CRISIL's assessment reveals heartening all-round impact

FinTech BizNews Serviced

Mumbai: 9th February, 2024: Fund of Funds for Startups (FFS), a key component of the Startup India Action Plan launched by Hon’ble Prime Minister Shri Narendra Modi ji in 2016, is today one of the flagship programmes of DPIIT, Government of India and has proven to be a game changing intervention of Government of India in country’s Startup Ecosystem. The scheme is being managed by SIDBI on behalf of, and under the overall guidance and direction of DPIIT.

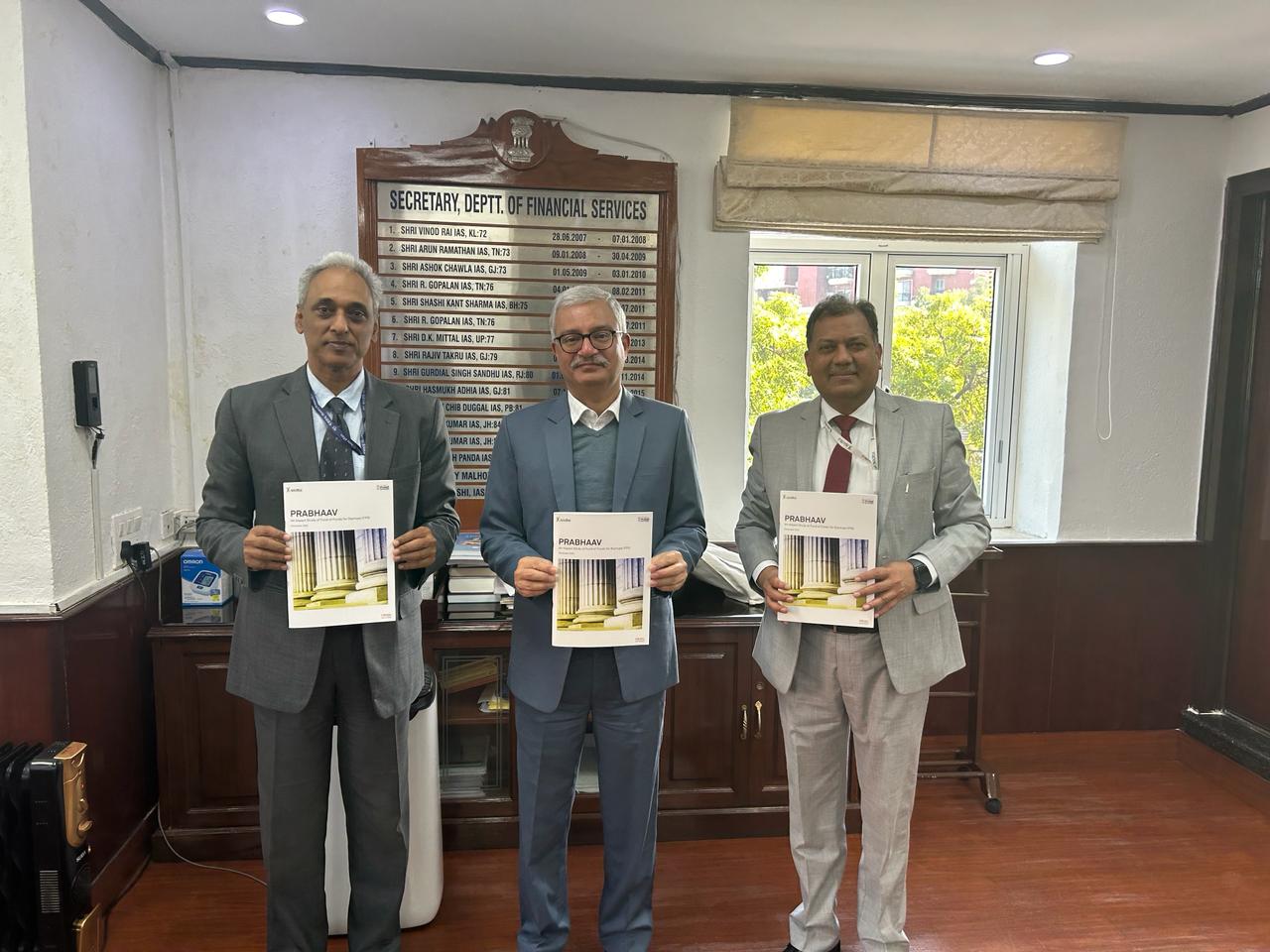

In this connection, a third-party assessment of the scheme was undertaken by CRISIL, India’s premier analytics company and pioneer of AIF benchmarking in the country. CRISIL’s impact assessment report viz. Prabhaav, was unveiled today by SIDBI.

S. Ramann, Chairman & Managing Director, SIDBI along with Shri S P Singh, CGM Venture Finance, presented the report to Dr Vivek Joshi, Secretary, Dept. of Financial Services, Ministry of Finance, GoI, Shri Rajesh Kumar Singh, IAS, Secretary, DPIIT and Shri Sanjiv, IRS, Joint Secretary, DPIIT, Ministry of Commerce & Industry.

The Fund of Funds for Startups, which contributes to the corpus of category I & II Alterative Investment Funds (AIFs), with a mandate for investment to startups, is one of the key initiatives which has transformed India into the 3rd largest startup ecosystem in the world today, by providing a sizeable catalytic pool of risk & growth capital to startups.

The report reveals heartening all-round outcomes of this initiative of GoI on aspects encompassing multiplied flow of capital, innovative solutions, inclusiveness & diversity in coverage of startups, deepening of startup funding ecosystem in the hinterlands of the country, strengthening of governance as well as wealth creation.

Key highlights of the report indicate that as on November 30, 2023, as many as 129 AIFs have been sanctioned commitment out of FFS across segments. The scheme has already catalysed investments to the tune of ~4x of the amount drawn with ₹17,534 crore invested in 938 unique startups. Thus, the scheme resulted in significant multiplier effect, promoting enhanced capital flow into this segment. While FFS largely focusses on early-stage funding in young companies, as many as 18 of its startups have already become unicorns.

