The fiscal deficit is expected to ease by 20 to 30 bps from the budgeted level to 4.2% of GDP. Alternatively it will open up for additional spending.

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

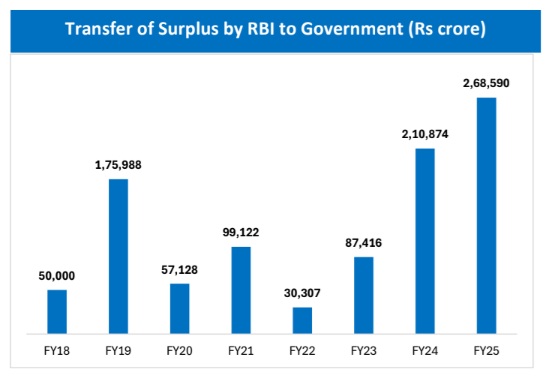

Mumbai, May 24, 2025: The RBI has announced a dividend transfer of Rs 2.7 trillion to the Government. Simultaneously, in a prudent move, the RBI has increased the risk buffer, otherwise the dividend transfer could have topped Rs 3.5 trillion.

The RBI Board had recommended that the risk provisioning under the Contingent Risk Buffer (CRB) be maintained within a range of 7.5% to 4.5% of the RBI’s balance sheet. The transferable surplus for the year has been arrived at on the basis of the revised Economic Capital Framework (ECF) as approved by the Central Board in its meeting held on May 15, 2025. Based on the revised ECF, and taking into consideration the macroeconomic assessment, the Central Board decided to further increase the CRB to 7.5% (from 6.5% in FY24 and 6.0% in FY23).

The Union Budget for 2025-26 had projected a dividend income of Rs 2.56 lakh crore cumulatively from the Re-

serve Bank and public sector financial institutions. With today’s transfer, this number would be now much higher

than the budgeted estimates. We expect fiscal deficit to ease by 20 bps from the budgeted level to 4.2% of GDP.

Alternatively, it will open up for additional spending for around Rs 70,000 crores, other things remaining un-

changed.

This surplus payout is driven by robust gross dollar sales, higher foreign exchange gains, and steady increases in interest income. Notably, the RBI was the top seller of foreign exchange reserves in January among other Asian central banks. In September 2024, foreign exchange reserves peaked to $704 billion and the RBI RBI has sold truck loads of dollar to stabilize the currency.

The dynamics of surplus for RBI was decided by its LAF operations and interest income from its holding of domestic and foreign securities. The balances under the daily LAF show that RBI was in absorption mode from 03 June to 13 Dec’2024. However, after mid December the system liquidity turned to injection mode till end March 2025.

The average absorptions add to RBI expenses under LAF.

Gross dollar sales rose to $371.6 billion in FY25 (till Feb25) against $153 billion in FY24. Meanwhile, decline in G-sec yields has had a bearing on MTM gains on RBI's holdings of rupee securities. In FY25, RBI's holdings of rupee securities increased by Rs 1.95 lakh crore, to Rs 15.6 lakh crore as of March 2025.

This surplus payout is driven by robust gross dollar sales, higher foreign exchange gains, and steady increases in interest income. Notably, the RBI was the top seller of foreign exchange reserves in January among other Asian central banks. In September 2024, foreign exchange reserves peaked to $704 billion and the RBI has sold truck loads of dollar to stabilize the currency.

IMPACT ON RBI’S BALANCE SHEET

The dynamics of surplus for RBI was decided by its LAF operations and interest income from its

holding of domestic and foreign securities. The balances under the daily LAF show that RBI was in absorption mode from 03 June to 13 Dec’2024. However, after mid December the system liquidity turned to injection mode till end March 2025. The average absorptions add to RBI expenses under LAF.

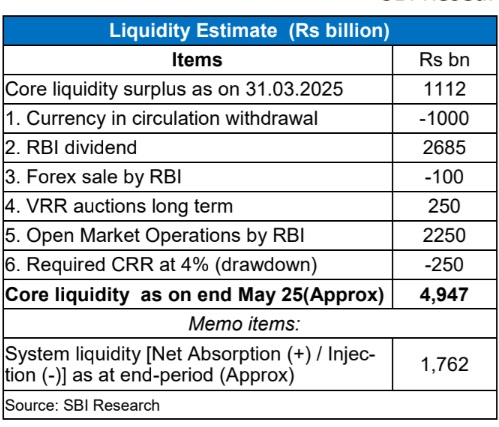

System liquidity turned to surplus mode and stands at Rs 1.2 lakh crore on 31 Mar’25. Average liquidity deficit from 16th Dec 24 to 28 Mar’25 was Rs 1.7 lakh crore

Durable liquidity is likely to remain surplus in FY26, supported by several factors, like OMO purchase, RBI’s dividend transfer, BOP surplus of around USD 25-30 bn in FY26.