INR is expected to post a moderate weakness towards 84.5-85.0 levels by Mar-25

FinTech BizNews Service

Mumbai, March 26, 2024:

Merchandise exports stood at USD 41.4 bn in Feb-24 (12.2% MoM and 11.9% YoY)

compared to USD 36.9 bn in Jan-24. In absolute terms, this marked the highest level on FYTD basis, while annualized growth was at a 20-month high.

Subcategories of Merchandise Exports

o Of 14 key subcategories of exports, 11 registered annualized expansion. The best

performance was seen in the case of Miscellaneous export items (87%), Electronics

(54.8%), Plantation (43.1%), Chemicals & Products (27.9%) and Rubber & Plastic (22.1%).

o Drag on exports in annualised terms was led by Gems & Jewellery (-11.3%) and Marine Products (-7.1%).

o Petroleum exports expanded by 5.1%YoY – to mark the second consecutive

expansion in last 1 year, amidst marginal increase in crude oil prices. In absolute

terms, refined oil exports remained steady at USD 8.2 bn. Brent crude oil price

continued to firm up gradually by 4.4% in Feb-24, building on the 2.9% increase from

Jan-24.

o Core exports (i.e., Exports excluding Petroleum and Gems & Jewellery exports) too rose to the highest level on FYTD basis, at USD 30.1 bn from USD 26.1 bn in Jan-24, driven by increase in exports of Machinery (USD 1.2 bn), Chemical products (USD 0.9 bn) and Electronics (USD 0.7 bn).

Merchandise Imports

Merchandise imports stood at USD 60.1bn in Feb-24 (12.7% MoM and 12.2% YoY) vs. USD 53.4 bn in Jan-24

o At a granular level, 8 of the 15 sub-categories registered an annualised expansion.

Gems & jewellery clocking a growth of 94.6%YoY emerged as the best performer, followed by Electronic items (+23.2%YoY).

o Drag on imports was led by Project Goods (-89.9%), Leather goods (-21.0%)

Chemicals (-15.7%), Plastic & Rubber (-8.7%) Agri & Allied Products (-7.8%), and Transport Equipment (-5.2%).

o Sequentially, petroleum imports rose marginally to USD 16.9 bn in Feb-24 from USD 16.6 bn in Jan-24, reflecting the increase in crude oil prices. On the other hand, gems and jewellery imports rose sizeably to USD 10.1 bn in Feb-24 from USD 4.1 bn in Jan-24, reflecting the record high global prices of gold coinciding with pick-up in domestic demand owing to the wedding season.

o Core imports rose marginally to USD 33.2 bn in Feb-24 from USD 32.7 bn in Jan-24, led by sequential increase in Machinery imports (USD 0.4 bn) and Transport

equipment (USD 0.2 bn).

Trade Balance

o The sequential expansion in monthly merchandise trade deficit was led by Non-core trade deficit (owing to Gems and Jewellery), which widened from USD 9.9 bn in Jan-24 to USD 15.5 bn in Feb-24.

o On the other hand, core deficit narrowed to USD 3.2 bn from USD 6.6 bn in Jan-24, led by sectors of Machinery, Electronics and agri commodities.

Services Trade

Services trade surplus is estimated to have risen to a record high of USD 16.8 bn in Feb-24 from USD 16.2 in Jan-24 (revised lower from USD 16.8 bn). This was led by services exports continuing to rise, to a record high of USD 32.2 bn in Feb-24. While a break-up of services trade data will be available with a lag, it is expected that the continued diversification of services exports led by category of ‘Other business services’ reflecting the growth of Global Capability Centres (GCCs) in India, have added to the traditional strength enjoyed by IT services exports from India.

Says Suman Chowdhury, Chief Economist and Head- Research, Acuité Ratings & Research: “The sharp uptick in merchandise exports witnessed in Feb-24 is encouraging but it remains to be seen whether it is driven only by the seasonal factor at the fiscal end or has elements of a structural recovery. On the other hand, the monthly increasing trend in gross services exports which has seen a cumulative growth of 8.4% till Feb appears to be structural and based on the expansion of outsourcing centres by multinationals in India. While the merchandise trade deficit has continued to be volatile, the CAD is expected to be better than expectations and anchor around 1.0% of GDP over the next one year due to the buoyancy in services exports and importantly, the softness in commodity prices. The foreign exchange reserves stand at a robust USD 642 bn as in mid-March. Nevertheless, we expect the INR to undergo a mild depreciation in FY25 given the delay and the relatively moderate rate cuts in the developed nations along with RBI’s active management of the currency to keep it reasonably anchored to the real effective exchange rate.”

