Of the 47 sectors CRISIL Market Intelligence and Analytics (MI&A) Research tracks, all but 13 recorded an on-year pick-up in revenue growth

FinTech BizNews Service

Mumbai, January 16, 2024: Revenue of Indian corporates is projected to have increased 8-10% on-year in the December quarter but declined 100-150 basis points (bps) sequentially. In the September quarter, on-year revenue growth had improved after easing for four quarters on the trot.

Of the 47 sectors CRISIL Market Intelligence and Analytics (MI&A) Research tracks, all but 13 recorded an on-year pick-up in revenue growth. In all, our analysis covered 350 companies (excluding financial services and oil and gas sectors).

Revenue growth would have been stronger but for the decline in agri-linked sectors such as fertilisers, consumer staples such as edible oils, industrial commodities such as chlor-alkalis and commodity chemicals, and aluminium. Also, revenue growth seemed to be propelled by volume, particularly in the domestic market, while realisation either declined or grew at a sedate pace.

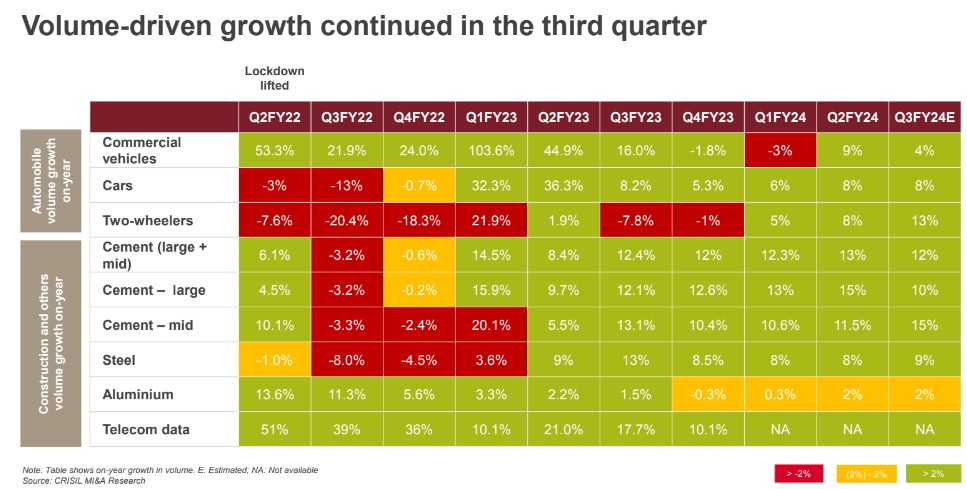

Says Aniket Dani, Director- Research, CRISIL Market Intelligence and Analytics, “Construction-linked sectors, which together account for 20% of overall revenue, grew 5-7% as construction activity picked up post the lean monsoon season, thereby augmenting growth in the cement and steel industries as well. Corporate revenues continued to be driven by consumer discretionary products and services, and consumer staples, which contribute over a third of total revenue. Automobiles, airlines, retail and hospitality supported growth. Led by the healthy performance of pharmaceuticals and IT services, export-linked sectors rose 16% and outpaced overall revenue growth.”

Says Arindam Pal, Associate Director- Research, CRISIL Market Intelligence and Analytics, “Corporate India has continued to benefit from softening input costs this fiscal, which are likely to give a leg-up to volume growth. Prices of key commodities such as coal and crude oil have eased, as have power and freight costs. This, coupled with continued volume growth in the domestic market, will support operating profitability in the near term.”

Revenue is estimated to have risen 8-10% on-year during the third quarter of this fiscal

• After picking up pace in the previous quarter, revenue growth eased once again during the December quarter

• The growth was led by the domestic market, while exports, particularly of commodities, remained modest

• Of the 47 sectors tracked, all but 13 sectors, accounting for 10% of the revenue, expanded

• Revenue is expected to grow 9-12% this fiscal, led by domestic consumption and despite a global slowdown and interest rate hikes

Automobiles and steel products steer revenue growth

Nine of the top 10 sectors, contributing to up to three-fourths of overall revenue, record improvement. Revenue of power and construction sectors falls sequentially. We estimate the revenue of aluminium makers remained under pressure due to a fall in global prices, lower premiums of major export destinations and a modest 0-1% growth in volume led by the domestic market, revenue of steel players grew 17-19%. Exports growth was impacted by stagnant prices and a competitive global market.

Revenue of IT services companies

Revenue of IT services companies is estimated to have outpaced overall revenue. For cement makers, revenue likely grew 11-13% due to a healthy increase in volume aided by a post-monsoon pick-up in construction activities. Revenue of FMCG companies is estimated to have grown a sedate 5% due to muted rural demand. Early and efficient capital deployment and improved construction activity resulted in 6-8% growth in the construction sector’s revenue.

Revenue of pharmaceutical companies increased 17-19%, backed by a strong domestic market, continued exports to regulated markets and easing pricing pressure in the United States

Power sector revenue was up 8-10% due to better power demand. Telecom services revenue is seen up 9-11%, supported by the expected 8-9% rise in average revenue per user due to the telecom players hiking prices. Revenue of automobile manufacturers is estimated to have risen at a healthy pace due to a pick-up in demand for passenger vehicles, tractors and two-wheelers.

India Inc continues to benefit from easing input costs

Power, fuel and freight cost moderate as well, but rising crude oil prices a monitorable. CRISIL MI&A Research estimates the aggregate Ebitda of corporates to have grown more than 15% on-year during the third quarter.

• Ebitda margin is seen expanding 130 basis points (bps), backed by continued moderation in input costs

• In the first nine months of the year, Ebitda margin likely stood at 19-20%, up from 18-19% a year ago

• Energy and metal prices, which remained high during the year-ago quarter, are falling since the slowdown in global growth is impacting demand

• Ebitda margin is expected to recover 120-170 bps this fiscal, supported by cooling commodity prices and volume-driven revenue growth.