8.3 Cr Sanctions in 9 months of FY24-25

FinTech BizNews Service

Mumbai, India, 25 Mar 2025. The Fintech Association for Consumer Empowerment (FACE), the Reserve Bank of India (RBI)-recognised Self-Regulatory Organisation in the FinTech sector (SRO-FT), has released its latest report analysing the landscape of FinTech personal loans in India. The report, covering data from Apr 2018 to Dec 2024, highlights the growing role of FinTech Non-Banking Financial Companies (NBFCs) in expanding credit access across diverse customer segments.

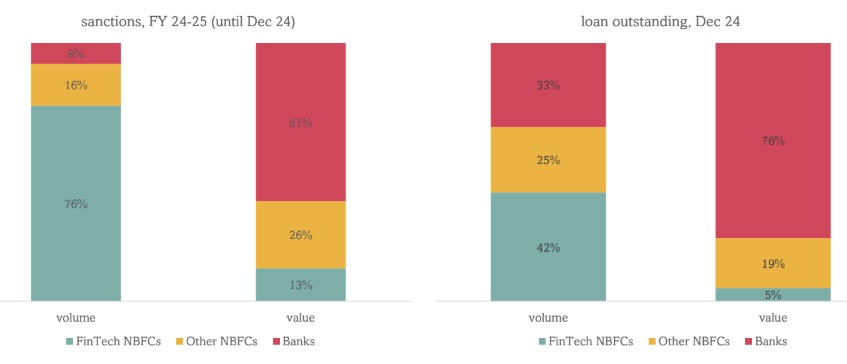

While FinTech NBFCs account for only 13% of the total personal loan sanction value in FY 24-25 (until December 2024), they drive 76% of sanction volumes, reinforcing their position as key enablers of digital financial inclusion. Amidst a deceleration in sanctions, the report underscores FinTech's potential to expand formal credit access and offers insights into evolving customer demographics, regulatory shifts, and market dynamics.

Sugandh Saxena, CEO of FACE, emphasised the FinTech sector’s impact, stating: "FinTech is key to digital financial inclusion and inclusive growth for the country. FinTechs have made a remarkable contribution through their customer-centric and digital approach to meet customers’ diversified credit needs, making credit accessible and convenient for several market segments. With over two-thirds of loans catering to young and tier II & III city customers, FinTech is key to meeting the country’s growing aspirations and resilience. At FACE, we focus on contributing to the FinTech journey by championing responsible conduct, innovation, and customer protection, which bring value to customers and all stakeholders."

Key Highlights of the Report:

Market Leadership in Volume

Focus on Underserved Markets

Accessible Credit

Portfolio and Risk Trends

Shift in Customer Vintage (FY 24-25 vs. FY 23-24)