The cut in CRR would release primary liquidity of about Rs2.5 lakh crore to the banking system by December 2025. Besides providing durable liquidity, it will reduce the cost of funding of the banks, thereby helping in monetary policy transmission to the credit market; Calibrated communication fortifies expectations, while the surprise rate cut evokes THE LUCAS PARADIGM;

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, June 7, 2025: Monetary Policy Committee delivered a strong monetary policy stimulus by reducing the policy rate by 50 bps and slashing the CRR by 100 bps in staggered fashion from this September to December. This front-loaded larger cut will reinvigorate a credit cycle.

Response was correctly anticipated by SBI in its pre-policy note. All members except one voted for 50 bps cut (one external member voted for 25 bps reduction). The MPC also decided to change the stance from accommodative to neutral.

The CRR cut is the toast of the town which will reduce the M0, sparking a 20-30 bps surge in money multiplier and energizing liquidity. The cut in CRR would release primary liquidity of about Rs2.5 lakh crore to the banking system by December 2025. Besides providing durable liquidity, it will reduce the cost of funding of the banks, thereby helping in monetary policy transmission to the credit market. This surprise move embodies Lucas Hypothesis illustrating how surprise policy actions can be meaningful in influencing real economic dynamics while at the same time effective communication ensures that expectations are anchored, balancing surprise with credibility for optimal monetary policy transmission.

On the macroeconomic side, real GDP growth for FY26 is projected at 6.5% owing to sustained rural economy, continued expansion in services sector, higher capacity utilization, improving balance sheets of financial and non-financial corporates, and government’s capital expenditure push. Taking into consideration the factors like above normal monsoon, record Kharif crop prospects, moderation in the prices of key commodities, including crude oil, RBI has revised downwards its FY26 CPI inflation projection to 3.7% from 4.0% in last assessment.

Text mining analysis of Governor’s speech strongly reflects prominence of growth-related terms over inflation in the analysis indicates that supporting economic expansion remains the RBI’s primary concern, even as it carefully monitors inflationary pressures.

The cumulative reduction in the repo rates now stands at 100 bps since Feb 2025. The impact of the policy stimulus is partially visible on both assets and liability sides of banks.

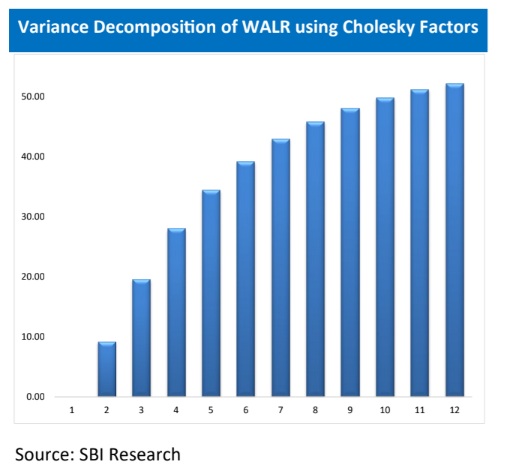

Variance decomposition analysis using a VAR indicates strong transmission of monetary policy from the repo rate to the loan rate on outstanding loans in coming quarters.

Fixed deposits (FDs) rates have been reduced in the range of 30-70 bps since February 2025. Transmission to deposits rates is expected to be strong in the coming quarters with further rate cut in deposits expected from banks.

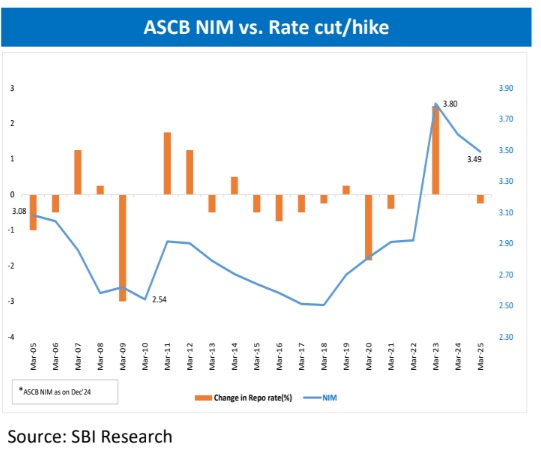

The historical changes in ASCB NIM against changes in policy rates suggest compression of NIM. Exact impact will vary with individual banks. With around 60% of ASCB loans linked to EBLR, immediate impact on average lending rate would be around 30 bps.

However, the reduction in CRR will also cushion the impact of fall in average lending rate with some reduction in cost of fund.

Going ahead, the trajectory of the monetary policy will be data dependent and evolving situation as available headroom is narrow. The large transfer of RBI profit has improved headroom for fiscal policy to achieve the necessary stabilization. We expect status quo for the next quarter.

