While aggregate deposits in the banking system grew by 10.2%, NRI deposits increased by 7.2%

FinTech BizNews Service

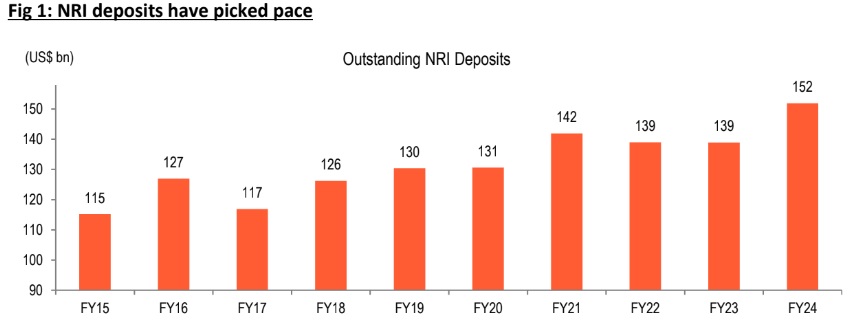

Mumbai, June 14, 2024: Dipanwita Mazumdar, Economist, Economics Research Department, Bank of Baroda, has undertaken a special study on ‘Trends in NRI deposits’. The study covers the last 10 years and shows that while aggregate deposits in the banking system grew by 10.2%, NRI deposits increased by 7.2%. The difference was roughly the rate of depreciation. Similar trends may be expected in future too if these assumptions hold.

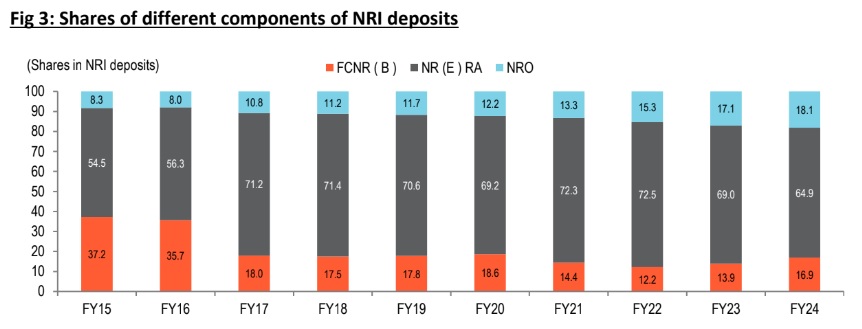

The higher growth in NRI deposits has been in tandem with faster pace of increase in aggregate deposits. Its share in the pie currently stands at 6.2%. The 10-Years CAGR of NRI deposits stood at 7.2% while for aggregate deposits was 10.2%. Within NRI deposits, share of FCNR (B) deposits has picked up considerably. Shares of NRO deposits has also increased. Interest rate differential and an insulated domestic economy from global disturbances may be the reason for the same.

The movement of NRI deposits is interesting. During Covid period, it has picked up sharply to US$ 142bn from US$ 131bn despite a softer interest rate regime globally. Bank deposits probably have been the preferred choice of savings during that uncertain environment where other asset classes exhibited considerable volatility. Apart from this, increase in precautionary savings globally (Gross savings rate to GDP of world rose to 27.1% from 25.8% in the same period, as per World Bank data), has also led to repatriation of savings in terms of bank deposits. However, with normalization of economic activity, some correction was witnessed in NRI deposits in FY22 and FY23. Again, in FY24 (provisional figures), considerable momentum was visible. A possible explanation could be a more calibrated approach of domestic central bank compared to global central banks, where the rhetoric of interest rates has been far more volatile.

NRI deposits vis a vis aggregate deposits:

NRI deposits in rupee terms have grown at a CAGR of 7.2% in the past 10-Year while aggregate deposits have grown at a much sharper pace of 10.2% during the same period supplemented by higher domestic resources. The rupee had depreciated by 3.2% during this period.

The last 5-Year CAGR of NRI deposits has been 6.6% while for deposits again it recorded a double-digit

growth of 10.1%. Notably, Non-Resident Ordinary Rupee Accounts (NRO accounts) have grown at a far

sharper pace. The 10-Year CAGR for the same stood at 15.2% higher than the 10-Year CAGR of aggregate deposits. There may be several reasons of the same ranging from ease of liquidity, interest rate differential and repatriation issues. On the other hand, Foreign Currency Non-Resident Accounts-FCNR(B) has witnessed volatility.

Thus, on account of faster pace of increase in aggregate deposits (as seen in the CAGR data as well), the shares of NRI deposits have flattened at 6.2%. However, with start of the rate cut cycle by Fed and hence a favourable interest rate differential for India, there is scope for the share to further increase.

How shares of different components of NRI deposits have evolved?

Some shift in shares is witnessed in the past few years. Share of NRO deposits has consistently risen, especially post Covid period. NRO account basically handles domestic revenue. Thus, an insulated domestic economy compared to global counterparts in terms of growth and policy dynamics could explain this rise. FCNR (B) deposits have picked up considerably since FY22. Higher remittance flows could be a possible explanation of the same. (Note: Here the higher share of FCNR (B) in NRI deposits seen during FY15 and FY16, is a one-off event, on account of Central Bank’s measure to support domestic currency). However, the share of FCNR (B) deposits is still lower than seen during pre-Covid period. NR (E)RA have exhibited some volatility. This is basically used by non-residents for transferring foreign profits to India. Muted growth in the global space, stickier inflation and an elevated borrowing cost might have impacted profitability of companies which is reflected in the falling share of these

deposits.

NRI deposits are useful both from the point of view of augmenting aggregate deposits of banks as well as bringing in foreign exchange. The flow of funds will depend a lot on interest rate differentials and remittances into the country. Based on the trends witnessed in the last decade, a growth rate of 9-10% in NRI deposits could be expected in the next five years or so which will keep it aligned with growth in overall deposits which would be in the region of 12-13% and rupee depreciation of 2-3% per annum.

Disclaimer:

The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.

Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel, directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any information that may be displayed in this publication from time to time.