Gross NPA ratio of the bank at 2.42% improved by 72 bps YoY

FinTech BizNews Service

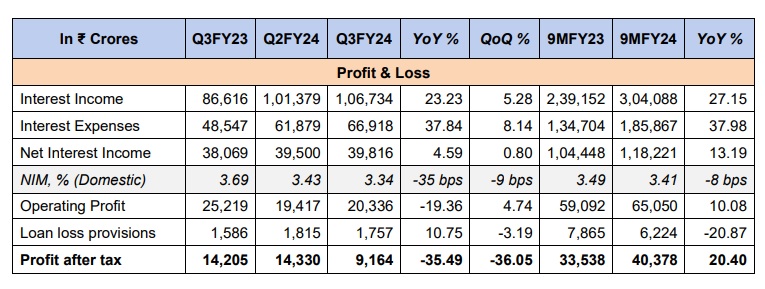

Mumbai, February 3, 2024: SBI announced its Q3FY24 results on Saturday. SBI’s Net Profit for Q3FY24 at Rs9,164 crores after accounting for one-time exceptional item of Rs7,100 crores.

Profitability

• Net Profit for 9MFY24 at Rs40,378 crores improved by 20.40% over 9MFY23 (Rs33,538 crores). Net Profit for Q3FY24 at Rs9,164 crores after accounting for one-time exceptional item of Rs7,100 crores.

• Operating Profit for Q3FY24 is at Rs20,336 crores.

• Bank’s ROA and ROE for 9MFY24 stand at 0.94% and 19.47% respectively.

• ROA for Q3FY24 is at 0.62%.

• Net Interest Income (NII) for Q3FY24 increased by 4.59% YoY.

• Whole Bank NIM for 9MFY24 decreased by 1 bp YoY to 3.28% while Domestic NIM for 9MFY24 decreased by 8 bps YoY to 3.41%

Balance Sheet

• Credit growth at 14.38% YoY with Domestic Advances growing by 14.47% YoY.

• Corporate Advances and SME Advances cross Rs10 lakh crores and 4 lakh crores respectively.

• Foreign Offices’ Advances grew by 13.90% YoY.

• Domestic Advances growth driven by SME Advances (19.24% YoY) followed by Agri Advances which grew by 18.12% YoY.

• Retail Personal Advances and Corporate loans registered YoY growth of 15.28% and 10.71% respectively.

• Whole Bank Deposits grew at 13.02% YoY, out of which CASA Deposit grew by 4.48% YoY. CASA ratio stands at 41.18% as on 31 st December 23.

Asset Quality

• Gross NPA ratio at 2.42% improved by 72 bps YoY.

• Net NPA ratio at 0.64% improved by 13 bps YoY.

• PCR (Incl. AUCA) stands at 91.49%. Provision Coverage Ratio (PCR) at 74.17% declined by 195 bps YoY.

• Slippage Ratio for 9MFY24 improved by 5 bps YoY and stands at 0.67%. Slippage Ratio for Q3FY24 increased by 17 bps YoY and stands at 0.58%.

• Credit Cost for Q3FY24 remained flat YoY at 0.21%. Capital Adequacy

• Capital Adequacy Ratio (CAR) as at the end of Q3FY24 stands at 13.05%. Alternate Channels

• Share of Alternate Channels in total transactions increased from 97.2% in 9MFY23 to 97.7% in 9MFY24.