The data lent support to the narrative that India is the fastest growing economy in the world

Aditi Gupta,

Economist,

Bank of Baroda

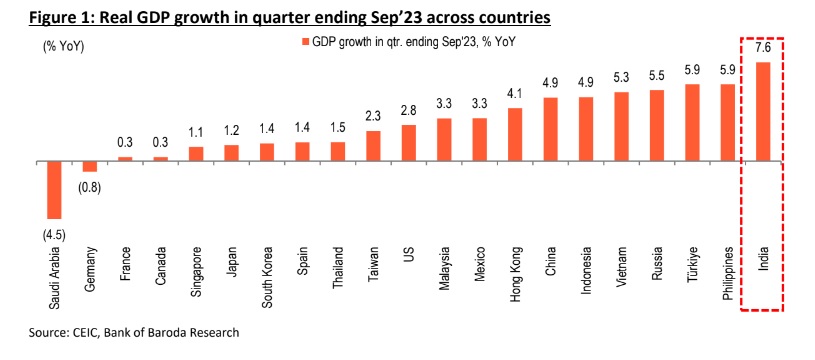

Mumbai, December 2, 2023: India on track to be the fastest growing economy India’s GDP expanded at a robust pace of 7.6% in Q2FY24, beating market expectations. The data lent support to the narrative that India is the fastest growing economy in the world, a fact which is often reiterated by international agencies. In this brief analysis, we compare India’s GDP growth in the quarter ending Sep’23 with other major economies in the World. This gives a sense of India’s relative under/over-performance vis-à-vis other major advanced as well as developing economies, which are comparable in terms of both structural and level of economic development. Figure 1, gives the yearon-year growth in real GDP for a total of 21 countries for the quarter ending Sep’23.

India has outperformed all major countries in terms of growth in real GDP in the Sep’23 quarter. In fact, India has done remarkably well when compared with its developed counterparts. - Growth in the Eurozone continues to languish, led by a sharp and protracted slowdown in Germany. - Amongst developed countries, US has performed the best, even so at 2.8%, it is still much below India. - An interesting thing to note here is that Emerging economies have done much better than the developed economies, and the trend is likely to continue. - To put this in perspective, while the average growth differential between India and advanced economies is about 7%, for EMs it is much lower at ~4%. o Growth in some EMs such as Indonesia, Vietnam, Turkey and Philippines has been noteworthy, even though it continues to trail India. o China, which was once touted as the engine of global growth, continues to grapple with the after effects of the long-drawn Covid-19 pandemic and property sector crisis. It registered a subdued growth of just 4.9%.

It is to be noted here that there are country specific factors which are shaping the growth trajectory in each of these countries. While all the countries were faced with the twin blow of the pandemic and the commodity price shock, the fiscal and monetary responses have been divergent as also the linkage with the global economy in terms of coupling, which in turn are defining the growth outcomes of these countries. India will continue to outperform Based on projections by the International Monetary Fund (IMF) in Oct23, India is expected to be the fastest growing major economy in the World (see Figure 2). While IMF expects India’s GDP growth at 6.3%, there is likely to be an upward bias to this number in subsequent updates. Amongst major economies, China is expected to grow by 5%; however given the recent headwinds, its growth path will not be easy. US economy while showing significant and unexpected traction, is expected to grow at a below trend pace of 2.1%.

In H1FY24, growth has been 7.7%. - While growth is likely to be lower in H2 led by an unfavourable base as well as headwinds from external and agriculture sector, the underlying momentum is expected to be maintained. Export is anticipated to remain weak due to a slowdown in global demand. Agriculture sector is likely to come under further duress due to lower rabi sowing, which will put further pressure on rural demand which has remained lacklustre even in H1. - On the positive side, high frequency indicators such as core sector output, auto sales, air passenger traffic, PMIs, credit growth etc., indicate a continued strength in the economy. Apart from this, festive demand and buoyant investment activity, will also play a part in boosting growth. Overall, we expect FY24 GDP in the range of 6.6%-6.7.

(Disclaimer: The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)