GDP deflator declined to 3.1% yoy in Q4 FY25 compared to 3.7% yoy in Q3 FY25.

FinTech BizNews Service

Mumbai, May 30, 2025: The State Bank of India’s Economic Research Department has come out with a Research Report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India:

The NSO released the GDP figures for Q4 FY25 and the provisional estimates for the whole year. India’s economy grew by 7.4% in Q4 FY25 as against 8.4% growth in same quarter last fiscal. The Q4 estimate was a clear surprise as it was 40 bps higher than RBIs 93rd Professional Forecasters survey median estimate of 7%. The GVA grew by 6.8% in Q4 and 6.4% in FY25.

Core GVA grew by 6.4% in FY25. Nominal GDP grew by 9.8% in FY25 as against 12.0% growth in FY24, in line with flat growth in GDP deflator indicating broad based correction in domestic prices. The gap between GDP and GVA of 60bps is due to higher Net Indirect taxes which grew by 12.7%.

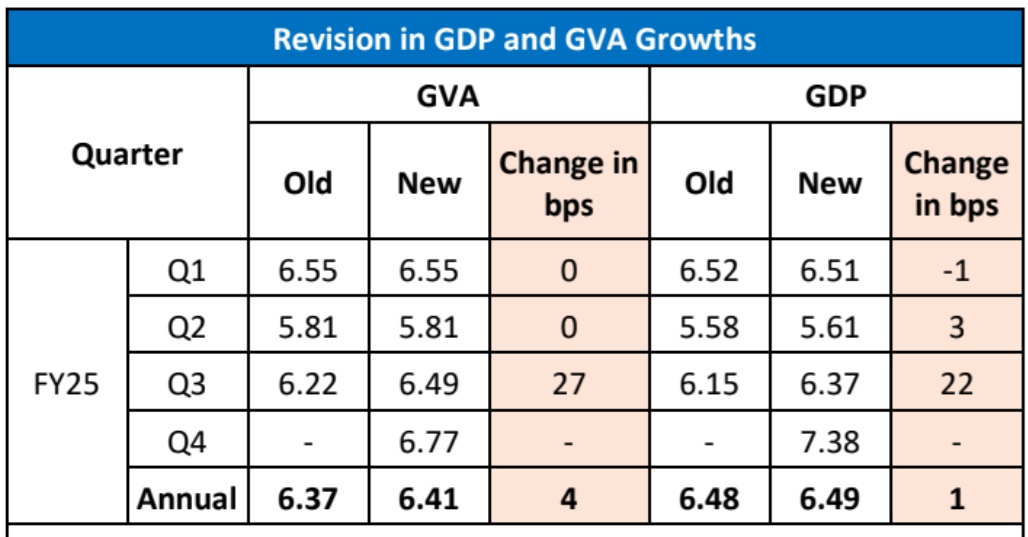

There were no major revision in Q1, Q2 and annual data but the Q3 GDP data is revised upwards by 22 bps and GVA data by 27 bps.

From the production side, all sectors exhibited better growth numbers in Q4 FY25. While industry grew by 6.5%, the services sector grew by 7.3% in Q4. Within Industry Construction sector grew by whopping 10.8% in Q4 (a 6-quarters high) and manufacturing sector increased by 4.8%. Agriculture sector grew by 5.4% in Q4 FY25 over a low base of 0.9% in Q4 FY24. For FY25, Agriculture GVA grew by 4.6% in as against 2.7% growth in FY24.

From the expenditure side, the GDP growth of 7.4% in Q4 was supported by strong uptick in the capital formation which registered a 9.4% yoy growth. The recovery in capital formation was on account of revival in core sector in Q4 as evident from high frequency indicators. The overall growth in capital formation for FY25 now stands 7.1%. The private consumption maintained its health run in Q4 and overall, the private consumption registered a growth of 7.2% for FY25.

The government expenditure grew by 2.3% in FY25.

The export demand was healthy in for whole year registering a growth of 6.3%, while the imports contracted for the whole year by 3.7%. This growth was frontloaded because of export push amidst US tariffs uncertainty. The highest contraction in imports happened in Q4 at 12.7% was another factor in pulling the overall GDP growth to 7.2% in Q4. The corporate sector growth based on annual accounts show similar trends in Q4. Based on data of around 3,300 listed entities, reported top line growth of 5% while EBIDTA grew by around 12%. Further, Corporate ex-BFSI, for Q4FY24, reported EBIDTA growth of 8% while bottom line grew by 23%. The operating margin in the sample shown marginal improvement during Q4FY25.

We believe that the Indian economy is poised to remain the fastest-growing major economy in FY26 (GDP growth expected at 6.3-6.5%) by leveraging its sound macroeconomic fundamentals, robust financial sector and commitment towards sustainable growth. With higher anticipated saving based on latest RBI Annual report, the domestic finances will be sufficient to finance the anticipated growth and we do not expect demand induced pressure on prices in FY26. The downside to growth emanate from external and geopolitical factors.