Headline CPI inflation set to breach the lowest ever historical print in July 2025

FinTech BizNews Service

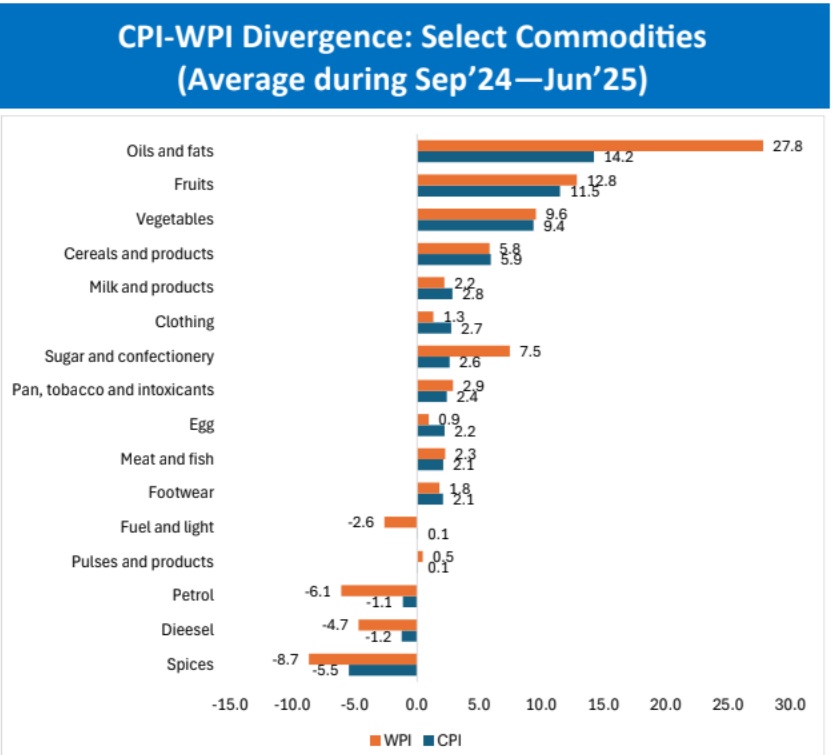

Mumbai, July 15, 2025: India’s CPI inflation moderated to 77-month low of 2.10% in June’25, vis-a-vis 2.82% in May’25 and 5.08% in June’2024. The decline is mainly due to decline in food inflation, which is also at 77-month low of –0.20%, led by continued decline in food items particularly vegetable, pulses and spices. However, the imported inflation has again risen for the month of June 2025, making it the 13th consecutive straight monthly rise. The rise in gold and silver prices have contributed the most to build-up in imported inflation. The overall share of imported inflation in total CPI inflation buildup now stands at 71% in June’25 up from 50% in May, states the Research Report from the State Bank of India’s Economic Research Department, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India.

The impact of the trade tariffs on inflation, particularly the domestic inflation part consisting of 75% weight in overall basket can be further deflation in domestic relative prices. The sectors that are at risk of major impact include Clothing and footwear and household items consisting of electronic and manufacturing items. Share of these two items is close to 10.3% in CPI basket.

An analysis done using Threshold diffusion indices (which capture the dispersion of price increases in CPI basket beyond the specified y-o-y thresholds of 4% and 6%) indicates that Threshold diffusion indices continued to remain well below the 50-level mark (18 in the case of more than 6% and 32 in the case of more than 4%), indicating that the extent of price increases across a majority of the CPI items continued to remain muted.

Internationally, Global commodity prices have been decelerating in the past four months. All the major components are in the negative territory, apart from fertilizer and precious metals.

We examined spatial convergence across states to assess whether there exists regional dispersion—a phenomenon indicative of greater price alignment and effective macroeconomic transmit particularly given the multiple overlapping shocks.

Using a cross-sectional β-convergence approach, we test the hypothesis that states with larger initial deviations from the all-India inflation rate exhibit greater reductions in those deviations over time. We found that a negative and statistically significant β coefficient confirms the presence of spatial inflation convergence—suggesting that inflation rates in states with initially wider gaps are moving closer to the national trend.

The Research Report further argues that with a firmly benign inflationary trend envisaged going ahead, notwithstanding the tumult on part of trade led restrictions and non-linear pass-through of such vagaries, the plot seems to be spiced with a further 25 bps rate cut (sooner than later) to give an adrenaline boost to the economic juggernaut as global developments necessitate us to build today for tomorrow.