AI, ML Integration In Digital Lending Platforms Will Enhance CX, Making Loan Approvals Faster

FinTech BizNews Service

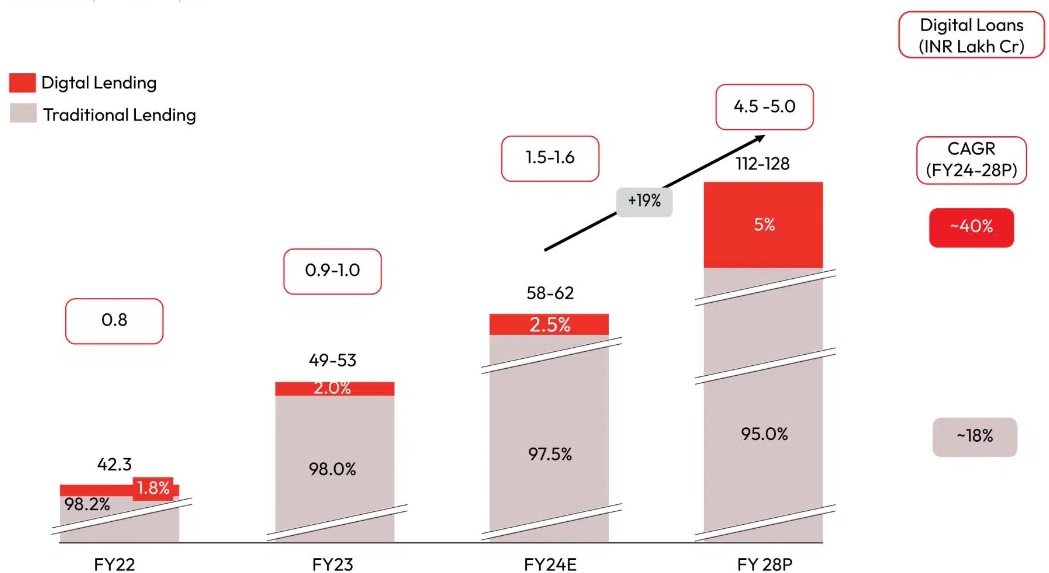

Mumbai, July 16, 2024: Digital lending is projected to account for 5% of India's total retail loans by FY28, up from 1.8% in FY22 and approximately 2.5% in FY24, states a Report by Redseer Strategy Consultants.

The key insights from this very insightful report, authored by Jasbir S Juneja, Partner, Redseer Strategy Consultants, are as follow:

Digital lending is expected to grow at an impressive 40% CAGR.

Gen Z (18-25) and millennials (26-38) are the primary drivers of the digital lending surge.

