BoB Essential Commodity Index (BoB ECI) has edged down to 2.4% in Oct'23

Dipanwita Mazumdar,

Economist,

Bank of Baroda Research

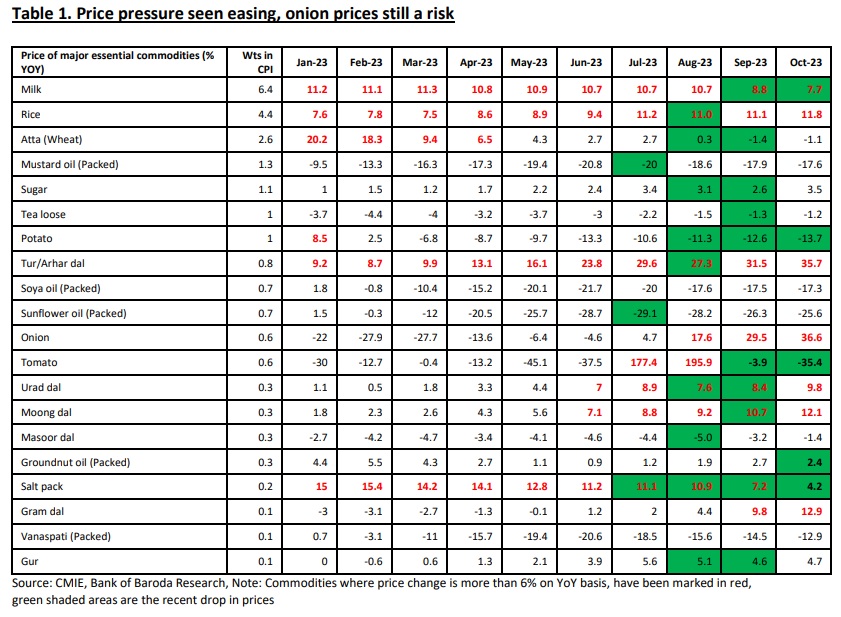

Mumbai, November 4, 2023: BoB Essential Commodity Index (BoB ECI) has edged down to 2.4% in Oct’23. Sequentially, it has inched up slightly by 0.3% against a decline of 1.8% in Sep’23. The sequential pick up is on account of correction in tomato prices (falling at a less than sharper pace than last month). However, other than that, softening in prices is broad based. Especially some degree of sequential moderation in price of pulses is a respite. What needs monitoring is the rise in Onion prices. In Oct’23, the retail price of Onion has increased by 36.6% on YoY basis, while in sequential terms it has risen by 12.9%. Even for the first three days of Nov’23, it has risen at a faster pace registering 88% and 54.1% increase on YoY and sequential basis, respectively. The gap between wholesale and retail price of Onion is also higher (currently at Rs 9.5/kg, long run average is Rs 6.3/kg), so a significant degree of pass through is yet to happen. However, with the arrival of Oct-Dec harvest in the market, some correction in prices is expected. Meanwhile government’s intervention in the form of subsidized selling in some cities will provide temporary relief to inflation. We do not foresee significant spike as this season coincides with fresh arrival of harvest.

We expect headline CPI to settle between 4.5-4.7% in Oct’23.

Price picture using BoB Essential Commodity Index:

So where is CPI print headed?

Based on the price dynamics, we expect CPI to settle between 4.5-4.7% in Oct’23. Till Mar’24, we are foreseeing a below 5% inflation and gradual crawling towards the 4% target. Price moderation is broadly in line with expectation. However, onion and potato prices to a certain degree are playing spoil sport. But with fresh arrival of harvest, no upside surprise is expected in prices. Apart from this, core services inflation has neared towards the 4% level. Thus, we rule out any immediate upside risk to inflation.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)