Fibe’s Millennial Upgrade Index: Professional Growth, Entrepreneurship, Financial Independence: Aspirations Of Millennials

FinTech BizNews Service

Mumbai, February 17, 2025: With over 300 million young people, India has the largest youth population in the world, filled with dreams and aspirations. Fibe, India’s leading fintech, launched its 'Fibe-Millennial Upgrade Index', revealing insightful data on the ambitions of young Indians, encompassing both short and long-term goals across metros and beyond.

Long-term goals:

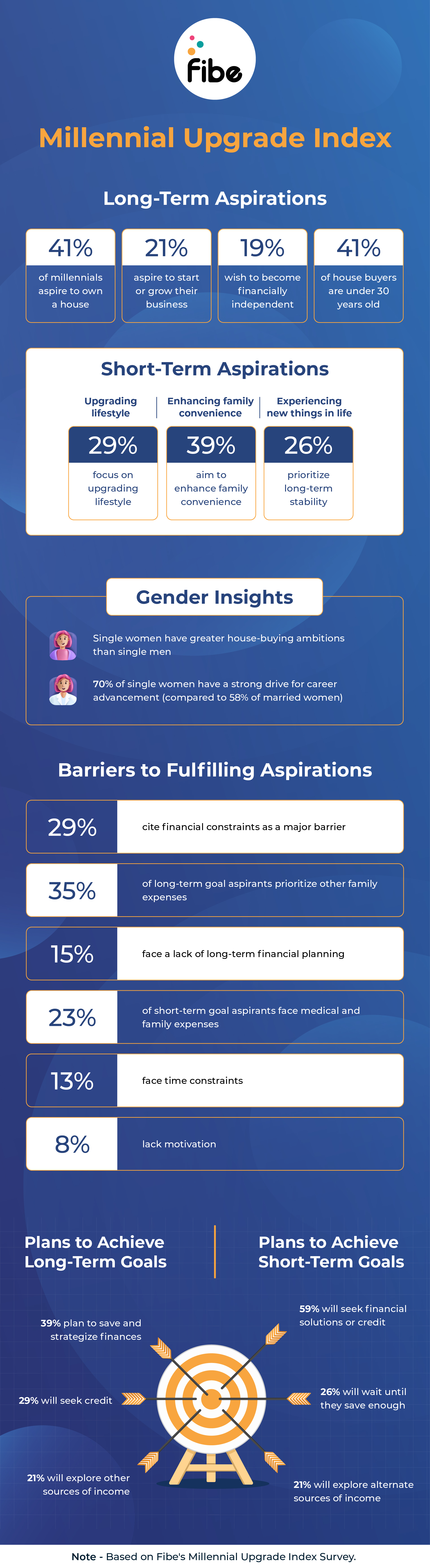

The study highlights that homeownership (41%), entrepreneurship (21%), and financial independence (19%) are the top three long-term goals of Indian millennials. Notably, over 41% of individuals aspiring to own a house are under the age of 30. A key insight is that more millennials in Bharat are eager to start their own businesses than in metros. Millennials prioritize these long-term goals for greater fulfillment and stability in life, to fulfill family needs, and to gain societal recognition.

Aspirations of Women in India:

Importantly, the study underscores the growing aspirations of women in India, with single women indicating greater ambitions of buying a house compared to single men. Additionally, single females (70%) showed a stronger drive for career advancement compared to married women (58%).

Short-term goals:

The survey also highlights that millennials in metros are more concerned about securing a better job due to increased competition, with 60% of metro respondents indicating it as a key goal. The study reveals that in the short-term, the top four priorities for millennials are upgrading their lifestyle, enhancing convenience for family, and experiencing new things in life.

Fibe’s co-founder & CEO Akshay Mehrotra said, “Empowering India’s youth is a necessity and a catalyst for our nation’s economic growth. Our study uncovers their vibrant aspirations alongside the formidable challenges they encounter, underscoring the urgent need for tailored financial solutions. Most millennials indicated that they would seek credit from financial institutions to fulfill short-term aspirations, valuing accessibility, convenience, flexibility, and addressing immediate financial gaps. At Fibe, we remain committed to creating an impact on the lives of individuals and helping them fulfill their needs at every stage of life. As a responsible lender, we also aim to educate these youngsters on responsible borrowing practices so that they can confidently pursue their dreams while managing their credit profile.”

Barriers to achieving aspirations:

Plans to achieve aspirations:

This shift towards external borrowing underscores the growing trust in digital lending platforms. A notable 21% of millennials are exploring alternate sources of income. This growing trend towards non-traditional income streams highlights a shift in how millennials approach financial planning and fulfilling their goals.

‘Fibe-Millennial Upgrade Index’ was conducted among 8,000 individuals across metros and non-metros. The majority of the respondents (47%) are below 30 years old, followed by 26% from 30-35 years of age, 14% from the 35-40 years age group, and 13% are above the age of 40 years.