RBI Warns Boards Of Banks, NBFCs To Avoid Exuberance In Unsecured Lending

FinTech BizNews Service

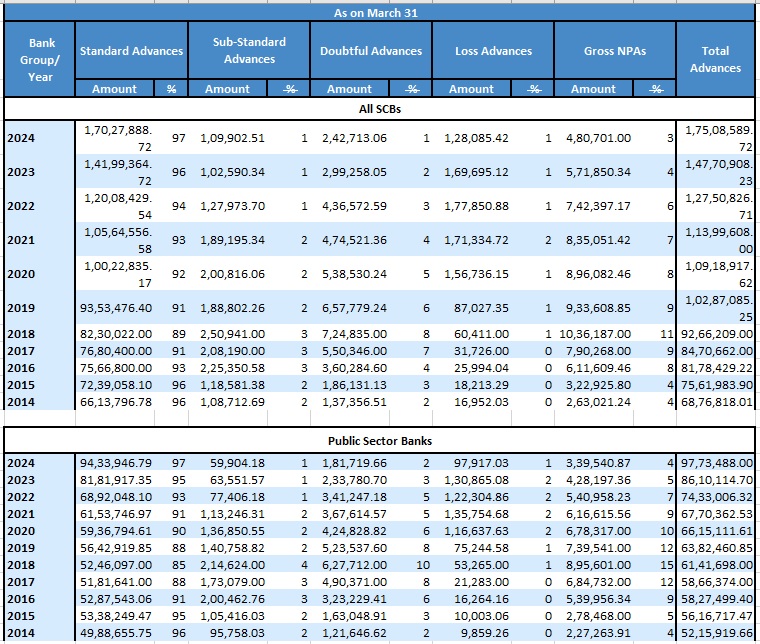

Mumbai, 27 December, 2024: In India, strong macroeconomic fundamentals have boosted the performance and soundness of the Indian banking and nonbanking financial sectors. Banks’ profitability improved for the sixth consecutive year in 2023- 24, while their gross non-performing assets (GNPA) ratio reached its lowest level in 13 years at 2.7 per cent at end-March 20242. Banks’ capital position remained satisfactory, as reflected in key parameters like leverage ratio and capital to risk weighted assets ratio (CRAR). Strong credit expansion by NBFCs was accompanied by further strengthening of their balance sheets, improvement in credit quality and profitability, and satisfactory capital buffers, according to the Reserve Bank of India’s Report on Trend and Progress of Banking in India 2023-24, released on 26 Dec, 2024.

Focus on early detection and pre-emptive correction

Under the process of supervision of banks, NBFCs and other financial entities, the focus is now on early detection and pre-emptive correction. The enhanced off-site assessment framework is more analytical and forward looking with introduction of macro-stress tests, early warning indicators (EWIs), fraud vulnerability index (FVI), micro-data analysis (MDA), and use of artificial intelligence (AI) and machine learning (ML) techniques.

SupTech initiative with end to-end workflow solution

The Reserve Bank’s frequent and wide interactions with supervised entities (SEs), including with managing directors (MDs) and chief executive officers (CEOs) as well as board directors, will be carried forward. Engagement with SEs is also being strengthened through DAKSH portal – a SupTech initiative with end to-end workflow solution to streamline and strengthen various supervisory processes. Additionally, direct interactions with statutory auditors have further strengthened the oversight framework. This consultative approach is also being followed in revision of various regulatory guidelines including Basel III standards. The Reserve Bank is also working on issuing final guidelines on disclosure framework for climate related financial risks.

Unsecured Lending

In response to the Reserve Bank’s November 2023 macroprudential measures to contain potentially excessive risk build-up from high credit growth in unsecured retail segments, there has been some moderation in credit growth, but delinquency levels and leverage warrant enhanced vigil. While specific limits have been prescribed for unsecured lending by urban co-operative banks (UCBs), boards of SCBs and NBFCs have discretion in fixing limits on unsecured exposures. However, some entities have fixed very high ceilings, which need to be continuously monitored. Going forward, the Reserve Bank expects the boards of REs to show prudence and avoid exuberance in the interest of their own financial health as also systemic financial stability.

