India’s 10Y yield is trading further higher today at 7.27%

Sensex is trading flat today, while other Asian indices are trading mixed

FinTech BizNews Service

Mumbai, November 24, 2023: Eurozone composite PMI inched up to 47.1 in Nov’23 from a near 3-year low of 46.5 in Oct’23, but remained in the contraction zone. As the downturn in business activity remains broad-based, the fear of recession has resurfaced in the current quarter. Furthermore, the recently released ECB minutes highlighted that inflation has been moderating in line with expectation and the members noted the possibility of interest rate hike, which remains on table. Separately, Japan’s headline inflation accelerated to 3.3% in Oct’23 (3% in Sep’23) and even the core inflation inched up to 2.9% in Oct’23. Additionally, factory activity contracted for the 6th straight month down to 48.1 in Nov’23 (48.7 in Oct’23) amidst weaker demand.

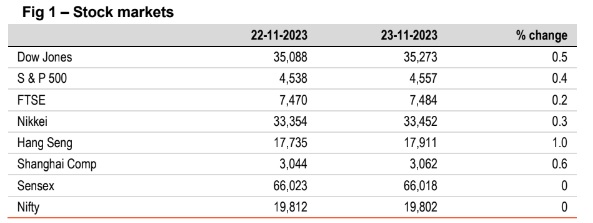

- Global indices ended higher. Investors awaited more guidance on US interest rate movement. FTSE inched up with gains in energy stocks and comes in the wake of the interim budget along with measures announced by the government to support growth. Sensex ended flat. However, it is trading flat today, while other Asian indices are trading mixed.

- Global currencies closed mixed. DXY ended flat, as markets in US remain closed and investors assess possible impact of latest macro data from US on Fed policy (more than expected fall in jobless claims and continued increase in inflation expectations of consumers). INR ended flat, and is trading at similar levels today, while other Asian currencies are trading lower.

- Major global yields closed higher. 10Y yield of UK rose the most (+10bps) as UK treasury announced much smaller than expected cut in borrowings for the current fiscal year (-£500mn versus est.:-£15bn). Markets in US were closed. India’s 10Y yield rose to 7.26%, even as oil prices eased. It is trading further higher today at 7.27%.