Fed Chair Powell, noted that Fed is not getting tolerant to higher inflation and hinted rate cuts very much remain on table

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, April 1, 2024: Recently comments by fed officials have made a case for divided house as far as the interest rate cuts is expected in Jun’24. Fed official, Waller made a case of postponing rate cuts than was initially anticipated (in Jun’24). Fed Chair Powell, noted that Fed is not getting tolerant to higher inflation and hinted rate cuts very much remain on table. Recently, PCE index (Fed’s preferred gauge of inflation) rose by 2.5% in line with expectations with core PCE at 2.8%. On a monthly basis, headline PCE moderated to 0.3% in Feb’24 (0.5% in Jan’24). Additionally, US GDP slowed down to 3.4% in Q4CY24 (4.9% in Q3). Separately, in Europe, Germany’s employment levels edged up along with improvement in retail sales.

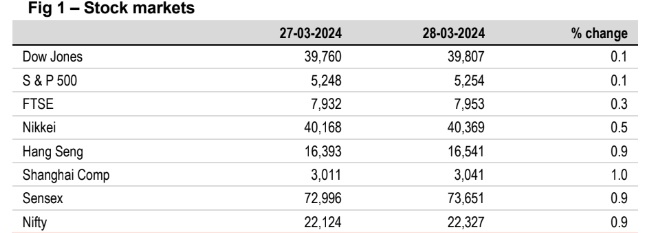

§ Global stock indices ended higher. FTSE ended in green despite poor macro data confirming the economy had actually slipped in to recession in CY23 (-0.3% in Q4). Amongst US indices, S&P500 in Q1CY24 performed the best in over 5-years. Sensex climbed up by 0.9% led by gains in power and cap goods stocks. It is trading higher today, while other Asian indices are trading mixed.

Global currencies closed mixed against US$. DXY gained by 0.2% amidst comments by Fed officials. Investors will monitor the crucial PCE data to gauge the future path of Fed’s rate cycle. JPY ended flat as it inches up to close to the 152 mark and this might propel some government intervention. Asian currencies are trading mixed today.

▪ Global 10Y yields ended mixed. Yields in US, Germany and China inched up by 1bps each. Fed official Waller, noted given the disappointing inflation print, Fed might have to delay rate cuts. Investors have already priced in a 64% chance of rate cut in Jun’24. India’s 10Y yield softened by 1bps.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)