Report by Motilal Oswal Financial Services on evolving landscape of wealth management ecosystem

UHNI, HNI, mass affluent, retail

Wealth management business in India is well poised to register a healthy CAGR of 12-15% over the next five years. We are confident that all segments: UHNI, HNI, mass affluent, and retail offer significant growth opportunities.

As per the Knight Frank Wealth Report 2022, the Indian UHNI (ultra HNI) population and HNI population is expected to clock a CAGR of 7% and 12%, respectively, over 2021-26.

The UHNI space is experiencing a transformative phase marked by several key drivers. These include: 1) inter-generational wealth transfer, 2) increased interest in complex products such as international investments and 3) evolution from a purely physical to a ‘phygital’ model (Tech plays a more prominent role for RM than for clients).

The HNI and mass affluent segments are being serviced through innovative, tech driven, AI, and ML-led modes. Account aggregation will be one of the key enablers for further accentuated growth in this segment.

New-age wealth management firms are also taking a more holistic approach by integrating banking and lending services and emerging as a comprehensive, one-stop solution for clients, thereby increasing the value of their relationship.

Drivers for Wealth Management

360ONE will gain out of emerging trends

We believe 360ONE is well placed to gain out of the emerging trends as it 1) enhances its reach in the lower tier cities (earlier focus was on metros and top 10 cities), 2) diversifies into the INR50-250m net-worth customer base vs INR250m+ earlier, and 3) invests in technology to strengthen its phygital approach.

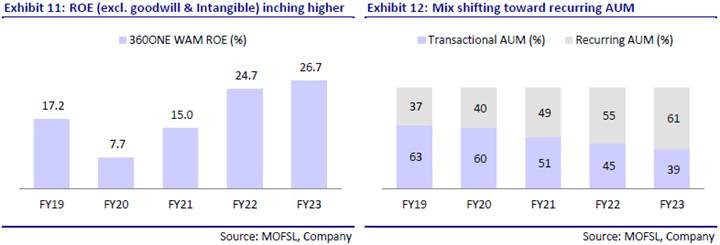

We expect 360ONE to register an AUM CAGR of 13% over FY23-25 and the cost-to-income ratio to decline to 44% in FY25 from 45.9% in FY23, translating into an earnings CAGR of 12%. With a healthy dividend payout of 80% and RoE of 26% by FY25, we find valuations reasonable at P/E of 21x FY25E EPS. We maintain our BUY with a one-year price target of INR620.