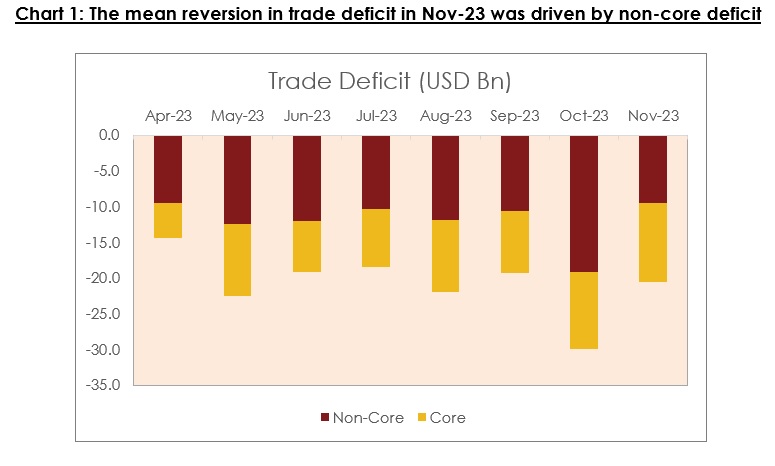

India's merchandise trade deficit mean reverted in Nov-23 to USD 20.6 bn from a record level of USD 29.9 bn in Oct-23

FinTech BizNews Service

Mumbai, December 18, 2023:

India’s merchandise trade deficit mean reverted in Nov-23 to USD 20.6 bn from a record level of USD 29.9 bn in Oct-23. The sequential correction was entirely on account of imports, as exports posted a mild increase.

India’s merchandise trade deficit reverted in Nov-23 to USD 20.6 bn from a record level of USD 29.9 bn (revised lower from USD 31.5 bn) in Oct-23. The sequential correction was entirely on account of imports, as exports posted a mild increase.

Merchandise exports

Merchandise exports stood at USD 33.9 bn (1.1% MoM and -2.8% YoY) in Nov-23.

Merchandise Imports

Merchandise imports scaled back from a record high of USD 63.5 bn in Oct-23 to USD 54.5 bn in Nov-23. On annualised basis, this translated into a de-growth of 4.3%.

Trade balance

The entire sequential correction in monthly merchandise trade deficit was on account of non-core i.e., Gems & jewellery and petroleum products, as core deficit widened marginally (to USD 11.0 bn from USD 10.7 bn in Oct-23).

Services Trade

Deficit Outlook

We had in our last trade note, highlighted the possibility of Nov-23 trade deficit print moderating from record high levels in Oct-23 on account of tapering of festive demand along with easing of crude oil prices. Nevertheless, the quick incremental correction of USD 9.3 bn of Nov-23 from a sharp jump in merchandise trade deficit by USD 10.5 bn in Oct-23 is somewhat unusual and can be considered as one-off.

From an outlook perspective, we continue to believe that merchandise trade deficit in H2 FY24 would be wider in comparison to H1 FY24, owing to sluggish growth in global trade volumes, domestic export restrictions on select agricultural commodities and India’s strategic advantage of importing relatively cheaper Russian oil dissipating.

However, there are some downside risks emanating to our FY24 CAD forecast of USD 67 bn owing to –

Rupee Outlook

After facing persistent, albeit mild depreciation pressure over five consecutive months, INR is finally making at attempt to recoup some of its recent losses. The currency has strengthened by around 40 paise against the USD after reaching a low of INR 83.4 in the first week of Dec-23. This is in line with the drop in the dollar index futures by around 2% and a sharp correction in 10 year US Treasury yields by 120-130 bps over the same period.

This development is aligned to our call on INR (82.5 levels by Mar-24). However, the price action appears to be taking place somewhat ahead of our expectation.

Says Suman Chowdhury, Chief Economist and Head – Research “The trade deficit is likely to remain elevated in the rest of the current fiscal due to the export headwinds and high imports induced by strong domestic demand. This will get reflected in a CAD which is likely to hold up at around 2.0% in FY24. Nevertheless, as argued in our previous notes, INR could remain supportive in Q4 FY24 on account of favorable year-end seasonality and market positioning ahead of India’s inclusion in JPM EM bond index (from Jun-24). While global geopolitical risk and domestic election related uncertainties remain on the table, the tail risks have reduced significantly amidst the current softness in commodity prices and the just concluded state elections (that on aggregate basis went in favor of the incumbent BJP government at the centre).”

DISCLAIMER: This report is based on the data and information (data) obtained by Acuité from sources it considers reliable. Although reasonable care has been taken to verify the data, Acuité makes no representation or warranty, expressed or implied with respect to the accuracy, adequacy or completeness of any Data relied upon. Acuité is not responsible for any errors or omissions or for the results obtained from the use of the report and especially states that it has no financial liability, whatsoever, for any direct, indirect or consequential loss of any kind arising from the use of its reports. Any statement contained in this report should not be treated as a recommendation or endorsement or opinion or a substitute for reader’s independent assessment.