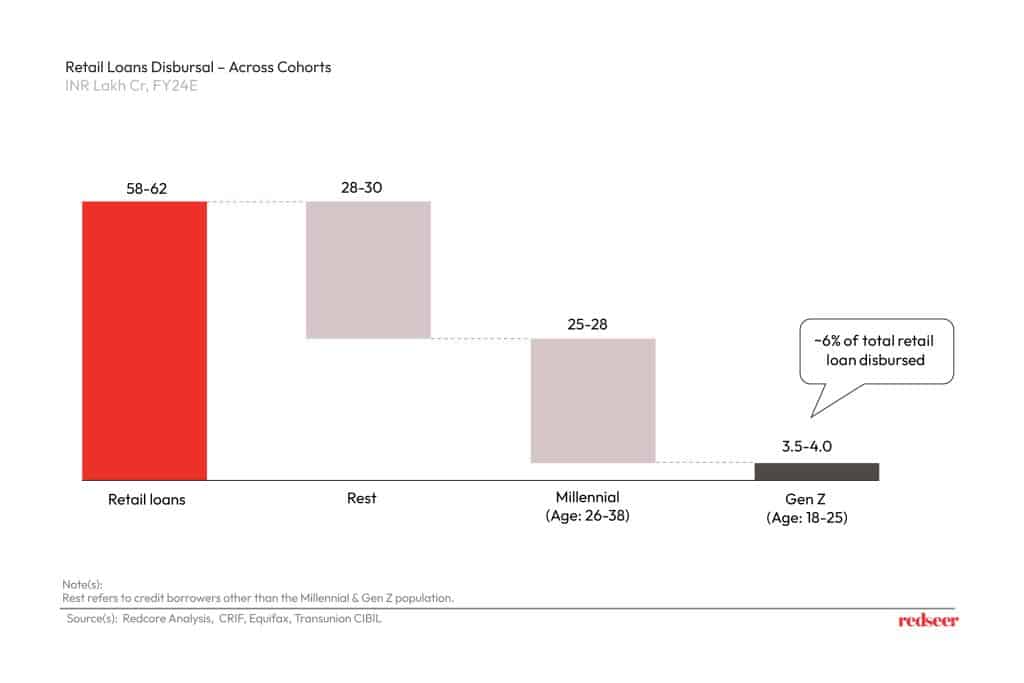

In FY24, Gen Z borrowed INR 3.5-4 lakh crore and millennials INR 25-28 lakh crore out of the total INR 62 lakh crore retail loans disbursed.

Comparing India with Global Benchmarks

This comprehensive study highlights the huge potential for credit in India. It also emphasizes the significant role that Millennials and Gen Z play, not just as users of financial services but as catalysts for change, shaping the market trajectory. The findings underscore a generational shift towards digital lending, with the younger demographic leading the way.

Key Findings:

1. India's retail credit market presents a substantial growth opportunity

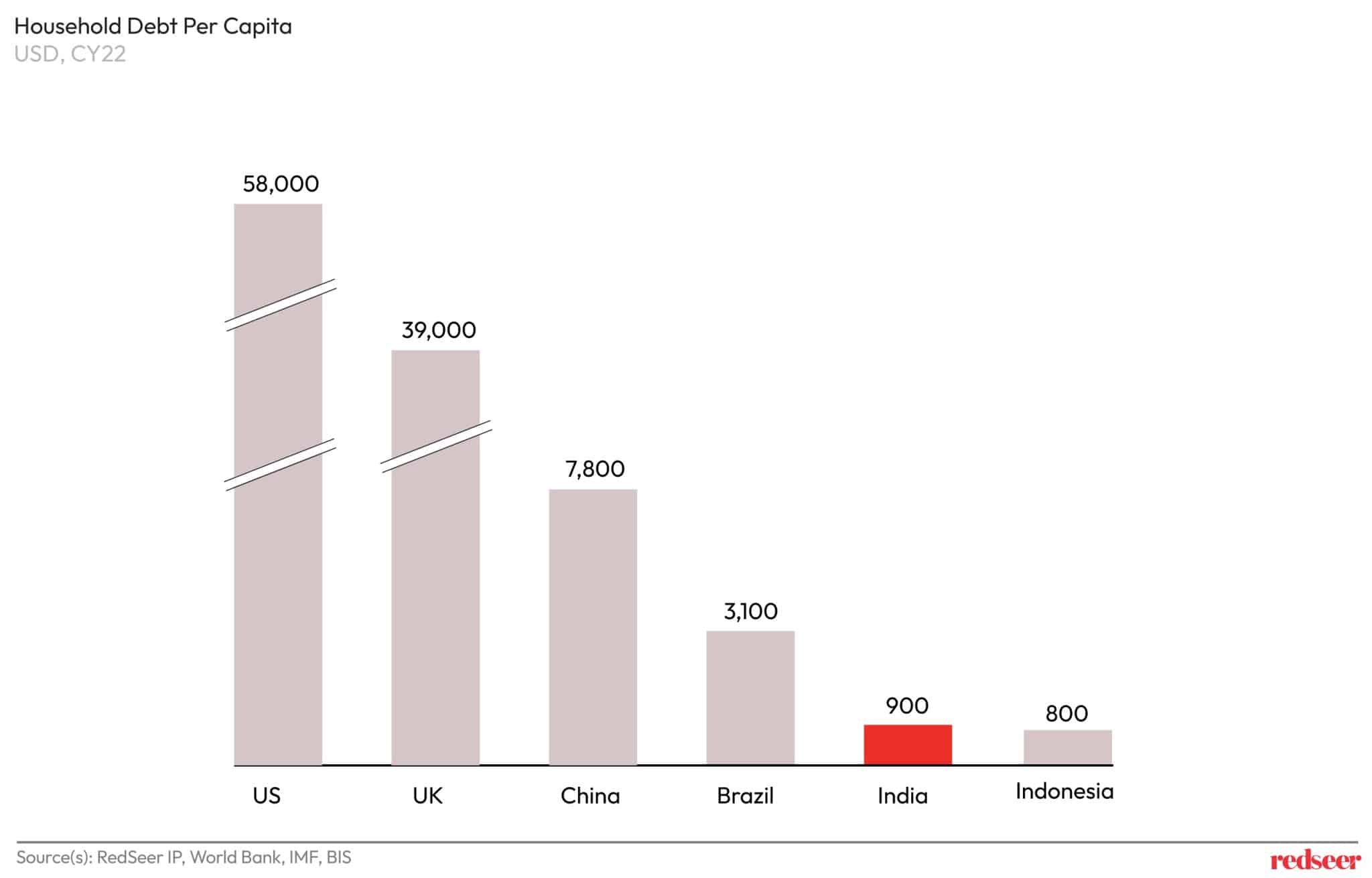

○ The report by Redseer highlights the huge growth potential for the Indian lending market, when compared to developing economies like China and Brazil.

