Credit growth of StCBs remained robust in 2022-23 and they liquidated their SLR investments to bridge the C-D gap due to contraction in deposits; 2 StCBs reported GNPA ratios greater than 50 %

FinTech BizNews Service

Mumbai, January 27, 2024: The Reserve Bank of India recently released the Report on Trend and Progress of Banking in India 2022-23, a statutory publication in compliance with Section 36 (2) of the Banking Regulation Act, 1949. This Report presents the performance of the banking sector, including co-operative banks during 2022-23 and 2023-24 so far.

State Co-operative Banks

State co-operative banks (StCBs) operate in a two-tier/three-tier/mixed-tier structure. In a two-tier structure, mostly located in the northeastern part of India, StCBs operate through their own branches, whereas in case of a three tier structure, StCBs work as the apex bank for all DCCBs. At end March 2022, the short-term rural co-operative sector consisted of 34 StCBs. At end-March 2022, StCBs had 2,089 branches, providing more than 45 % of their total credit towards agriculture.

Balance Sheet Operations

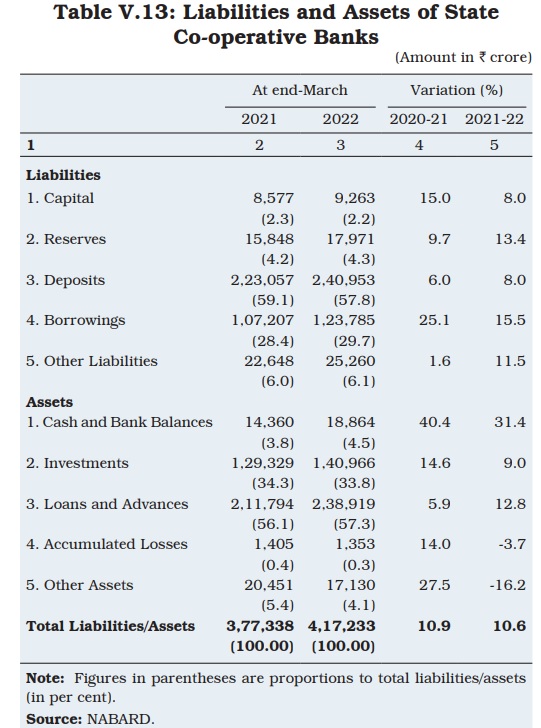

Owned funds of StCBs, which comprise share capital and reserves, grew by 11.5 % during 2021-22, and were 6.5 % of their total liabilities at end-March 2022. The growth in owned funds was driven by accretion to share capital and improvement in profitability. Although deposits accelerated in 2021-22, they were outpaced by growth in loans and advances.

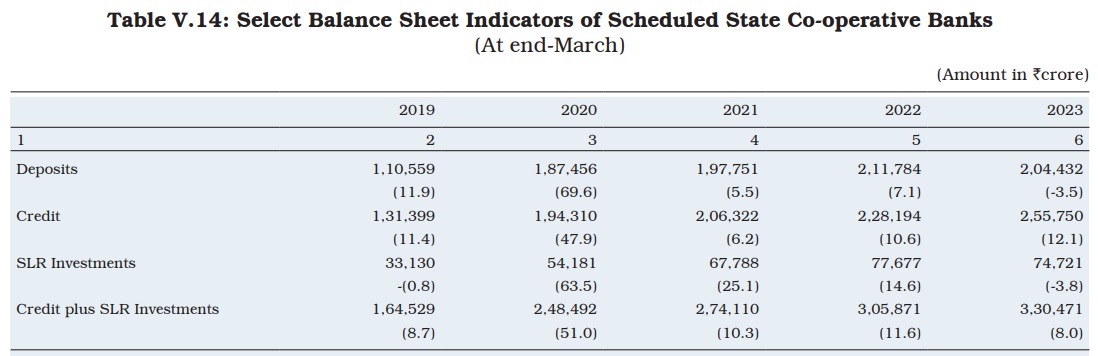

Credit growth of StCBs remained robust in 2022-23 and they liquidated their SLR investments to bridge the C-D gap due to contraction in deposits.

Profitability

Reflecting the accommodative monetary policy stance and the reduction in deposit and lending rates, growth in the interest income of StCBs decelerated in 2021-22 while there was a contraction in interest expended. On balance, net interest income rose by 30.3 %, faster than 13.9 % in the previous year, which led to higher profits. However, the contraction in non-interest income adversely affected their profitability.

The western region, especially Maharashtra, contributes the major share in StCBs’ net profits. 31 StCBs posted a profit of Rs2,338 crore while 3 StCBs (viz. Arunachal Pradesh, Puducherry and Jammu and Kashmir StCB) incurred losses of Rs50 crore.

Asset Quality

Asset quality of StCBs improved during 2021-22 on lower slippages. Within NPAs, substandard and loss category loans contracted. However, the doubtful category — which constitutes nearly half of the outstanding NPAs — grew for the fifth consecutive year. While a majority of the 34 StCBs reported lower GNPA ratios at end-March 2022 than a year ago, two StCBs reported GNPA ratios greater than 50 %. The improvement in GNPA ratios and recovery-to-demand ratios was led by southern and western states.