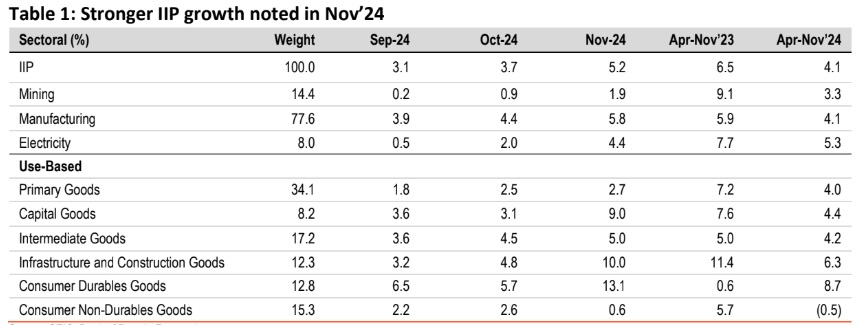

The capital goods, infra good and consumer durable goods registered a healthy increase in Nov’24.

FinTech BizNews Service

Mumbai, January 10, 2025: The industrial Growth is quite good at 5.2% and one can expect this tempo to be maintained in coming months, according to an analysis of the industrial growth numbers for November by Bank of Baroda Economist Jahnavi Prabhakar.

IIP growth registered a robust growth of 5.2% in Nov’24 against a growth of 3.7% in Oct’24. This was

supported by improvement across all the sectors. Manufacturing sector expanded by 5.8%, with over

15 sub-sectors registering stronger growth than last year. Both mining and electricity sector registered

strong growth in Nov’24. Within use-based classification, capital goods, infra good and consumer

durable goods registered a healthy increase in Nov’24. A festival push during this period, supported

the production. In the coming months, we expect a steady pick up in production level. This has been

reflected by high frequency indicators. Moreover, given the expectation of higher government

spending followed by improvement in investment in H2, the IIP growth is likely to be higher in H2FY25.

The attention will now shift towards upcoming Budget and RBI policy which is expected to be growth

conducive.

IIP growth strengthens: IIP growth rose by 5.2% (6-month high) in Nov’24 compared with 3.7% in

Oct’24. This was much higher than BoB’s estimate of 4.5% increase. This was driven by broad-based

improvement across all the sectors. Manufacturing sector registered a strong growth of 5.8% (8-

month high) against a growth of 4.4% in Oct’24. Both mining and electricity output expanded to 1.9%

(0.9% in Oct’24) and 4.4% (from 2%) respectively for Nov’24. The festive period has pushed forward

the production. On a FYTD basis, IIP growth moderated to 4.1% compared with 6.5% growth registered

last year. Manufacturing (4.1% against 5.9%) and mining (3.3% against 9.1%) sectors also noted slower

growth in FYTD’24. Electricity growth too softened to 5.3% from 7.7% last year.

Within manufacturing, out of 23 sub-sectors, 15 contributed to higher growth in Nov’24. These

included, manufacture of furniture, computer & electronic, fabricated metal, machinery equipment,

other non-metallic minerals amongst others. Notably, 7 sectors have recorded slower growth

including, manufacture of rubber, plastics, other transport equipment and coke and refined petroleum

products during the same period.

Capital good shines: Within use-based classification, infrastructure and capital goods output

registered remarkable growth at 10% (4.8% in Oct’24) and 9% (3.1% in Oct’24) in Nov’24 respectively.

Both primary (2.7% from 2.5% in Oct’24) and intermediate goods (5% from 4.6% in Oct’24) also

registered an improvement in Nov’24. Interestingly, growth for consumer durable output accelerated

to a 13-month to 13.1% in Nov’24 compared with a growth of 5.7% in Oct’24. However, the only

disappointment was the slower growth in FMCG goods at 0.6% (2.6% in Oct’24) in Nov’24.

Way forward: Amidst lower manufacturing, the advance estimates have recently pegged lower

industrial sector growth at 6.2% in FY25 from 9.5% in FY24 on account of base effect. However, despite

these figures, a revival is expected in H2 (H1FY25 at 4.1%) which has been evident from the incoming

data such as the GST collections, steady PMIs. Additionally, a push to capex spending as well as

recovery in investment cycle in the coming months bodes well for the overall sector. The focus will

now shift towards upcoming Budget with expectation of announcements that will boost

manufacturing growth.