ECLGS loans' overall GNPA rose to 6.5% in Sep 2023 from 5.5% in Mar 2023, with services and trade loans accounting nearly half of total delinquencies

FinTech BizNews Service

Mumbai, January 11, 2024: Jocata Sumpoorn index, moved down to 0.53 in November indicating that the sales performance of credit-seeking MSMEs is at the level last seen in April 2023, down from the relatively higher zone of moderate expansion in October.

Analysis by Dr. Sumita Kale, Principal Economist at Jocata and Narasimhan Venkatesan Principal Advisor, Jocata, shows insightful updates for the sector. While bank credit to MSMEs continues to remain robust, YoY growth has declined to 15% in November, compared to 18% YoY witnessed in November 2022. Further, the RBI press release on sectoral deployment of bank credit in November called out the "tapered down" growth in credit to NBFCs, which is expected to continue in response to the RBI measures tightening risk-weight norms. The RBI's latest Financial Stability Report for the second quarter of 2023-24 revealed a mixed picture - on one hand, the quality of bank MSME portfolios improved with the GNPA declining to 4.7% in September 2023 from 6.8% in March 2023 and 7.7% in September 2022 and on the other hand, SMA-2 loans (that is loans whose payments are overdue for 61 to 90 days) rose slightly to 1.7% in September 2023 from 0.9% in March 2023. The bright spot in export data also dimmed a bit in November - Non-petroleum and non-gems and jewellery exports which had risen by 11.74% in October, fell by 2.8% year on year in November. According to a recent reply in Parliament, the MSME sector accounted for 45.56% of India's exports in the first six months of this financial year, higher than its 43.59% share in 2022-23. The Jocata Sumpoorn therefore aligns with the export trend relatively closer.

Further, the S&P Global Composite PMI for India slipped to 57.4 in November from 58.4 the previous month - while Manufacturing PMI was marginally up at 56, compared to 55.5 in October, the Service PMI fell from 58.4 in October to 56.9 in November. The RBI's Financial Stability Report noted that while the overall GNPA of loans extended under the ECLGS rose to 6.5% in September 2023 from 5.5% in March 2023, services and trade loans that made up a third of the ECLGS disbursements, accounted for nearly half of the total delinquencies. Clearly, the impact of the pandemic is still flowing through the system and some sectors are more affected than others. So while the Indian economy continues to be on a strong footing, data from the Jocata Sumpoorn index over the year showing growth in the sales activity of MSMEs at a steady yet slow pace, makes the case for more targeted government support for the MSME sector.

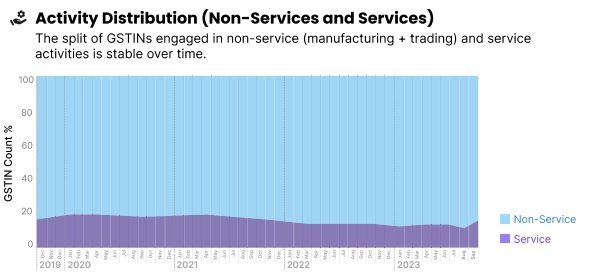

Key highlights of the month