Sectoral Deployment of Bank Credit – November 2024

FinTech BizNews Service

Mumbai, 31 December, 2024: Data on sectoral deployment of bank credit for the month of November 20241 has been collected by the Reserve Bank of India from 41 select scheduled commercial banks, accounting for about 95 per cent of the total non-food credit deployed by all scheduled commercial banks.

On a year-on-year (y-o-y) basis, non-food bank credit as on the fortnight ended November 29, 2024 grew at 11.8 per cent, as compared to 16.5 per cent for the corresponding fortnight of the previous year.

Highlights of the sectoral deployment of bank credit are given below:

Credit to agriculture and allied activities registered a growth of 15.3 per cent (y-o-y) as on the fortnight ended November 29, 2024 (18.1 per cent for the corresponding fortnight of the previous year).

Credit growth to industry was at 8.1 per cent (y-o-y) as on the fortnight ended November 29, 2024 compared to 5.5 per cent for the corresponding fortnight of the previous year. Among major industries, credit to ‘chemicals and chemical products’, ‘infrastructure’, ‘petroleum, coal products and nuclear fuels’, and ‘all engineering’ recorded a higher growth.

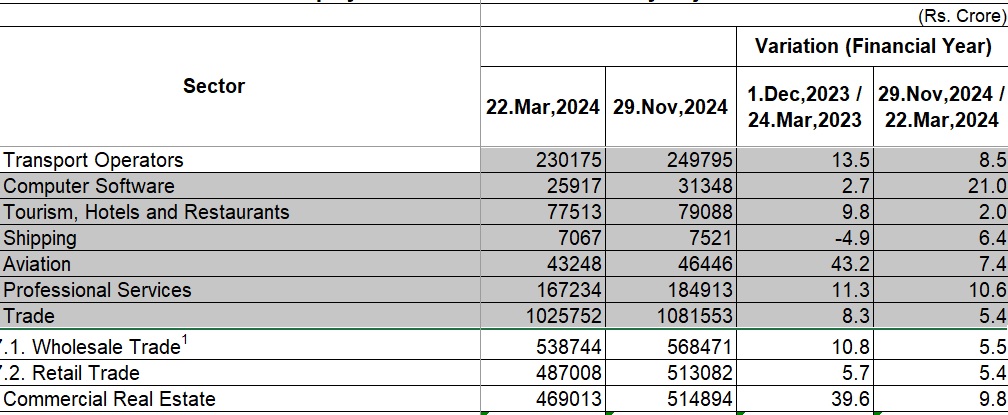

Credit growth to services sector was at 14.4 per cent (y-o-y) as on the fortnight ended November 29, 2024 (22.2 per cent for the corresponding fortnight of the previous year), primarily due to lower growth in credit to ‘non-banking financial companies’ (NBFCs) and trade segment. However, credit growth (y-o-y) to ‘commercial real estate’ and ‘computer software’ accelerated.

Personal loans registered 16.3 per cent growth (y-o-y) as on the fortnight ended November 29, 2024 as compared with 18.7 per cent for the corresponding fortnight of the previous year, largely due to decline in growth in ‘other personal loans’, ‘vehicle loans’ and ‘credit card outstanding’. However, ‘housing’ – the largest constituent of this segment – recorded accelerated growth (y-o-y).