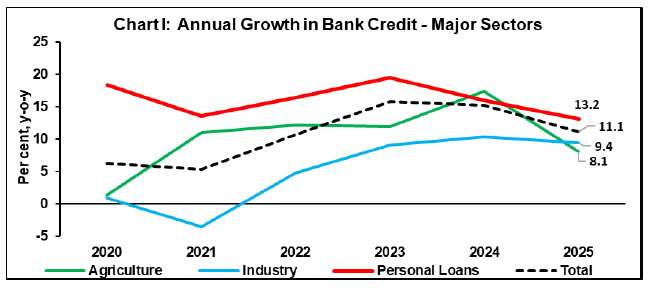

The deceleration in credit growth (y-o-y) was observed across all bank groups

FinTech BizNews Service

Mumbai, May 30, 2025: Today, the Reserve Bank released the web publication ‘Basic Statistical Return on Credit by Scheduled Commercial Banks (SCBs) in India – March 2025’1 on its ‘Database on Indian Economy’ (DBIE) portal2 (https://data.rbi.org.in Homepage > Publications). The publication provides information on various characteristics of bank credit in India, based on data submitted by SCBs {including Regional Rural Banks (RRBs)} under the annual ‘Basic Statistical Return (BSR) – 1’ system, which collects information on type of account, organization, occupation/activity and category of the borrower, district and population3 group of the place of utilization of credit, rate of interest, credit limit and amount outstanding.

Highlights:

The deceleration in credit growth (y-o-y) was observed across all bank groups during FY 2024-25. Private sector banks witnessed the steepest decline to 9.5 per cent in March 2025 after a sustained credit growth above 15 per cent for the preceding three years.

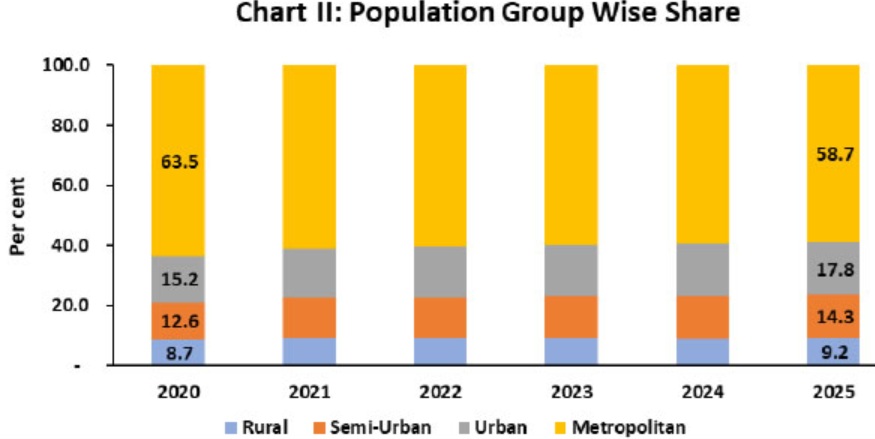

With higher credit growth in rural, semi-urban and urban areas compared to metropolitan area, the share of metropolitan branches in total credit declined to 58.7 per cent in March 2025 from 63.5 per cent five years ago.