Improvement in Kharif sowing bodes well for the inflation outlook

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, July 09, 2024: Global markets treaded water as investors await further cues on US monetary policy.

Fed Chair’s testimony to the Congress later today, and US CPI report on Thursday

will shape the trajectory of future rate cuts. Traders have increased bets of 2-rate

cuts by the Fed this year after the US payroll report, with the first rate cut expected in

Sep’24. In the Eurozone, results of the parliamentary have pushed the nation into a

political limbo which is likely to persist for some time. In Germany, exports declined by 3.6% in May’24, against expectations of a decline of 1.9%. In India, the South-West monsoon has gained momentum, with cumulative rainfall 1.8% above normal till 8 Jul 2024. This has resulted in an improvement in Kharif sowing which is 14%

higher compared with last year (up to 5 Jul 2024), led by higher sowing of pulses, oilseeds and paddy. This bodes well for the inflation outlook.

Global indices broadly ended lower. Investors remained cautious ahead of Fed Chair’s testimony. In Europe, all eyes are on snap election and its aftermath.

Investors are also eyeing any movement before China’s annual policy meeting.

Stocks in Hang Seng fell the most, followed by Shanghai Comp. Sensex closed flat. It is trading higher today, while Asian stocks are trading mixed.

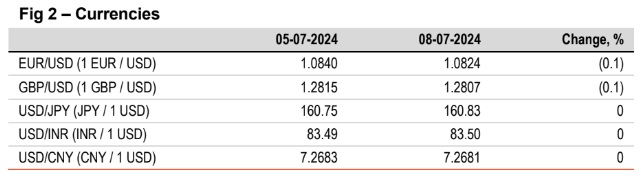

Global currencies traded in thin ranges ahead of US CPI report and Fed Chair’s testimony. DXY rose by 0.1%. EUR depreciated amid political uncertainty in France. INR closed marginally weaker despite a decline in oil prices. It is trading at the same levels today, while Asian currencies are mostly trading weaker.

US 10Y yield closed flat as market await cues from Fed Chair’s testimony over

timing of rate cut. Germany’s 10Y yield fell by 2bps amidst risk off sentiments

surrounding political developments in Europe. In Japan and China, 10Y yield

firmed up by 2bps each, awaiting signals from respective policymakers. India’s

10Y yield closed stable. It is trading at the same level today.

Oil prices fell amid talks of US ceasefire plan to pacify tensions in Middle-East.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)