Manufacturing sector relatively steady, slowdown in services evident

FinTech BizNews Service

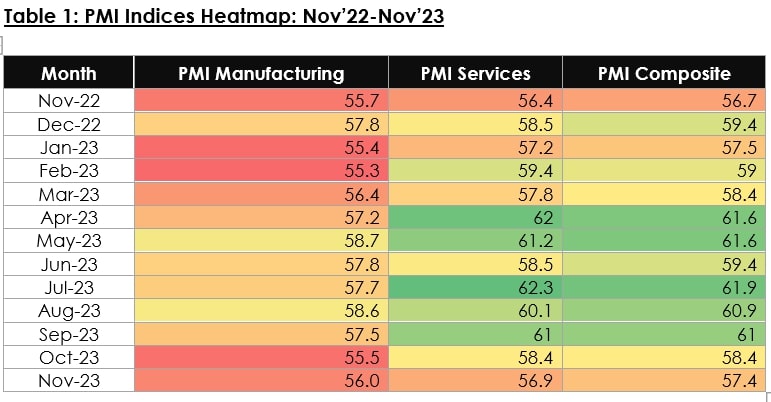

Mumbai, December 6, 2023: India Manufacturing PMI (Purchasing Managers’ Index) remained largely steady with only a modest uptick, rising to 56.0 in Nov-23 from 55.5 in Oct-23. On the other hand, PMI Services witnessed a larger decline from 58.4 in the previous month to 56.9 which is the lowest print in the current fiscal. Consequently, PMI Composite has also dropped to 57.4 in Nov-23 from 58.4 in Oct-23. While all these readings remain higher than 55.0 and continue to reflect a fairly healthy undercurrent of economic activity in both manufacturing and services sectors, the moderation in the PMI trajectory over Oct-Nov’23 indicates a potential slowdown in GDP growth in H2FY24 after a robust first half when the Indian economy grew by 7.7%, says a report from Acuité Ratings & Research.

PMI Mfg has a modest rise in Nov-23 after reaching an eight-month low in Oct-23 but it is still significantly lower than the high of 58.7 reached in May-23 and the average of 57.4 till date in the current fiscal. The manufacturing sector has witnessed a buoyancy in the current fiscal with a double digit GVA growth of 13.9% in Q2 of the current fiscal. Notwithstanding the global slowdown and its impact on exports, the manufacturing sector has seen a healthy momentum due to lower input costs, broad pickup in consumer demand and also the positive impact of government programmes such as the PLI (performance linked incentives) in certain manufacturing businesses. The survey participants in the manufacturing sector have reported a growth in new export businesses and also a rise in employment for the eighth successive month. However, the survey has also indicated that the input costs are seeing renewed pressures and may be passed on to the customers, leading to a reversal in the WPI deflation in the near term. On an overall basis, the positive business environment persists in the Indian manufacturing sector.

After witnessing a particular buoyancy in the first half of the year, the PMI Services index has seen a steady decline to 56.9 in Nov-23, significantly down from the average of 60.1 recorded in the first eight months of the year. The moderation in growth in the services sector after a build-up of pent-up demand has also been corroborated in the latest GDP data where the services GVA growth has slowed down to 5.8% YoY in Q2FY24 from 10.3% YoY in Q1FY24. There has also been a weaker growth in services exports – IT and IT enabled services in particular due to the global slowdown and the postponement of IT spending by multinational companies. Nevertheless, exports has remained an area of strength in services with new business gains from Asia, Europe, and the U.S. The PMI survey also noted there were faster increases in input costs and output charges in October; a pick-up in inflation expectations in October and higher competitive pressures dampened business confidence. The service economy registered a stronger rate of increase in cost burden than the manufacturing industry. Additionally, employment growth in the sector decreased to its lowest level in three months.

Given the slower increases in manufacturing and services activity, the Composite PMI also witnessed its lowest reading since Mar-23 at 57.4, materially lower than the average of 60.3 over the Apr-Nov’23 period.

Says Suman Chowdhury, Chief Economist and Head-Research, Acuité Ratings & Research Ltd “ The moderation in the PMI indices is consistent with our expectation of a moderation in domestic economic growth in the second half of the year. Acuité Research expects GDP growth to moderate to 5.5% in H2FY24 on account of lower agricultural output induced by the continuing El Nino phenomenon and its impact on rural demand. Further, the transmission of increased interest rates and a tightening on consumer loans may also slow down urban demand which has remained robust so far. Nevertheless, higher government expenditure and higher capital investments both by the public and private sector will drive growth and Acuité has revised its forecast to 6.5% for the whole year. The PMI survey also reports a build-up of cost pressures particularly in the services sectors which may not allow core inflation to drop further from the current levels.”

(DISCLAIMER: This report is based on the data and information (data) obtained by Acuité from sources it considers reliable. Although reasonable care has been taken to verify the data, Acuité makes no representation or warranty, expressed or implied with respect to the accuracy, adequacy or completeness of any Data relied upon. Acuité is not responsible for any errors or omissions or for the results obtained from the use of the report and especially states that it has no financial liability, whatsoever, for any direct, indirect or consequential loss of any kind arising from the use of its reports. Any statement contained in this report should not be treated as a recommendation or endorsement or opinion or a substitute for reader’s independent assessment)

About Acuité Ratings & Research Limited:

Acuité Ratings & Research Limited is a full-service Credit Rating Agency registered with the Securities and Exchange Board of India (SEBI). The company received RBI Accreditation as an External Credit Assessment Institution (ECAI), for Bank Loan Ratings under BASEL-II norms in the year 2012. Since then, it has assigned more than 9,700 credit ratings to various securities, debt instruments and bank facilities of entities spread across the country and across a wide cross section of industries. It has its Registered and Head Office in Kanjurmarg, Mumbai.

Media Contact:

Sahban Kohari Ph: + 91-9890318722 |

Disclaimer: This release is sent to you for the sole purpose of dissemination through your newspaper / magazine / media / website / agency. The release may be used by you in full or in part without changing the meaning or context thereof but with due credit to Acuité. However, only Acuité has the sole right of distribution of its releases through any media. Acuité has taken due care and caution for writing this release. Information has been obtained by Acuité from sources which it considers reliable. However, Acuité does not guarantee the accuracy, adequacy or completeness of information on which this release is based. Acuité is not responsible for any errors or omissions or for the results obtained from the use of this release. Acuité has no liability whatsoever to the users / distributors of this release.