REPO RATE CUT BY 50 BPS TO 5.5%

As correctly anticipated by SBI in its pre-policy note, MPC has

decided to reduce the repo rate by 50 basis points to 5.5%. All

members except one voted for 50 bps cut (one external member

voted for 25 bps reduction). The MPC also decided to change the

stance from accommodative to neutral.

Taking into consideration the factors like above normal monsoon,

record Kharif crop prospects, moderation in the prices of key

commodities, including crude oil, RBI has revised downwards its

FY26 CPI inflation projection to 3.7% (from 4.0%).

Real GDP growth for FY26 is projected at 6.5% owing to sustained

rural economic, continued expansion in services sector, higher

capacity utilization, improving balance sheets of financial and non

-financial corporates, and government’s capital expenditure

push.

CRR CUT BY 100 BPS IN PHASED MANNER STARTING FROM

SEPT 2025

RBI decided to cut CRR by 100 bps to 3% in a phased

manner (25 bps each starting from 06 Sept., 04 Oct, 01

Nov and 29 Nov 2025). With this cut CRR would reached

to per-pandemic level of 3% (27 March 2020).

Interestingly, SBI Research in its report dated 06th

Dec’2024, followed by many reports in 2025, has sug-

gested 100 bps cut in CRR, to reduce the liquidity stress.

The cut in CRR would release primary liquidity of about

Rs2.5 lakh crore to the banking system by December

2025. Besides providing durable liquidity, it will reduce

the cost of funding of the banks, thereby helping in

monetary policy transmission to the credit market.

The reduction in CRR may not mathematically translate

to any change in deposits and lending rates, however, it

may have positive impact on margins (3-5 bps on NIM)

of the banks. The CRR cut will reduce the M0, so, the

money multiplier will increase by 20-30 bps.

TRANSMISSION OF POLICY RATE

We anticipate a 50 bps cut can reinvigorate credit

cycle. The cumulative reduction of 100 bps in repo rate

will transmit to both asset and liabilities.

Following the 50-bps repo rate cut by RBI in February

and April 2025, banks repo-linked EBLRs already reduced

by similar magnitude. While the MCLR linked rates, has a

longer reset period may get adjusted with some lag.

Now with around 60.2% of the loans are linked to EBLR

and 35.9% are linked to MCLR, present cut will be imme-

diately transmitted to majority of loan portfolio.

To reduce the stress on margins, some banks have al-

ready reduced interest rates on savings accounts. Also,

fixed deposits rates have been reduced in the range of

30-70 bps since February 2025. Transmission to deposits

rates is expected to be strong in the coming quarters

with further rate cut in deposits expected from banks.

Further, as inflation is declining and assets/loans are

repricing quickly than liabilities, we believe that banks

may tinker with savings bank rate, to cushion margins.

Variance decomposition analysis using a VAR model to

examine the transmission of monetary policy from the

repo rate to the loan rate on outstanding loans

demonstrate a gradual but meaningful impact of repo

rate shocks on the variance of loan rates over a

12-month horizon. At the first month, the loan rate

variance is fully explained by its own shocks, reflecting

the inertia in outstanding loan rates to immediate policy

changes.

GROWTH LEADS THE CONVERSATION !!

The vibrant threads of growth shine more brilliantly

than those of inflation, illustrating a clear emphasis

on expansion outpacing price pressures!

Our text mining analysis of Governor’s speech

strongly reflects the RBI’s decision to cut the policy

rate by 50 basis points, underscoring its accommoda-

tive approach to navigating the current economic

landscape. The prominence of growth-related terms

over inflation in the speech indicates that supporting

economic expansion remains the RBI’s primary con-

cern, even as it carefully monitors inflationary pres-

sures.

Key themes such as growth, global, liquidity, stability,

and demand highlight the multifaceted challenges

the RBI is addressing through its policy stance. While

inflation remains important, the data suggests that

fostering sustainable growth takes precedence, sig-

naling confidence in the overall recovery momentum.

Amid a fluid and fragile global outlook, the sentiment

analysis suggests “global” continues to loom large in

economic discourse, reflecting persistent attentive-

ness to international developments.

Negative words like “uncertainty” are present but

limited, reflecting a cautiously optimistic outlook

amid ongoing global and domestic challenges. This

balance reveals the RBI’s careful calibration of policy

measures — aiming to stimulate growth while ensur-

ing inflation does not spiral out of control. Overall,

the text mining results align with the RBI’s commit-

ment to maintain stability and promote economic

resilience.

However, after the 100 bps cumulative rate cut since

Feb’25, there exists a limited scope of monetary

policy to further spurt growth and hence the stance

has been changed from accommodative to neutral.

POLICY IMPACT ON BANKING

The steep cut on policy rates is expected to pass on

to the EBLR linked loan book immediately with ASCB

share of 60%. Thus immediate impact on average

lending rate could be around 30 . However, the reduc-

tion in CRR will also cushion the impact of fall in average

lending rate with some reduction in cost of fund.