○ With household debt per capita of India at USD 900, it presents a significant growth opportunity for lenders compared to other nations.

2. Rapid Growth in Digital Lending

○ Digital lending in India is on the rise, led by Gen Z and millennials, with a notable increase from 1.8% of total retail loans disbursed in FY 22 to approximately 2.5% in FY 24. ○ The study projects that digital lending is expected to double to about 5% of total retail loans by FY 28, growing at an impressive 40% CAGR. ○ In FY 24, Gen Z borrowed INR 3.5-4 lakh crore, while millennials took INR 25-28 lakh crore of the total INR 62 lakh crore retail loans disbursed. Both groups prefer digital solutions for their financial needs due to the convenience and speed provided by new-age platforms.

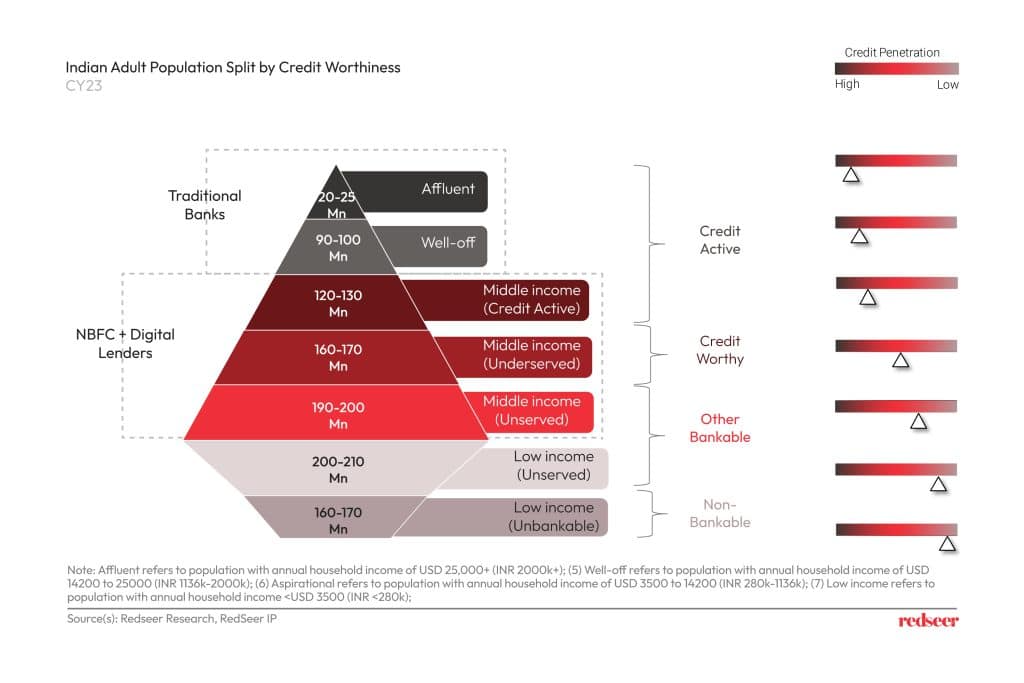

3. Diverse Borrowing Patterns Across Income Groups

○ Affluent Households (earning over INR 20 lakhs annually) and Well-off Households (earning between INR 12-20 lakhs annually) have high credit penetration rates and are catered by traditional banks for their diverse credit needs. ○ Middle-Income Households (earning between INR 3-12 lakhs annually) are credit active and are flexible in using both traditional and digital lending services. ○ Low-Income Households (earning less than INR 2.8 lakhs annually) offers rising new to credit customers that are currently being catered by digital lenders. ○ The Non-bankable Segment, a part of low income households, remains largely untapped but holds huge potential for growth in digital lending.

