As per the LenDenClub report, over 60% of lenders earn more than 20% returns, 90% prefer UPI for lending

FinTech BizNews Service

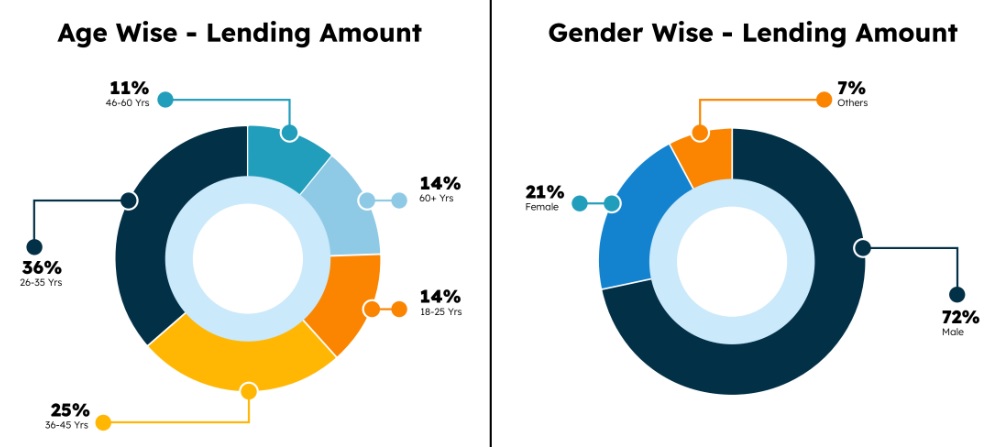

Mumbai, 19 November 2024: Millennials and Gen Z comprise the highest share of lending amounts on peer-to-peer lending platforms. Approximately 61% of P2P lenders are under 40 years old, with 36% falling into the 26-35 age group and 25% in the 36-45 age group. This underscores the significant participation of younger investors in this space. Data was released in the report titled "Manual Lending Pulse," by leading P2P lending platform LenDenClub that highlights lender behaviour and insights on P2P lending platforms.

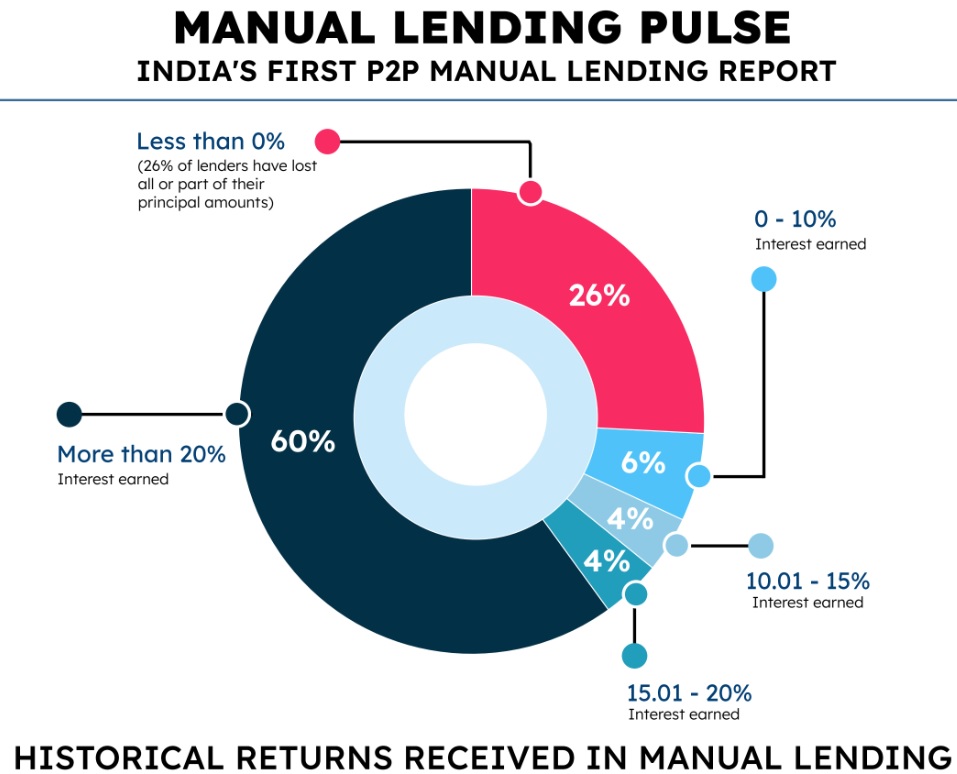

The report provides insights into the performance of digital finance in the P2P lending model. Over 60% of lenders on P2P lending platforms earned a return exceeding 20%, according to the report. Another 26% of lenders report returns of up to 10%, showing that P2P lending can offer a range of competitive returns when compared with other instruments. However, 14% of lenders face partial losses to their principal, indicating that P2P lending involves inherent risks.

The report reveals a gender-wise distribution of lending activity on the platform, with male lenders accounting for the majority at 72% of the total lending volume. However, female lenders make up a significant 21% share, indicating that P2P lending is also gaining traction among women.

In terms of gender, men still dominate, making up 72% of total lending activity. However, the number of female lenders is rising at 21%, a significant figure that shows how more women are entering the P2P space.

In addition to returns, the report sheds light on the geographic distribution in terms of the amount lent to borrowers from lenders, identifying Maharashtra as the top contributor with a 23% share. Karnataka follows closely with a 20% share, while Chhattisgarh, West Bengal, and Bihar round out the top five. Similarly, Maharashtra with 40% followed by Karnataka also lead in the user or lender count in P2P lending. This trend mirrors India's economic landscape, with Maharashtra and Karnataka, two of the top GDP contributors, also leading in P2P lending. However, the platform is not limited to economically developed regions. States like Chhattisgarh and Bihar demonstrate significant lending activity, indicating a growing demand for alternative financing options in less developed areas. This highlights the potential of P2P lending to bridge the financial gap and promote financial inclusion.

Digital payment solutions like UPI have played a crucial role in the evolution of the P2P lending landscape. Around 90% of lenders use UPI to add funds for lending to borrowers. This shows a shift towards faster and more convenient ways to engage with the platform. UPI makes it easier for lenders to move money quickly and efficiently.

Furthermore, the report highlights that a majority of lenders prefer short-term lending commitments, with 34% opting for a three-month tenure and 23% choosing a one-month tenure. This preference for shorter durations reflects a growing desire among lenders for quicker returns and the ability to actively manage their P2P lending activities.

Bhavin Patel, Co-founder & CEO of LenDenClub commented "This is the first of its kind report published by any Indian P2P Lending Platform. Manual lending is a very famous option amongst HNIs and retail customers in the USA and UK. These are more mature markets of p2p lending. These two markets together have facilitated around $100 Billion worth of lending transactions through these platforms. A sizable chunk of this money has come from manual lending options. It became famous there over the period of time as and when lenders/investors saw good returns on their money. India is also following the suit and seeing a good surge in manual lending numbers lately. The data clearly indicates that P2P lending is not only empowering individuals to earn attractive returns, but also contributing to financial inclusion by providing access to credit in underserved regions of the country."

The analysis in the report is based on data from 13,107 lenders over the past year, covering the period from November 2023 to October 2024.

Manual lending refers to a process where the lender personally selects the loans or borrowers they want to fund. Unlike automated lending, where an algorithm or preset preferences allocate funds, manual lending allows lenders to actively review individual loan applications and make decisions based on their preferences and risk appetite.