At the consolidated level, Return on Assets (ROA) for Q2FY25 (annualized) was 2.53% (2.68% for Q2FY24). Return on Equity (ROE) for Q2FY25 (annualized) was 13.88% (14.99% for Q2FY24).

FinTech BizNews Service

Mumbai, 19 October, 2024: The Board of Directors of Kotak Mahindra Bank (“the Bank”) approved the unaudited standalone and consolidated results for the quarter and half-year ended September 30, 2024, at the Board meeting held in Mumbai, today.

Consolidated results at a glance

Consolidated PAT for Q2FY25 was Rs 5,044 crore, up 13% YoY from Rs 4,461 crore in Q2FY24. PAT of Bank and key subsidiaries given below:

PAT (Rs crore) | Q2FY25 | Q2FY24 |

Kotak Mahindra Bank | 3,344 | 3,191 |

Kotak Securities | 444 | 324 |

Kotak Mahindra Life Insurance | 360 | 247 |

Kotak Mahindra Prime | 269 | 208 |

Kotak Asset Management & Trustee Company | 197 | 124 |

Kotak Mahindra Investments | 141 | 126 |

Kotak Mahindra Capital Company | 90 | 27 |

BSS Microfinance | 16 | 108 |

At the consolidated level, Return on Assets (ROA) for Q2FY25 (annualized) was 2.53% (2.68% for Q2FY24). Return on Equity (ROE) for Q2FY25 (annualized) was 13.88% (14.99% for Q2FY24).

Consolidated Capital Adequacy Ratio as per Basel III as at September 30, 2024 was 22.6% and CET I ratio was 21.7% (including unaudited profits).

Consolidated Networth as at September 30, 2024 was Rs 147,214 crore (including increase in reserves due to RBI’s Master Direction on Bank’s investment valuation of Rs 4,777 crore and gain on KGI divestment of Rs 2,730 crore). The Book Value per Share at September 30, 2024 was Rs 740 (Rs 605 at September 30, 2023).

Consolidated Customer Assets which comprises Advances (incl. IBPC & BRDS) and Credit Substitutes grew to

Rs 510,598 crore as at September 30, 2024 from Rs 428,404 crore as at September 30, 2023, up 19% YoY.

Total Assets Under Management as at September 30, 2024 were Rs 680,838 crore up 37% YoY over Rs 498,342 crore as at September 30, 2023.

Kotak Asset Management, the 5th largest AMC saw its Domestic MF Equity AUM increase by 60% YoY to Rs 319,161 crore as at September 30, 2024.

Kotak Mahindra Bank standalone results

The Bank’s PAT for Q2FY25 stood at Rs 3,344 crore, up 5% YoY from Rs 3,191 crore in Q2FY24.

Net Interest Income (NII) for Q2FY25 increased to Rs 7,020 crore, from Rs 6,297 crore in Q2FY24, up 11% YoY. Net Interest Margin (NIM) was 4.91% for Q2FY25.

Fees and services for Q2FY25 increased to Rs 2,312 crore from Rs 2,026 crore in Q2FY24, up 14% YoY. Operating profit for Q2FY25 increased to Rs 5,099 crore from Rs 4,610 crore in Q2FY24, up 11% YoY. Customers as on September 30, 2024 were 5.2 cr (4.6 cr as on September 30, 2023).

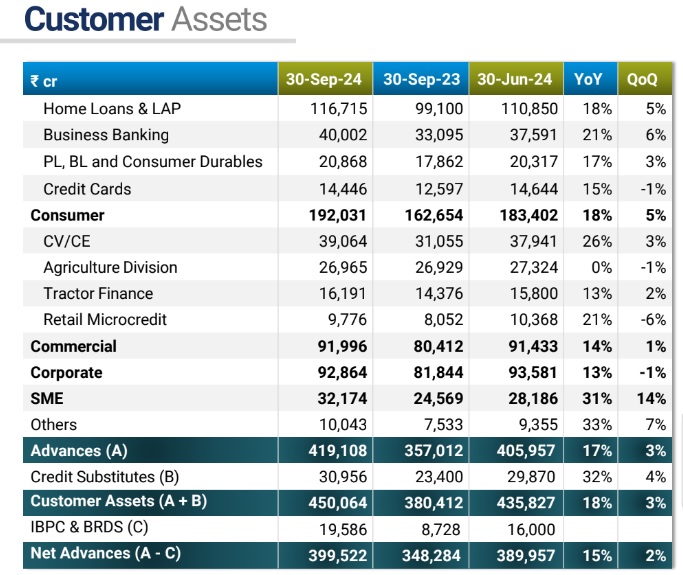

Customer Assets, which comprises Advances (incl. IBPC & BRDS) and Credit Substitutes, increased by 18% YoY to

Rs 450,064 crore as at September 30, 2024 from Rs 380,412 crore as at September 30, 2023. Advances (incl. IBPC & BRDS) increased 17% YoY to Rs 419,108 crore as at September 30, 2024 from Rs 357,012 crore as at September 30, 2023.

Unsecured retail advances (incl. retail microcredit) as a % of net advances stood at 11.3% as at September 30, 2024.

Average Total Deposits grew to Rs 446,110 crore for Q2FY25 compared to Rs 385,950 crore for Q2FY24 up 16% YoY. Average Current Deposits grew to Rs 61,853 crore for Q2FY25 compared to Rs 58,351 crore for Q2FY24 up 6% YoY. Average Savings Deposits grew to Rs 124,823 crore for Q2FY25 compared to Rs 121,967 crore for Q2FY24 up 2% YoY. Average Term Deposits grew to Rs 259,434 crore for Q2FY25 compared to Rs 205,632 crore for Q2FY24 up 26% YoY.

CASA ratio as at September 30, 2024 stood at 43.6% (June 30, 2024 at 43.4%) TD sweep balance grew 41% YoY to Rs 52,411 crore.

As at September 30, 2024, GNPA was 1.49% & NNPA was 0.43% (GNPA was 1.72% & NNPA was 0.37% at September 30, 2023).

Capital Adequacy Ratio of the Bank, as per Basel III, as at September 30, 2024 was 22.6% and CET1 ratio of 21.5% (including unaudited profits).

Standalone Return on Assets (ROA) for Q2FY25 (annualized) was 2.17% (2.45% for Q2FY24).