Outlook

The adverse impact of spillover from ongoing disturbance in the Red Sea region is yet to manifest on India’s trade data. Having said so, the sequential contraction/expansion in Jan-24/Feb-24 respectively, corresponds to typical seasonality seen in these months historically.

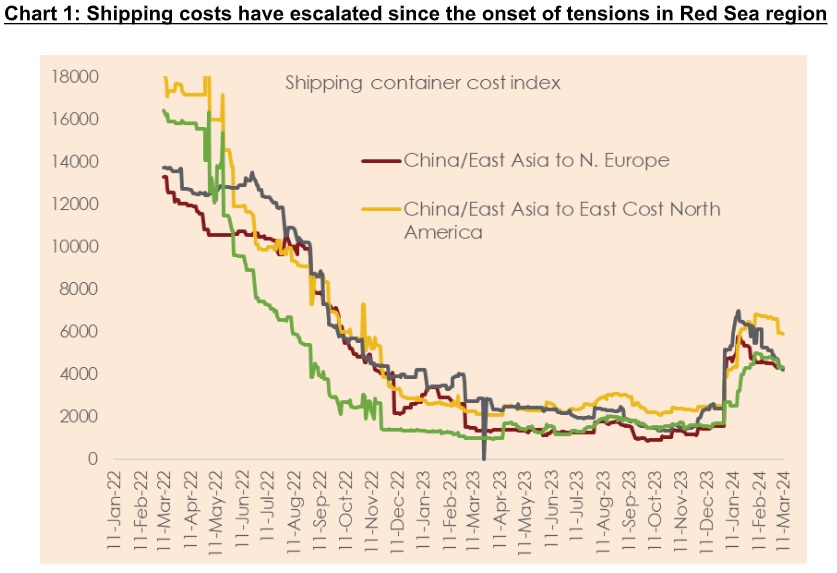

While cost of freight container transportation has come off marginally over the last few weeks (see chart), but costs do continue to remain elevated compared to pre-Red Sea region tensions. The impact can be expected to filter through, manifesting as higher input costs if tensions continue to persist over the coming months. We will continue to watch the incoming data for the impact. For now, we believe that the upward revision to global growth and trade forecasts for 2024, by international global agencies, could offer more support than envisaged previously for domestic exports.

Looking ahead, considering range-bound commodity price movement along with a negligible impact from the ongoing Red Sea disturbance as yet, we revise lower our FY24 current account deficit forecast to 0.8% of GDP (USD 28 bn) from 1.3% (USD 47 bn) with downside risk, earlier. Commensurately, the forecast for FY25 current account deficit stands adjusted lower to 1.0% of GDP (USD 38 bn) from 1.5% (USD 59 bn).

Rupee Outlook

The Indian rupee has moved within a narrow trading band of 81.6-83.5 in FY24 so far. This marks the tightest trading band for the currency in 29-years, something that is also reflected in its current levels of extremely subdued volatility. While a mild strength in the INR was visible over the last one month, a rise in volatility driven by the demand for dollars during the fiscal year end and the pressure on the Chinese yuan may lead to a weakness in the INR towards the end of March.

We continue to expect INR to post a moderate weakness towards 84.5-85.0 levels by Mar-25.

o Amidst better than anticipated data releases in the US, the Fed has been giving

pushbacks to market expectations of an early pivot. As such, the first rate cut

expectation has moved from Mar-24 to Jun-24 with cumulative rate cut expectations

for 2024 currently being priced in at 75-100 bps vs. 125-150 bps earlier this year.

o Even when the Fed starts to ease monetary policy, its adverse impact on the USD

could be short-lived as other key central banks would also follow suit in cutting rates,

thereby reducing the monetary policy divergence.

o Trade related geopolitical uncertainties can continue to impede global supply chains and escalating costs.

o Last but not the least, the RBI has been extremely active in conducting two-sided

intervention in the FX market in a bid to anchor INR’s real effective exchange rate.

Key Takeaways from the attached report: