Shift in balance from Private Sector Banks to Public Sector Banks; Headline Credit Growth More Like Arithmetic Average

Dr. Soumya Kanti Ghosh

Member, 16th Finance Commission &

Group Chief Economic Advisor

State Bank of India

Mumbai, June 30, 2025: SCBs credit growth moderated to 9.6%,as on 13 June 2025 (19.1% a year ago;) due to weaker momentum as well as unfavorable base effects

❑ By excluding merger impact (HDFC merged with HDFC Bank w.e.f. 13 July 2023), SCBs credit grew by 10.6%, as on 13 Jun 2025 (15.5% a year ago).

❑ Till 13 June, credit increased by Rs 70,005 crore (0.4% YTD), compared to last year growth of Rs 2.74 lakh crore (1.7% YTD)

Headline Credit Started to Decline from June 2024

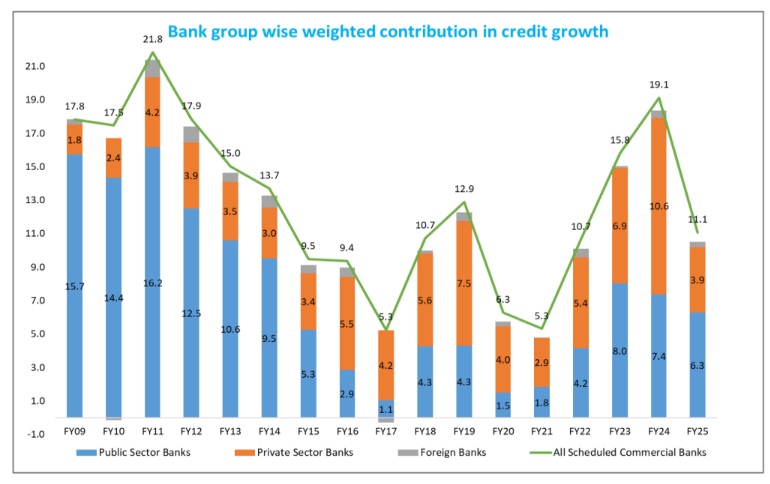

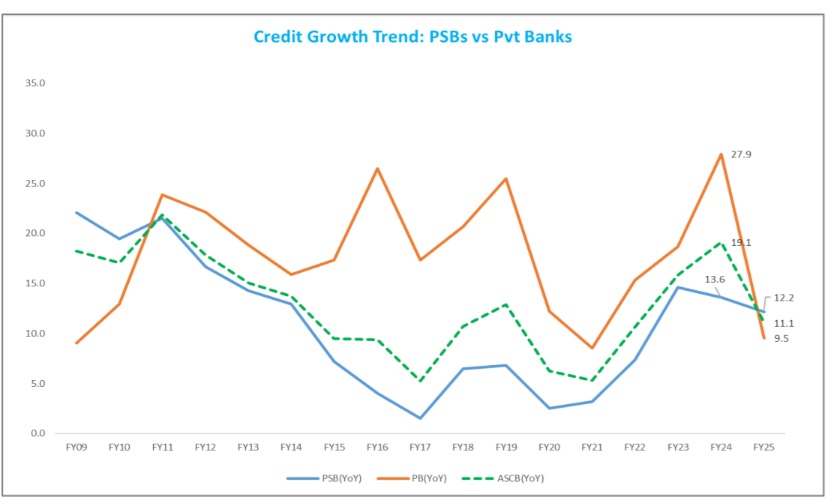

❑ After 3-years of sustained growth in bank credit during FY21-FY24, credit started to decline from June 2024 and reached 11.1% in FY25

❑ The bank-group wise contribution to SCB growth indicate that private bank’s growth slowed down significantly

compared to PSBs

❑ Public sector banks show a stable growth of 12.2% in FY25 compared to FY24 growth of 13.6%. However, private sector bank’s credit growth declined to 9.5%, lowest since FY21

However,....Credit-to-GDP gap has narrowed; Financial Deepening will continue to rise

❑ The credit-to-GDP gap has narrowed, reflecting the improved credit demand in the economy in the face of rising capacity utilization in the manufacturing sector

Working capital growth has cushioned credit growth decline in FY25

❑ Investment announcements increased to more than Rs 50 trillion in FY25 (from Rs 38 trillion in FY24) supported by both Government as well as Private participation. However, execution appears to be timid as reflected in single digit growth of 8% in term loans as compared to ~ 11.1% growth in overall ASCB credit at the end of March’25 vis-à-vis 24.4% and 20% growth respectively a year ago

❑ Present growth is mainly on account of growth in working capital loans which grew by around 17% in March’25 vis a vis around 10% a year ago

Sectoral Credit reveal that credit to MSME sector is running at 17.8%....

❑ The sectoral credit growth indicates credit growth to various sectors of the economy has softened driven by a moderation in growth of credit to services sector and agriculture and allied activities. Personal loans growth also decelerated to 11.9% (y-o-y), as compared with 26.7% a year ago, largely due to decline in growth of ‘Housing’, ‘Other Personal Loans’, ‘Vehicle Loans’ and ‘Credit Card outstanding’.

❑ Personal loans share in incremental credit growth has declined in FY25 to 37% from 43% in FY24, while Industry share has increased to 17% in FY25 from 11% in FY24

❑ The X factor in credit growth is credit to MSME sector rising by 17.8% YoY

MSME Credit bucks the overall headline trend in credit growth...

❑ An increased supply of credit to existing borrowers, with the MSME sector witnessing a notable improvement in balance sheet serious delinquencies — measured as 90 to 120 days past due (DPD) and reported as ‘sub-standard’, which has dropped to a five-year low of 1.8%. This improvement, particularly among borrowers with exposures ranging from Rs 50 lakh to Rs 50 crore, marked a 35 basis points decline from the previous year

❑ There has been a definition change for the MSME sector wherein, as an example, for medium enterprises the turnover limit has been increased to Rs 500 crores. Thus, it is possible that MSME credit growth could be enlarged even further

❑ The formalization of MSMEs with the help of URN seeding is giving necessary fillip to the MSME credit growth. Udyam registration number (URN) is a permanent identification number for businesses looking to register themselves under the MSME definition and to seek the guarantee cover. Till 27 June, a total of 2.72 crore registration has been done through Udyam Assist Platform

❑ The Government has taken great initiative by providing enhanced guarantee cover to various category of MSME borrower viz.

enhancing the CGTMSE cover from Rs 5 crore to Rs 10 crore, introduction of Mutual Credit Guarantee Scheme for MSME manufacturing sector (for loans up to Rs 100 crore), increasing the Credit Guarantee cover for loans to Start-up from Rs 10 crore to Rs 20 crore, introduction of Credit Guarantee covers for Exporters for Term Loan of up to Rs 20 crore. All these initiatives also give good boost to MSME credit growth

To facilitate MSMEs in unblocking working capital by converting trade receivables into cash the turnover threshold for buyers mandatory onboarding on the TReDS platform has been reduced from Rs 500 crore to Rs 250 crore

❑ SMEs could be thus benefitting from a plethora of overlapping factors, capacity expansion in a benign regime when public policies are getting increasingly reoriented for their welfare as also scaling of operations by entities that are moving up the value chain and entry of new players along traditional / blended areas with a renewed push for Make in India, and Digital India

guardrails facilitating such decisions seamlessly. Interestingly, the MSMEs depend greatly on large corporates through backward integration (and at times, forward integration) and hence the MSMEs activity level could be a gauge of corporate activities (with all channels of financing options (banks/non-banks) embedded holistically)

PSB’s share in bank credit is now at 56.9% and has shown significant improvement from FY20 following 4R strategy

❑ The Government’s 4R’s strategy of recognition, resolution, recapitalization and reforms have reaped rich dividends. The asset quality in the banking system is now at a record low of 2.6% in H1FY25 from 11.5% in FY18. Now, PSBs share in outstanding credit has improved to 52.3% in outstanding credit in FY25, after 14-years of decline to 51.8% in FY24 from 75.1% in FY10. The share in incremental credit of PSBs has also increased to 56.9% in FY25 from 20% in FY18

Reinterpreting credit growth in the broader sense

.....Private Credit is making rapid inroads...could change the legacy guardrails fast

❑ Private credit has been rearing to grow; the Goldilocks period on the anvil repositioning the nation within not only Asian counterparts but also amongst the most promising jurisdictions globally beckoning a league of marquee asset managers

❑ Private credit deals totaled ~Rs 774 bn in FY24 (counting only 163 deals above Rs 8.5 bn and above as per E&Y), growing 7% over CY23 satiating the growing needs of varied strata of India Inc. through tailored financing solutions primarily via Alternative Investment Funds (AIFs) while issuances of NCDs remains in practice

❑ Interestingly, the deals were led from the front by domestic fund houses who captured 60%+ of market share on

both value-volume terms, benefitting sectors like real estate, consumer durables and financial services firms the

most

❑ With a dash for yields, Private credit is likely to witness greater traction as family offices to HNIs rub shoulders with global fund houses, exploring myriad avenues like distress/special funding to refinancing to growth capital to bridge loans

❑ While the present situation is not at par with somewhat beleaguered growth of NBFCs whom the RBI strategically brought within the regulatory perimeter through Scale Based Regulations, the evolving trajectories of India’s burgeoning credit markets across strata would necessitate a pivot in regulatory attention sooner than later

Diversion in Bank Credit to alternative sources of funding like Commercial Paper, ECB & tapping capital markets

❑ Rise in Borrowing from Commercial Paper: In FY25, fund raised through CPs increased by 14.4% to Rs 15.7 lakh crore from Rs 13.7 lakh crore in FY24. In current FY so far (Apr-15 June), borrowing from commercial paper (CP) has increased to Rs 3.95 lakh crore, compared to last year borrowing of Rs 3.2 lakh crore. The higher borrowing in CP segment are apparently due to the lower interest rate compared to bank loans.

❑ ECB Borrowing Increased: ECBs have emerged as a key source of funding for Indian corporates, enabling capital expansion and modernization. High levels of ECB potentially contribute to slower domestic credit growth by influencing the allocation of funds and potentially impacting the risk appetite of banks

• The Large Corporate Framework effective from April1,2019 might be the reason why such entities are tapping the ECB route

❑ Robust performance of Capital markets: Money raised from Equity, including through IPOs, FPOs, InvITs/ ReITs, OFS, QIP and IPPs., increased by more than two-fold in FY25 i.e. from Rs 1.90 lakh core in FY24 to Rs 3.71 lakh crore in FY25. Though, equity will be an enabler to support further growth and debt raising in longer term, in short term these trends affect bank credit growth, as a part of the same may have been used to repay debt pre-maturely, as also fund capex requirements

Also, India Inc has increased cash holdings and thus funding expansion mostly through internal cash accruals...

❑ India Inc has increased cash holding, In last two years (FY24/FY25), we are witnessing increase in cash and bank balance by Indian Corporates by around 18-19%. Major sectors reporting increased cash holdings includes IT, Automobiles, Refineries, Power, Pharma etc. Cash and Bank balance of India Inc, ex BFSI, which was around Rs 5 lakh crore in FY14 is estimated to be around Rs 13.5 lakh crore in FY25

Corporate balance sheets are healthy

❑ In last four years, Indian Inc. maintained average EBIDTA margin of 22%, while average wage bill grew by around 12%, reflecting modulation in wage bill, among others, while keeping the margin of safety

❑ Further, with retained earnings and capital infusion, aggregate capital growth of these listed entities, ex BFSI in FY25, grew by around 15%, while loan funds grew by only 8% improving the debt equity ratio by around 4 bps as of March’2025 (from 0.71 to 0.67)

❑ All these key variables suggest improved health of corporate balance sheet and Indian Inc. looks set to ride the wave of future opportunities

Outlook

❑ Following 100 bps repo rate cut by RBI, many banks have reduced their repo-linked EBLRs by a similar magnitude

❑ Now around 60.2% of the loans are linked to EBLR and 35.9% are linked to MCLR. MCLR, which has a longer reset period and is referenced to the cost of funds, will get adjusted with some lag

❑ Apart from that the 100-bps reduction in CRR to 3%, would release primary liquidity of about Rs2.5 lakh crore to the banking system by December 2025. Besides providing durable liquidity, it will reduce the cost of funding of the banks, thereby helping in monetary policy transmission to the credit market

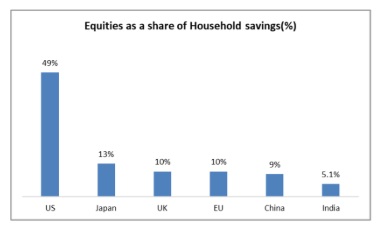

❑ In future, sources of credit origination of banks through deposits (primarily household savings in bank deposits) needs to be keenly watched .... financialization of household savings has gained significant momentum (equities as % of household savings in India increased from 2.5% in FY20 to 5.1% in FY24)