4. Comparison of Gen Z and Millennial Borrowing Habits

○ For Gen Z, personal loans make up about 40% of their borrowing, often used for experiential expenses like travel and tech upgrades. In contrast, Millennials account for only 21% of personal loans, reflecting a lesser reliance on this category. This difference can be attributed to the distinct life stages and financial needs of the two age cohorts.

○ For millennials, credit card spending makes up about 30% of their retail loan disbursals, highlighting its significance in their financial portfolio. For Gen Z, credit cards are the preferred financing option after personal loans.

5. Digital Borrowing Surge signals bright future, driven by the younger generation

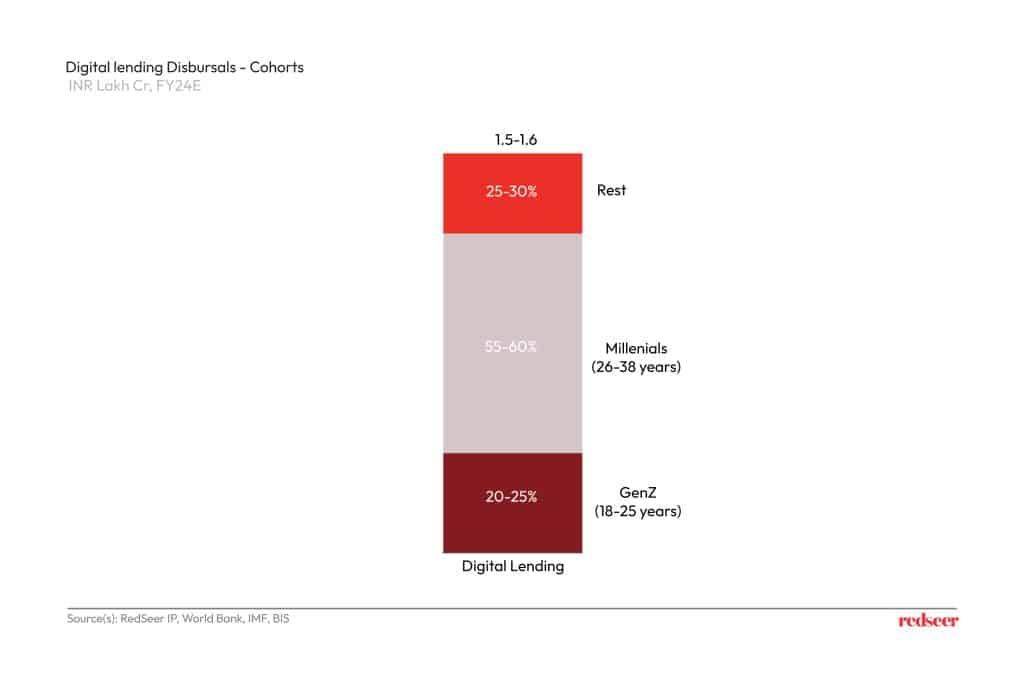

○ Gen Z individuals are embracing digital lending platforms, and make up 20-25% of the total digital loans disbursed.

○ The proportion of credit-active Gen Z individuals in India (15-20%), has room for significant growth compared to countries like South Africa (35-40%), China (40-45%), and the USA (75%).

○ Lenders have a tremendous opportunity to offer tailored products that can evolve with borrowers' changing needs.

“Gen Z and millennials are at the forefront of transformative change across various sectors, including the retail lending market. In India, retail credit presents substantial growth potential, driven by these younger generations. They are not just consumers of financial services; they are actively shaping and redefining the market's direction” said Jasbir S Juneja. “As Gen Z continues to mature and millennials advance in their careers, the demand for diverse credit products will likely expand. The younger generation’s familiarity with digital platforms will drive further innovation and competition in the lending market.”

The detailed study is given below: Imagine a world where getting a loan is as easy as ordering a pizza. No long queues, no mountains of paperwork—just a few taps on your smartphone, and you’re set. The new age of borrowing is on the brink of a major transformation, driven by the borrowing behaviors of Gen Z (aged 18-25) and millennials (aged 26-38). These younger generations are not just users of financial services but catalysts for change, shaping the market trajectory in unprecedented ways.

The retail lending landscape in India is undergoing a transformation, led by these younger generations. Our experts at Redcore have uncovered some fascinating trends: Gen Z, with their inherent tech-savviness, are not just open to borrowing—they’re leading the charge towards digital financial platforms for their financial needs and exploring new credit use cases like consumer durable loans and travel loans. This paradigm shift is redefining how loans are accessed and utilized, with an emphasis on digital-first solutions.