Gold Loans

In view of several irregularities observed in grant of loans against gold ornaments and jewellery, including top-up loans, the Reserve Bank advised SEs to comprehensively review their policies, processes and practices on gold loans to identify gaps and initiate appropriate remedial measures in a time-bound manner. SEs were advised to closely monitor their gold loan portfolios and ensure adequate controls over outsourced activities and third-party service providers.

Top-up Loans

While top-up loans provide additional credit facilities to customers on the strength of their existing collateral such as houses, automobiles or gold, many REs may perceive such secured loans as having lower risk. Hence, such additional facilities are often sanctioned with minimal processes and due diligence, with liberal underwriting standards and lax adherence to prudential guidelines on loan-to value (LTV) ratios, risk weights, and without ensuring the end-use of funds. These practices could lead to build-up of risks, especially during times when collaterals for such loans become volatile or face cyclical downturns. In view of these concerns, the Reserve Bank in November 2023 had instructed that all top-up loans extended by REs against movable assets, which are inherently depreciating in nature, should be treated as unsecured loans for credit appraisal, prudential limits and exposure purposes. The Reserve Bank will assess the need, if any, for additional regulatory interventions to mitigate the identified risks in cases of other top-up loans.

Foreclosure Charges/ Pre-payment Penalties on Loans

Banks and NBFCs are presently not permitted to levy foreclosure charges/ prepayment penalties on any floating rate term loan sanctioned for purposes other than business, to individual borrowers with or without co-obligant(s). To safeguard customers’ interest through better transparency, broadening the scope of such regulations to cover loans to micro and small enterprises (MSEs) is being considered.

Private Credit Markets

The shift in lending intermediation from banks to private entities is gaining traction globally. Traditionally, private credit firms raise resources from high-risk appetite investors to finance mid-sized companies — a segment which often faces challenges in getting finance from banks and public debt markets. Recent trends, however, indicate that the reach of private credit is expanding beyond mid-sized corporate borrowers, intensifying competition with banks in the syndicated loan markets5. In India, the size of such private credit firms and the resources raised by them is not very large. A closer look is, however, warranted at the inter-linkages between REs, including banks and NBFCs, with such firms. Strong interrelationship between them could give rise to systemic concerns along with the possibility of regulatory arbitrage to circumvent regulations. Know Your Customer (KYC)

The amendments to KYC master directions, issued on November 6, 2024, now mandate REs to seek from the customer or retrieve from Central KYC Registry (CKYCR), the customer’s KYC identifier for the purpose of verification of identity of the customer and for ongoing due diligence. It also mandates the use of CKYCR for the purpose of re-KYC or periodic updation of KYC details by REs. The amendment further mandates a time limit of seven days or as notified by the central government for REs to update customer records in CKYCR. REs are also required to retrieve the updated information from CKYCR and maintain the updated record.

However, certain gaps in implementation of these directions by REs are resulting in several accounts getting frozen, denying customers access to their funds. Other related issues include lack of a proactive approach in assisting and obtaining customers’ documents; inadequate staff deployment in such critical functions resulting in overcrowding or denial of service at branches; directing the customers to their home branch for KYC updation rather than facilitating the same at branch of customers’ convenience; and failure to update the details in the system even after the customers have provided the required documents. There are also instances of accounts meant to receive direct benefit transfers (DBT) from the government being made inoperative or frozen, contrary to regulatory guidelines. In such matters, it is essential for the banks’ boards to establish policies and direct banks to adopt standard operating procedures that are not only compliant with regulatory guidelines but also practical for effective implementation. Banks should ensure that KYC guidelines are followed with both precision and empathy.

Higher Employee Attrition

Employee attrition rates are high across select private sector banks (PVBs) and small finance banks (SFBs). The total number of employees of PVBs surpassed that of public sector banks (PSBs) during 2023-24, but their attrition has increased sharply over the last three years, with average attrition rate of around 25 per cent. High attrition and employee turnover rate pose significant operational risks, including disruption in customer services, besides leading to loss of institutional knowledge and increased recruitment costs.

In various interactions with banks, the Reserve Bank has stressed that reducing attrition is not just a human resource function but a strategic imperative. Banks need to implement strategies like improved onboarding processes, providing extensive training and career development opportunities, mentorship programmes, competitive benefits, and a supportive workplace culture to build long-term employee engagement.