Highest ever increase in Customer franchise to 4.29 million in FY24

FinTech BizNews Service

Mumbai, 26 April 2024: A meeting of the Board of Directors of Paisalo Digital Limited (PDL)

was held today to consider and approve the audited standalone and consolidated results for

the quarter and financial year ended 31 March 2024.

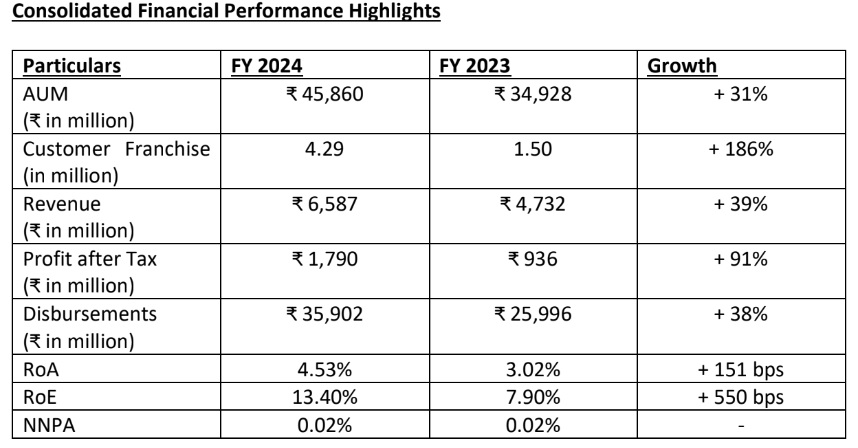

Consolidated Financial Performance Highlights

● Customer franchise stood at 4.29 million as of 31 March 2024 as compared to 1.50

million as of 31 March 2023.

● Assets under management (AUM) grew by 31% to ₹ 45,860 million as of 31 March

2024 from ₹ 34,928 million as of 31 March 2023.

● Revenue for FY24 increased by 39% to ₹ 6,587 million from ₹ 4,732 million in FY23.

● Disbursements grew by 38% to ₹ 35,902 million as of 31 March 2024 as compared to

₹ 25,996 million as of March 31 2023.

● Co-Lending Loan Disbursement grew by 100% to approximately ₹ 11,280 million as

of 31 March 2024 as compared to ₹ 5,640 million as of March 31, 2023.

● Profit after tax for FY24 increased by 91% to ₹ 1,790 million from ₹ 936 million in

FY23.

● Gross NPA (GNPA) and Net NPA (NNPA) as of 31 March 2024 stood at 0.21% and

0.02% respectively, as compared to GNPA 0.25% and NNPA 0.02% as of March 31,

2023.

● Capital adequacy ratio as of 31 March 2024 was 35.92%.

● Geographic footprint stood as 2,455 touch points as of 31 March 2024 as compared

to 1,052 touch points as of March 31 2023. The company added 1,403 touchpoints in

FY24.

● The Board of Directors have recommended a dividend of 10% i.e. ₹ 0.10 per equity

share of face value of ₹ 1.00 each for FY24. The dividend recommended by the Board

of Directors is subject to approval of members of the company at ensuing AGM of the

company.

● During FY24 the company has allotted bonus equity shares to the existing

shareholders of the company holding shares at the closing of business hours on the

record date i.e. 20 March 2024 in the ratio 1:1. The bonus shares were allowed trading

by stock exchanges on 28 March 2024.

Paisalo Digital Limited remains focused on sustaining its upward trajectory and strengthening

its market presence through strategic initiatives. With a resolute commitment, the company

persistently delivers ground breaking financial solutions to its clientele nationwide,

highlighting its steadfast investments in technology and product evolution.