SBI witnessed Highest ever quarterly Net Profit

FinTech BizNews Service

Mumbai, 7 February 2026: State Bank of India declared its Q3FY26 and 9MFY26 results today.

Business

Business crossed Rs103 Trillion.

Deposits & Advances crossed Rs57 Trillion & Rs46 Trillion respectively.

SME Portfolio crossed Rs6 Trillion.

Profitability

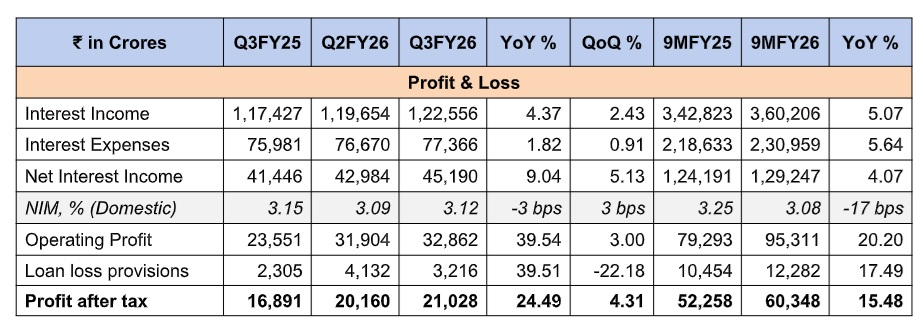

Highest ever quarterly Net Profit at Rs21,028 crores, witnessing a growth of 24.49% YoY.

Operating Profit for Q3FY26 up by 39.54% YoY to Rs32,862 crores.

Bank’s ROA and ROE for the 9MFY26 stand at 1.16% and 20.68% respectively.

Net Interest Income (NII) for Q3FY26 increased by 9.04% YoY.

Whole Bank and Domestic NIM for the 9MFY26 stand at 2.95% and 3.08% respectively.

Whole Bank NIM for Q3FY26 is at 2.99% and Domestic NIM is at 3.12%.

Balance Sheet

Whole Bank Advances growth at 15.14% YoY with Domestic Advances growth at 15.44% YoY.

Foreign Offices’ Advances grew by 13.41% YoY.

Retail Advances grew by 16.51% YoY, with double digit growth in all segments.

SME Advances grew by 21.02% YoY followed by Agri Advances growth of 16.56% YoY and Retail Personal Advances growth of 14.95%.

Corporate Advances registered YoY growth of 13.37%.

Whole Bank Deposits grew by 9.02% YoY. CASA Deposit grew by 8.88% YoY. CASA ratio stands at 39.13% as on 31 st December 25. Retail Term Deposits registered YoY growth of 14.54%.

Asset Quality

Gross NPA ratio at 1.57% improved by 50 bps YoY.

Net NPA ratio at 0.39% improved by 14 bps YoY.

Provision Coverage Ratio (PCR) increased by 88 pbs YoY and stands at 75.54% while PCR (incl. AUCA) increased by 63 bps and stands at 92.37%.

Slippage Ratio for 9MFY26 improved by 5 bps YoY and stands at 0.54%.

Slippage Ratio for Q3FY26 stands at 0.40%.

Credit Cost for Q3FY26 stands at 0.29%.

Capital Adequacy

Capital Adequacy Ratio (CAR) as at the end of Q3FY26 stands at 14.04%.

Alternate Channels

More than 68% of SB accounts opened digitally through YONO in Q3FY26.

Share of Alternate Channels in total transactions increased from 98.1% in 9MFY25 to 98.6% in 9MFY26.