Growing loan distribution user base offers Paytm tremendous upsell and lifecycle benefits

FinTech BizNews Service

Mumbai, 25 October, 2023: Paytm has reported revenue of Rs2,519 Cr, 32% YoY growth (despite timing of festive season pushing some of the revenues to Q3 FY 2024). Contribution profit is up 69% YoY to Rs1,426 Cr (margin of 57%, expansion of 13 percent point YoY), Paytm noted in a release.

Innovative device launches driving the merchant payment leadership

Earnings Release of Paytm states: We remain focused on expanding mobile payment acceptance network by enabling merchants with best-in-class product and technology. Paytm offers most comprehensive solution to address needs of wide variety of merchants. From a simple QR code to a variety of soundboxes, from comprehensive range of card machines to sophisticated payment gateway powering most of the large ecommerce platforms in India. In order to serve the diverse needs of our growing 3.8 Cr merchants, we continue to launch innovative products, like:

Card Soundbox: Empowers merchants to accept mobile and card payments, in a cost effective way, through our iconic Soundbox with ‘tap and pay’.

Pocket Soundbox: A small card-sized device which easily fits in the pocket and is helpful for merchants on the go, including auto drivers, delivery agents, parking fee collectors etc.

Music Soundbox: Allows merchants to listen to music over Bluetooth speaker, improving their engagement. These launches will help us in increasing TAM, merchant engagement, and card acceptance. With expansion of our distribution network, we have accelerated device subscriber addition to 44 Lakh YoY and 14 Lakh QoQ, taking overall merchant subscriber base to 92 Lakh. Rupay credit card on UPI rail is seeing good adoption by consumers and they are keen to link Rupay credit cards on their payment app. We believe, over a longer period of time, this has a potential of becoming a decent revenue stream for UPI payments. Paytm app remains a preferred choice for customers, with its offering to pay for various use cases through comprehensive payment instruments, such as UPI, Wallet, Postpaid, Cards, etc. Our Average Monthly Transacting Users (MTU) for Q2 FY 2024 grew by 19% YoY to 9.5 Cr as adoption of mobile payments for consumers in India continues. We have been focused on high quality users, and increasing engagement. With 33% YoY growth in Paytm App GMV and 32% YoY growth in Paytm App transaction volume, consumer engagement on the Paytm app continues to remain strong.

Improved portfolio quality for our lending partners

Earnings Release of Paytm further states: Our payments business helps us onboard customers and enables us distribute suitable credit products to them. Until September 2023, 1.18 Cr unique users have taken a loan through our platform. In Q2 FY 2024, across our three product offerings (Paytm Postpaid, Personal Loans, and Merchant Loans), loans amounting to Rs16,211 Cr were distributed through the Paytm platform. We are focused on superior credit quality outcome for our lending partners. We are seeing improvements in collection funnels in Postpaid and Personal Loans. While ECL for Postpaid came down in the previous 2 quarters, in this quarter, ECL for Merchant Loan have come down. Paytm’s strong consumer & merchant base, and symbiotic business model continue to see interest for lending partnership. Recently we have gone live with Tata Capital for lending partnership. We have already added 2 partners in FY 2024 and we expect to announce more partnerships in the coming quarters. We have now partnered with 9 NBFCs and Banks for our credit card and loan distribution business.

Focus areas

• Innovative products to expand mobile payments acceptance network: Indian merchants’ unique features and pricing requirements warrants innovative product launches. We are focused on solving this by launching various types of Soundboxes, Card machines and other devices, backed by a large distribution and service network.

• Expand Credit and Financial Services: Our focus is to expand credit offerings, which will help consumers and merchants find suitable product, in partnership with our lending partners.

• Farming of online merchants, by offering wider choice of payment instruments and better success rates.

• Enabling Commerce: We are enabling merchants to offer deals on Paytm app which drives customer engagement, as well as consumer traffic to the merchants.

Merchant Subscriptions (including devices)

Up 91% YoY to 92 Lakh: Our leadership in payment monetization continues. Added 44 Lakh and 14 Lakh new subscriptions in last year and quarter, respectively.

Loans Distributed through Paytm

Up 122% YoY to Rs16,211 Cr: As of September 2023, our lending partners have distributed loans through our platform to 1.18 Cr unique Paytm consumers and merchants. Paytm active user base continues to present significant upsell opportunities.

Payment Services: Leadership in payment monetization

According to Paytm: Our payment business continues to scale led by increase in GMV and higher subscription revenue. In Q2 FY 2024, payments revenue grew by 28% YoY to Rs1,524 Cr, despite some of the revenues getting pushed to Q3 FY 2024. In this financial year, online sales for the festive season will be captured in Q3, whereas in the previous financial year it was largely in Q2. Payments profitability improved with net payment margin expanding 60% YoY to Rs707 Cr.

