China's macro data has also boosted investor sentiments

Dipanwita Mazumdar

Economist,

Bank of Baroda

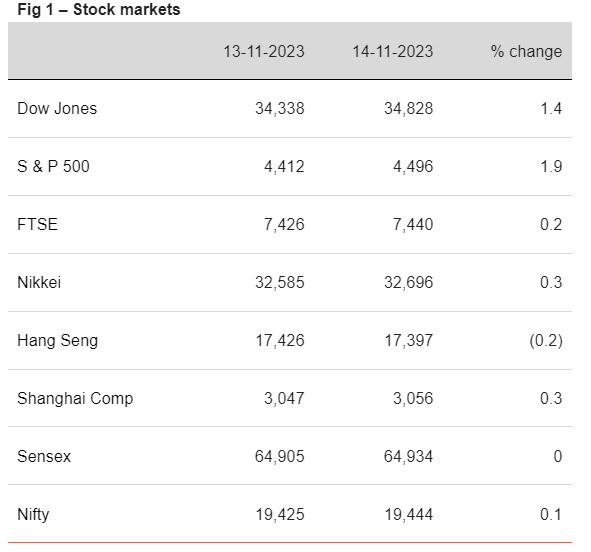

Mumbai, November 15, 2023: Softening CPI print in the US (flat sequential increase against 0.4% increase in Sep’23) provided some degree of comfort to markets. Even CPI excl. food and energy also moderated to 0.2% from 0.3%. On YoY basis, CPI and core came in at 3.2 and 4% respectively. This has raised bets for Fed fund rate to be on the same level as of now in the next meeting (94.5% probability against 85.5% a day before). Separately, in China, major high frequency macro indicators showed some momentum. Industrial production rose by 4.6% against expectation of 4.5% in Oct’23, on YoY basis. Retail sales rose by 7.6% (est.: 7%). In Japan, sharp contraction is visible in Q3 provisional GDP estimate as private consumption demand flat lined. On domestic front, WPI remained in deflation territory for 7th consecutive month.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)