Capital flows expected to normalize

FinTech BizNews Service

Mumbai, 27 October, 2023:

Acuité Ratings & Research has released thirty-third edition of Acuité Macro Pulse (AMP), a monthly commentary on the dynamic Indian and global economic landscape.

Says Suman Chowdhury, Chief Economist and Head – Research, Acuité Ratings & Research, "Following the ascending trail of the previous month, the Acuité Macroeconomic Performance Index (AMEP index) has shown further buoyancy in September. The average index print in the second quarter of the fiscal is 2.36% higher than in the corresponding period of the previous year. The steady and consistent momentum in economic activities in the second quarter of the current fiscal was supported by steady urban demand, onset of festive season, increased public expenditure in infrastructure and higher power demand in periods of deficient monsoon rainfall. Therefore, we expect the GDP growth in the second quarter of the fiscal to remain fairly strong at 6.4%-6.8%.”

The second half of the current fiscal, however, may be a different ball game altogether. With no base factor advantage, the economy will have to be driven by the strength of consumption demand and the acceleration in investments, both public and private. Suman Chowdhury indicates: The key concern on growth at this stage emanates from the downside risks to agricultural output induced by an irregular monsoon and the uncertain impact of the prevailing El Nino. This may impact agricultural incomes and may keep food inflation sticky particularly in cereals and pulses, thereby constraining rural demand. Further, new geo-political risks in West Asia may keep the global crude oil prices at elevated levels; while it may not put pressure on the headline inflation directly, it can enhance the fiscal and the current account deficits. In a pre-election period, it may be a difficult balancing act for the government to provide cushion against higher food and fuel inflation while also walking on the path of fiscal consolidation. These risks have made us hold on to the 6.0% growth forecast for FY24 as a whole.”

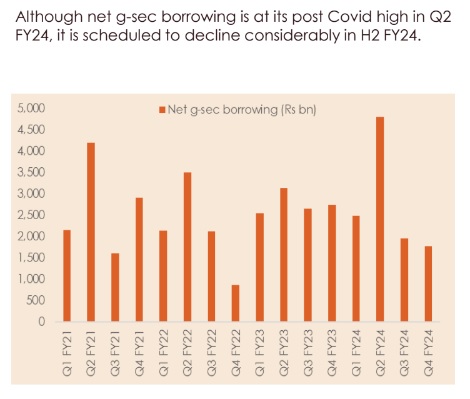

“Given the uncertainty on global interest rates, we see the phenomenon of “higher for longer” to play out at least till the first quarter of next fiscal which will also imply higher volatility on bond yields and the rupee. Nevertheless, we expect capital flows to normalize and the rupee as well as the bond yields to settle at lower levels by the end of the current fiscal”, believes Suman Chowdhury.