Financial Services and Others: Growing digital distribution of credit

According to Paytm, in Q2 FY 2024, revenue for financial services and others grew 64% YoY to Rs571 Cr. In view of economic uncertainties, we have worked with our partners for more stringent credit criteria, which is resulting in better portfolio outcome. While Postpaid ECL came down in the previous 2 quarters, Merchant Loan ECL has come down in this quarter. Improved portfolio performance should drive increase in take rate going forward.

Cloud & Commerce:

Majority of cloud business is now co-branded Credit Cards and advertising services

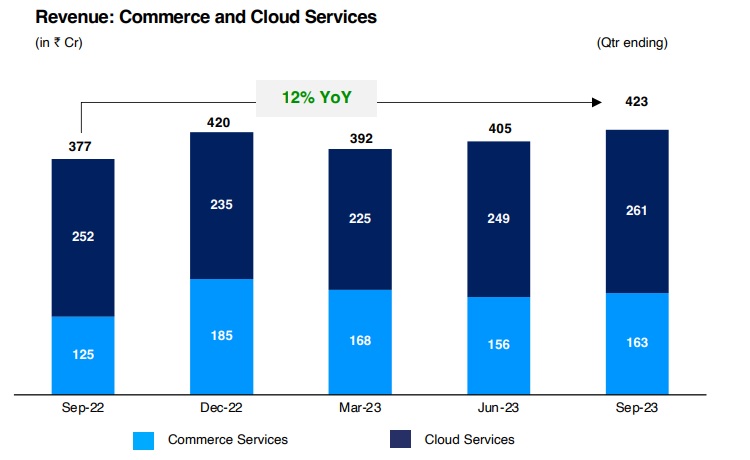

Earnings Release of Paytm further state: In our Commerce and Cloud segment, we monetize Paytm app traffic by providing marketing services to our merchants. In Q2 FY 2024, Commerce & Cloud revenue grew by 12% YoY to Rs423 Cr.

Cloud

Cloud business includes advertising, co-branded credit cards, marketing cloud, and loyalty business. Cloud business grew by 3% YoY to Rs261 Cr. We saw healthy YoY growth in co-branded credit card and advertising businesses. Total 8.7 Lakh credit cards activated as of September 2023 versus 3.0 Lakh last year. PAI Cloud business had a strong quarter last year. Telecom VAS offerings (marketing cloud) has seen decline YoY, according to Paytm.

Commerce

Our commerce business include travel, movie, entertainment ticketing, and selling of deals and gift vouchers to consumers. Q2 FY 2024 Commerce GMV grew 39% YoY to Rs2,893 Cr while revenue grew by 31% YoY to Rs163 Cr. Take rate has remained in the 5-6% range.

Loan Distribution & Collection

In Q2 FY 2024, the number of loans distributed through our platform grew to 1.32 Cr, a growth of 44% YoY. The value of loans distributed grew to Rs16,211 Cr, a growth of 122% YoY. Total number of unique users who have taken a loan through our platform has increased by 51 Lakh over last 1 year to 1.18 Cr. This growing loan distribution user base offers us tremendous upsell and lifecycle benefits. With onboarding of Tata Capital, we now have 9 bank and NBFC partners across all our lending products (including credit cards). We continue to work closely with our existing partners, and are on track to add more partners in the remaining financial year.

Paytm Postpaid The number of Postpaid Loans distributed grew 44% YoY, while the value of Postpaid Loans grew 122% YoY. Our large Postpaid customer base also provides cross-sell opportunities for Personal Loans and Credit Cards. Penetration1 for Postpaid is at 4.5% of MTU. Personal Loans The number of Personal Loans distributed grew 27% YoY, while the value of Personal Loans grew 91% YoY to Rs3,927 Cr. Average ticket size is ~Rs165,000 with average tenure of ~16 months. We/our partners have reduced shorter tenor loans (6 months) on our platform since they were likely to be riskier, resulting in the reduction in # of loans, while the disbursal volumes have remained steady. This has resulted in increase in average tenure and average loan size for personal loan portfolio. Cross-sell from Postpaid continues to see traction with over 35% of personal loans distributed in Q2 FY 2024 to existing Paytm Postpaid users. Penetration1 for Personal loans is at 1.1% of MTU.

Merchant Loans

The number of Merchant Loans distributed grew 130% YoY in Q2 FY 2024, while the value of Merchant Loans grew 171% YoY to Rs3,275 Cr. Proportion of loans distributed to a subscription merchant remains greater than 85% this quarter. Average ticket size is ~Rs180,000 with average tenure of 13 months. Our repeat rate (proportion of loans by value to merchants who have taken a loan before) remains at a healthy level of ~50%. Penetration1 for Merchant Loans is 6.4% of device merchants.