sheets in most sectors at their healthiest, capacity utilisation

around peak levels and expected interest rate cuts, a broad-based pick-up in private capex is finally in sight.”

The proprietary CRISIL Ratings’ credit quality framework1

for the corporate and infrastructure sectors — the COIN2

framework — provides our credit quality outlook for fiscal 2025 on 38 sectors accounting for ~72% of the rated debt.

Key takeaways from our COIN framework:

• For fiscal 2025, as many as 21 of 26 corporate sectors have strong to favourable credit quality outlook, marked by

robust balance sheets and healthy operating cash flows — expected to be as much, or higher, than in fiscal 2024

− These include auto-component manufacturers, hospitality and education sector companies where the credit

quality is supported by healthy domestic demand

− It also includes sectors benefiting from the government’s infrastructure spending, such as construction

companies, and steel, cement and capital goods manufacturers

• Four corporate sectors — specialty chemicals, agrochemicals, textile cotton spinning and diamond polishers are

facing headwinds given their fortunes are aligned with global macroeconomic conditions, which are subdued at

present. Barring diamond polishers, the other three are expected to witness partial recovery, following a

challenging fiscal 2024. That said, these sectors do have strong balance sheets and hence the outlook on the

sectors is stable to moderate

• Only one corporate sector — auto dealers — is expected to have a moderate credit quality outlook. While cash

flows here are expected to grow, balance sheets have relatively higher leverage to fund inventory needs

• All 12 infrastructure sectors have strong to favourable credit quality outlook. They are benefiting from government

initiatives in renewable energy and logistics. Residential real estate is riding on buoyant consumer demand, with

inventory levels expected to drop further in fiscal 2025 despite new launches

• Notably, none of the sectors analysed has a negative credit quality outlook

1

In this edition, we have changed the framework representation and renamed it as corporate and infrastructure credit quality

framework and realigned the number of sectors for a more meaningful representation.

2 Credit quality outlook framework for Corporate and Infrastructure sectors. The framework factors growth in cash flows and

balance sheet strength for corporates while revenue growth and movement in debt protection cover are considered for infra.

2

The financial sector’s (banks and non-banks) strong credit quality is supported by steady credit growth, healthy

capitalisation and stable asset quality.

For banks, credit growth is expected to remain healthy in fiscal 2025, but grow a tad slower at ~14%, compared with

~16% estimated for fiscal 2024, given the likely moderation in economic growth. A key monitorable here would be the

ability to mobilise cost-effective deposits. While rising deposit rates could impact net interest margins, asset quality

metrics are likely to be benign with gross non-performing assets continuing to decline.

For non-banks, growth in assets under management may moderate to 15-17% in fiscal 2025 from ~18% in fiscal

2024, with regulatory measures curtailing expansion of the unsecured loan book even as traditional segments grow at

a steady pace. The asset quality outlook is stable for most non-bank segments, but remains monitorable for

unsecured and microfinance loans.

Says Somasekhar Vemuri, Senior Director, CRISIL Ratings, "The outlook on India Inc’s credit quality is

positive for the first half of fiscal 2025, with upgrades expected to outnumber the downgrades. This is largely

led by tailwinds from the domestic economy and despite export-linked sectors only gradually ticking up in the

wake of uneven global recovery. Domestically, food inflation still weighs on rural demand even as the overall

inflationary pressure eases. To maintain its favourable position, India Inc will need to be watchful of supply-

chain disruptions from escalation in geopolitical tensions."