So, what does this mean for the future of retail lending in India? Let’s break it down and explore how the borrowing trends across Gen Z and millennials are driving the market, and showcase the growing potential of the digital lending space.

India’s retail credit presents a substantial growth opportunity, even when compared to developing economies like China, and Brazil. For instance, household debt per capita in these nations surpasses that of India, underscoring a substantial growth potential within the Indian lending market. This gap isn’t just an opportunity for lenders—it underscores the need to educate more Indians, especially in rural areas, about the benefits of formal credit.

Diverse Borrowing Patterns Across India’s Income Groups

Borrowing patterns of various income groups differ vastly where the crème is catered by traditional banks followed by digital lenders and NBFCs in the middle income groups.

Now, let’s take a detailed look at how different income groups in India are borrowing:

Overall, India offers rising new to-credit (NTC) customers with intent and eligibility for credit but lacking credit history.

The Digital Lending Boom

Although our study shows that traditional banks still rule the roost among the wealthy, digital lenders are quickly making their mark. Instant personal loan services are becoming popular with younger borrowers as these platforms offer instant loans through easy online processes, making them a hit with tech-savvy Gen Z and millennials.

The data from FY 22 to FY 24 highlights a significant growth in digital lending, which has increased from 1.8% to approximately 2.5% of the total retail loans disbursed. And it’s not stopping there—by FY 28, digital lending is expected to make up about 5% of the market, growing at a whopping 40% CAGR.

This rapid growth is driven by a digital push from the players leading to increased adoption across all age groups. Gen Z, in particular, along with millennials shows a higher penetration in digital lending compared to older age groups. They favor digital solutions for their financial needs due to the convenience and speed offered by the new-age players.

Now, Let’s examine the entire retail loan market: Gen Z contributes INR 3.5-4 lakh crore to retail loan disbursals, millennials account for INR 25-28 lakh crore, and the remaining disbursals total INR 28-30 lakh crore

Borrowing Patterns in Gen Z and Millennials

GenZ are often overlooked by traditional lenders and categorized as less attractive as they are new to credit and lack credit history. However, digital lending has made significant inroads with this demographic, offering tailored financial products and achieving notable disbursals.

Comparing Borrowing Habits: Personal Loans and Credit Card Preferences in Millenials and GenZ