The scheme has also channelised investments in startups in emerging sectors such as deep tech, agri/agri solutions, health tech, financial services, and sustainability. Implemented with emphasis on diversity & inclusiveness, after launch of FFS, 129 startups beyond Tier 1 cities have received investments aggregating ₹1,590 crore. Another heartening outcome was the increasing support to women led startups as well as women led fund managers.

The scheme has ushered in a revolution in Venture Capital Space in India too, emerging as hallmark of approval for the fund managers as well. As per the survey conducted by CRISIL as part of the assessment, 89% respondents confirmed that support under FFS was instrumental in anchoring their fund raise. More than 75% respondents said they experienced a positive impact in raising non-institutional domestic capital post commitment by SIDBI under the scheme. Further, out of the AIFs supported, as high as 35% are being managed by first time Fund Managers, which will help deepen and enhance the reach of the AIF / VC funding ecosystem, as summed up by CRISIL in its assessment.

The Secretary, DFS and Secretary, DPIIT appreciated the initiatives and progress demonstrated by SIDBI in managing the scheme and the outcomes already achieved.

Since, its formation in 1990, when the risk capital and VC ecosystem for innovative enterprises and startups was nearly non-existent in the country, SIDBI has been impacting the lives of citizens across various strata of the society through its integrated, innovative, and inclusive approach. Over the last 3 decades, SIDBI has taken several pioneering steps to support building up of startup ecosystem including support out of its own balance sheet. SIDBI supported setting up of several schemes on its own before emerging as a key partner of the Government of India and several State Governments for managing their vision in Startup space through Fund of Funds interventions. Apart from FFS, it also manages ASPIRE Fund of Funds of Ministry of MSME with focus on Agro and Rural enterprises, and state focussed Fund of Funds for Uttar Pradesh & Odisha.