Signs of a moderation in economic activity in H2FY24

FinTech BizNews Service

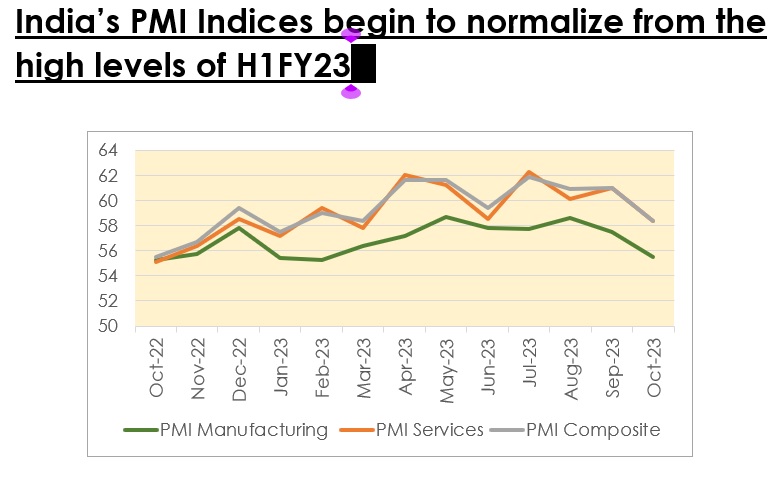

Mumbai, November 4, 2023: The seasonally adjusted India Manufacturing Purchasing Managers’ Index (PMI) stood at an 8-month low in Oct-23 as it dropped significantly to 55.5 from 57.5 in Sep-23. PMI Services also declined to 58.4 from 61.0 in the month before. Accordingly, PMI Composite has also subsided to 58.4 from 61.0 in Sep-23, the lowest index value in the current fiscal. While the lower value of indices in both manufacturing and services reflect a moderation in growth, their elevated levels still indicate a healthy momentum in economic activities.

PMI Manufacturing figure is marginally higher than that reported a year back in Oct-22 and below the average print of 56.3 recorded since FY23. The survey participants reported substantial, but slower, increases in production, exports, new orders, and stocks of purchases. Growth eased, weighed by competitive pressures and weak demand at some plants. Consumer goods sector contributed to the market slowdown leading to the softest rate of expansion. Cost pressures increased and output prices rose at a slower pace, as per the survey. Hiring activity remained modest in the sector as less than 4% of the companies hired additional staff. Business confidence has seen a dent amid concerns surrounding the path for inflation and demand. Nevertheless, the manufacturing sector remains in the growth zone for 28 months in a row since June-21, the period of disruption during the intense second Covid wave.

PMI Services print in Oct-23 grew at the slowest pace in the last seven months. The deceleration is due to competitive pressures and inflationary forces. Nevertheless, the data highlighted the second-fastest upturn in international orders placed with Indian services companies since the series started in September 2014. Exports was an area of strength in services, with new business gains from Asia, Europe, and the U.S. boosting growth to its second highest in the series over a nine-year history. The survey also noted there were faster increases in input costs and output charges in October; a pick-up in inflation expectations in October dampened business confidence. The service economy registered a stronger rate of increase in cost burdens than the manufacturing industry. Additionally, employment growth decreased to its lowest level in three months.

The S&P Global India Composite PMI also witnessed its lowest reading since March amid slower increases in manufacturing output and services activity.

Says Suman Chowdhury, Chief Economist and Head-Research, Acuité Ratings & Research Ltd “The drop from the high level of PMI indices in Aug-Sep’23 were expected but the extent of the drop has surprised us. Given that we are in the middle of the festive season, the intensity of activity in the services sectors such as transportation and hospitality should have led to a better reading of Services PMI. These readings may be an early indicator of a moderation in economic activity in the second half of the current fiscal due to lower agricultural output and weak rural demand. The PMI survey also reports a build-up of cost pressures particularly in the services sectors which may not allow core inflation to drop further from the current levels. We continue to stick to our original growth forecast of 6.0% for FY24.”

PMI Indices Heatmap: Oct’22-Oct’23

Year | PMI Manufacturing | PMI Services | PMI Composite |

Oct-22 | 55.3 | 55.1 | 55.5 |

Nov-22 | 55.7 | 56.4 | 56.7 |

Dec-22 | 57.8 | 58.5 | 59.4 |

Jan-23 | 55.4 | 57.2 | 57.5 |

Feb-23 | 55.3 | 59.4 | 59 |

Mar-23 | 56.4 | 57.8 | 58.4 |

Apr-23 | 57.2 | 62 | 61.6 |

May-23 | 58.7 | 61.2 | 61.6 |

Jun-23 | 57.8 | 58.5 | 59.4 |

Jul-23 | 57.7 | 62.3 | 61.9 |

Aug-23 | 58.6 | 60.1 | 60.9 |

Sep-23 | 57.5 | 61 | 61 |

Oct-23 | 55.5 | 58.4 | 58.4 |

Disclaimer: Acuité has taken due care and caution for writing this release. Information has been obtained by Acuité from sources which it considers reliable. However, Acuité does not guarantee the accuracy, adequacy or completeness of information on which this release is based.