Gen Z’s Digital Borrowing Surge Signals a Bright Future

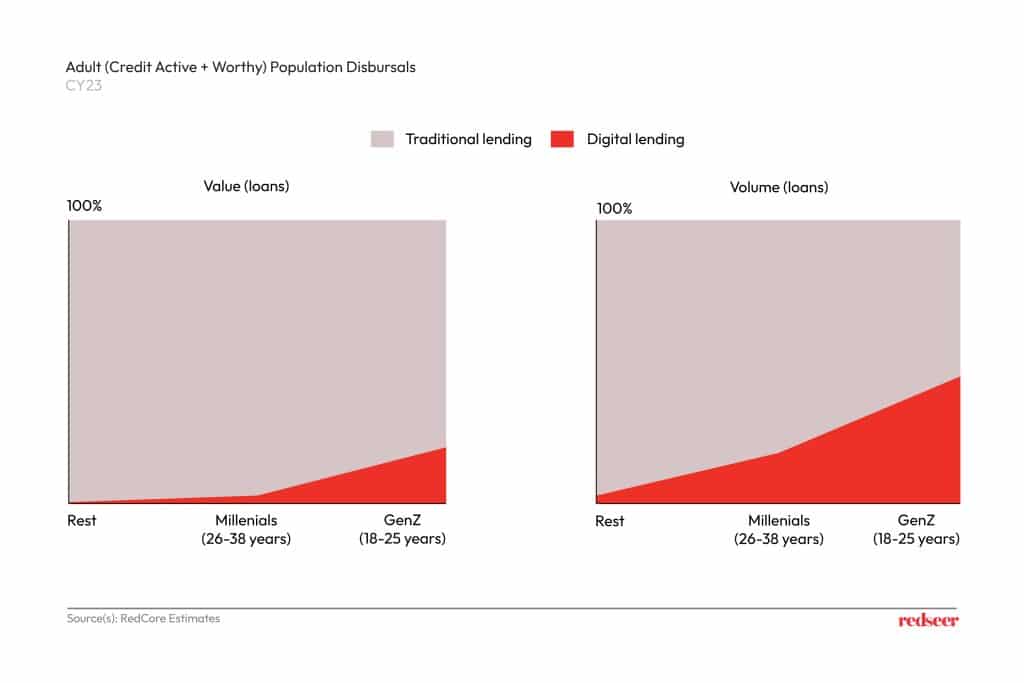

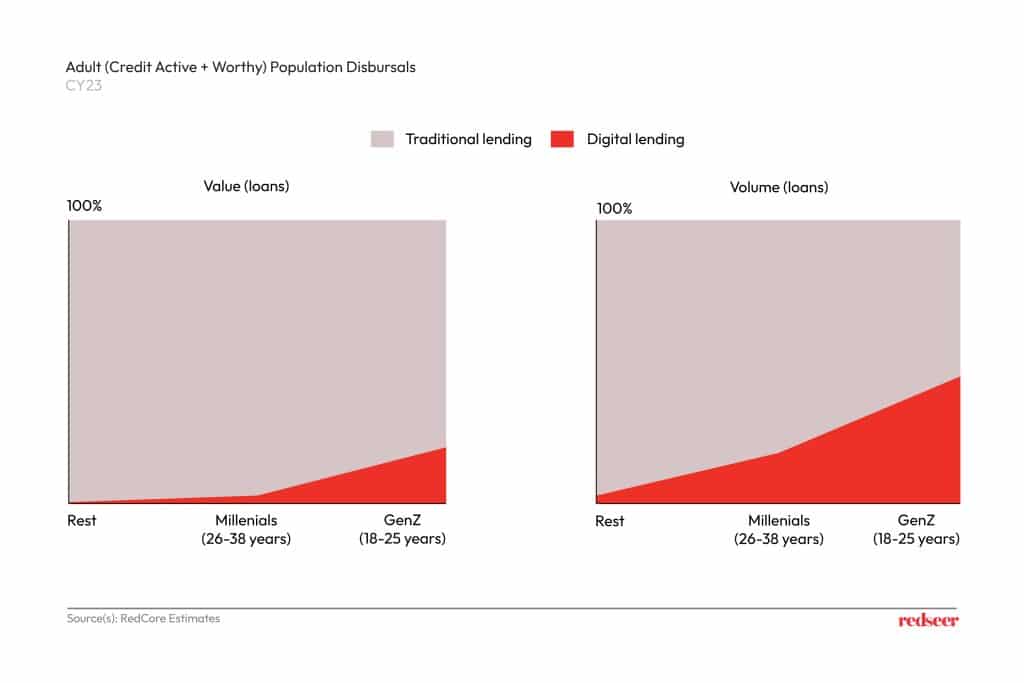

Let’s look at this comparison here. The value and volume penetration of digital loans is significantly higher for Gen Z compared to millennials and other demographics. The substantial volume of digital loans underscores the fact that more Gen Z individuals are embracing this convenient and accessible financial solution.

Even though Gen Z individuals are not the largest borrowers, they still comprise 20-25% of the loans disbursed through digital lending platforms.

Unlocking India’s Gen Z Credit Potential

The proportion of credit-active Gen Z individuals in India (15-20%) has room to rise significantly, offering substantial growth potential compared to other economies like South Africa (35-40%), China (40-45%), and the USA (75%). This means that there is significant growth potential for India’s credit-active Gen Z segment to adopt financial lending services. There is ample opportunity to expand and deepen the penetration of lending products among India’s Gen Z population. As this demographic matures and gains financial autonomy, there is potential for increased adoption of credit products, thereby fostering growth in the retail lending market.

The Future of Retail Lending

Gen Z in India is already reshaping lending dynamics with a preference for experiences over possessions, often borrowing for travel and related expenditures, emphasizing experiential consumption trends. This shift highlights the potential for growth in the retail lending sector.

As Gen Z continues to mature and millennials advance in their careers, the demand for diverse credit products will likely expand. The younger generation’s familiarity with digital platforms will drive further innovation and competition in the lending market.

For example, a recent graduate might initially rely on digital lenders for smaller personal loans to manage everyday expenses or purchase electronic gadgets. As they progress in their careers and their income stabilizes, they may seek larger loans for significant life events, such as purchasing a home or starting a business. This progression underscores the need for lenders to offer tailored products that evolve with borrowers’ changing financial needs.

Moreover, the increasing integration of AI and machine learning in digital lending platforms will enhance the customer experience, making loan approvals faster and more accurate. This technological advancement will further boost the appeal of digital lending among tech-savvy consumers.

As the market adapts to these changes, the future of retail lending in India looks promising, with digital innovation leading the way.