FACETS: FACE Members disburse 3 Cr loans in Q2 FY 24-25

FinTech BizNews Service

Mumbai, 24 Dec 2024: The Fintech Association for Consumer Empowerment (FACE), an RBI-

recognised Self-Regulatory Organisation in the FinTech Sector (SRO-FT), has released the 12th

issue of its quarterly report, FACETS. The data highlights India’s FinTech lending landscape's

steady scale-up, demonstrating its pivotal role in financial inclusion.

The report is based on data from 34 FACE member companies lending to customers through

their in-house NBFCs and in partnership with other regulated entities (mostly NBFCs). Of the 34

companies contributing their data, 23 are/have in-house NBFCs. The report analyses digital

loan disbursements, capturing metrics such as disbursement volumes, values, average ticket

sizes, growth and AUM.

Key Highlights from the report:

▪ Scale-up in loan disbursements: FACE member companies reported disbursing Rs

36,897 Cr during Q2 FY 24-25. Compared to Q2 FY 23-24, when the disbursement value

grew YoY by 44%, the disbursement value in Q2 FY 24-25 has moderated to 19%. The

disbursement volume reached nearly 3 Cr loans, driven by strong customer preference for

digital lending.

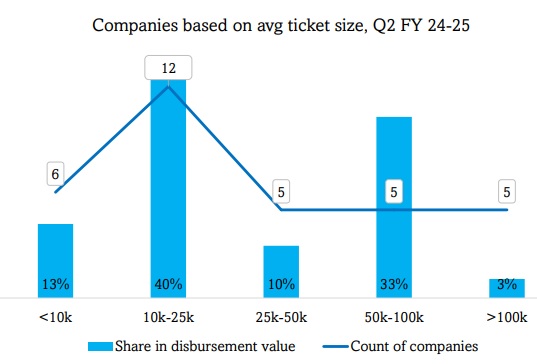

▪ Average ticket size: The average loan size for the quarter was Rs 10,891. The average

ticket size bucket of Rs 10k-25k is the most common, with 12 companies in that range,

accounting for 40% of total disbursement value. Overall, there is significant variation

amongst companies, demonstrating the FinTech sector’s ability to cater to varied consumer

segments and credit needs.

▪ AUM: As of Sep 2024, the total Assets Under Management (AUM) reported by 28 FACE

member companies stood at Rs 51,537 Cr. Of this, 74% was on the balance sheet.

To download the full report, please visit/ please click here: https://faceofindia.org/wp-

content/uploads/2024/12/FACETS-Issue-12_-September-2024.pdf