FlexiLoans expects over Rs. 1000 Crores of disbursements with over 10 lakh applications

FinTech BizNews Service

Mumbai, September 17, 2025: FlexiLoans.com (Flexiloans), India's leading MSME-focused digital lending NBFC, today released its 2025 festive season outlook report, projecting a significant surge in credit demand from India's small businesses.

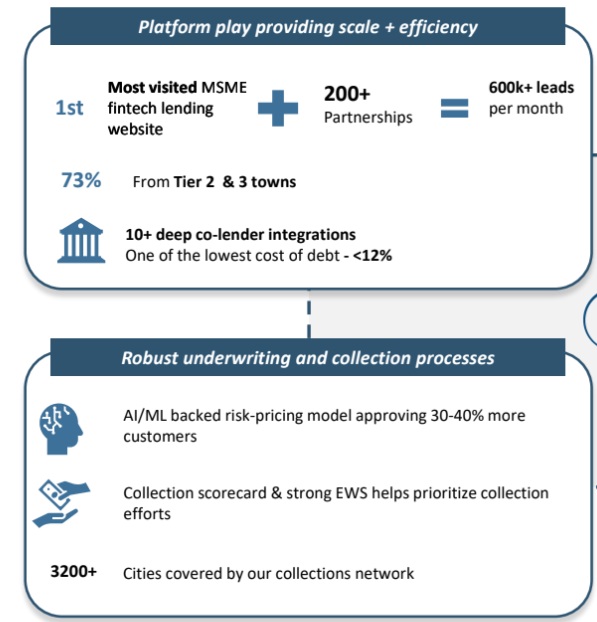

Leveraging its position as one of the most visited MSME fintech lending platforms, with over 600,000 leads per month. The company projects a 35-40% surge in loan applications during the festive period, translating into a 40% year-on-year growth in disbursements for FY26. It expects over Rs. 1000 Crores of disbursements with over 10 lakh applications expected during the festive season this year.

Since inception, the firm has consistently witnessed an ~80% average surge in festive season loan applications. This year, the momentum is expected to be stronger, driven by robust consumption, digital adoption in Tier 2 & 3 cities, and easing inflation.

An analysis of festive quarter (Q3) data from FY22 to FY25 reveals consistent double-digit growth in festive credit demand, with FY25 poised for the highest disbursement value yet. This demand is translating into record disbursement values, expected to reach approximately Rs3.45 lakh crore in FY25 Q3, up from Rs2.90 lakh crore in FY24.

Key Projections for the Festive Season 2025:

As India enters the festive season, the nation’s economic landscape is illuminated with unprecedented optimism. The report projects an ecommerce boom with 20-25% YoY growth, driven by Tier 2/3 adoption and festive mega-sales, with ecommerce giants expected to clock Rs1.2–1.4 lakh crore in GMV. This festive period is also set to be a major job creator, generating a 15-18% surge in employment opportunities. Industry projections, including a CareEdge Ratings report, highlight accelerated MSME formalization and credit growth as key drivers of this expansion. The surge, directly linked to the ecommerce boom and anticipated 50%+ sales spike in key segments, is prompting SMEs across retail, logistics, and manufacturing to rapidly scale their workforce.

Commenting on the festive outlook, Ritesh Jain, Co-founder, FlexiLoans.com, said: “Over the past four festive seasons, we have seen MSMEs increasingly rely on digital credit to capture consumer demand. With ecommerce and quick commerce accelerating in Tier 2 and 3 towns, 2025 is shaping up to be one of the strongest festive seasons for MSMEs. Our technology-first approach has broken barriers for credit access in Tier 2, 3, and even Tier 4 towns. This festive season, we expect record participation from MSMEs in these regions, and our digital lending stack is fully geared to empower them with fast, transparent, and affordable credit solutions.”

According to sectoral reports, NBFCs’ MSME AUM is projected to cross Rs5.3 lakh crore by FY26, growing at ~20% annually, outpacing banks. MSME loans rose from 5.9% of NBFC portfolios (FY21) to 9.1% (H1-FY25). Micro loans (sub-Rs10 lakh) remain the fastest-growing category, where NBFCs already command a >45% share.

Addressing a $250 Billion Opportunity- FlexiLoans, with its AI/ML-backed underwriting, deep co-lender integrations, and pan-India MSME reach, is strongly positioned to capitalise on this demand surge, supporting small businesses during the festive boom. It operates in a large white space, addressing the estimated $250 billion unmet credit demand from India's 60+ million MSMEs. Its strong moats in origination, AI/ML-backed risk-pricing, and fully automated scorecards allow it to approve 30-40% more customers while maintaining industry-leading low credit and collection costs.

FlexiLoans Key Highlights: