Ramesh G., Managing Director & Chief Executive Officer, HDB Financial Services: The integration of advanced technologies has been pivotal to our vision of efficiently serving a broader and more diverse customer base while laying a scalable foundation for future growth

FinTech BizNews Service

Mumbai, June 21, 2025: Technology is core to HDB Financial Services’ strategy. Its total Gross Loan Book increased to Rs10,68,776 Mn in FY 2024-25, as compared to Rs9,02,179.32 Mn in FY 2023-24, reflecting a year-on year growth of 18.47%. This was driven by the company's expanding scale across a diversified portfolio and supported by deeper customer engagement and digital sourcing tools.

Ramesh G., Managing Director & Chief Executive Officer, HDB Financial Services, says: “We have been making adequate IT investments. We have doubled our tech investment in the last 3 years. We will continue to do make adequate IT investments going forward.” He was speaking at the press conference for its IPO on Friday in Mumbai. HDB Financial Services shall open its Bid / Offer in relation to its Rs125 Bn initial public offer of Equity Shares on Wednesday, June 25, 2025. The Price Band of the Offer has been fixed at Rs 700 to Rs 740 per Equity Share.

Integrating Technology & Digital Initiatives across the Value Chain

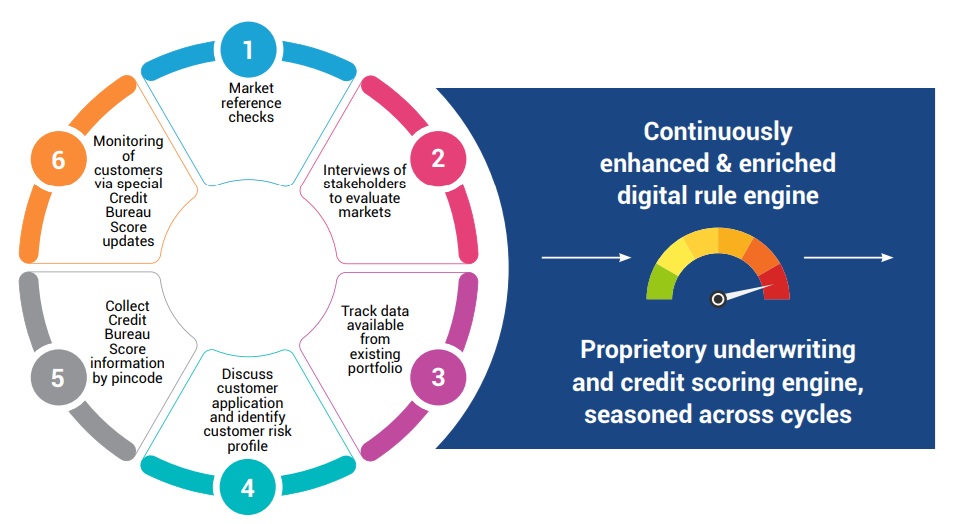

According to Ramesh G., Managing Director & Chief Executive Officer, the integration of advanced technologies has been pivotal to our vision of efficiently serving a broader and more diverse customer base while laying a scalable foundation for future growth. Our technology-led platform connects systems across the lending lifecycle, from customer sourcing and onboarding to underwriting, collections and servicing, enabling faster, more accurate and seamless execution. The implementation of integrated CRM and ERP systems has further optimised operational efficiency and expanding our customer reach through smarter engagement and streamlined processes.”

“We understand that improving the customer experience is crucial for long-term success. A cornerstone of this strategy is the HDB On-the-Go app, which empowers customers to manage their loans independently and efficiently. With over 8.8 million downloads, the app has become a primary driver of our omni-channel strategy. This app facilitates paperless onboarding and quick loan disbursements, enabling customers to apply for and manage their loans in a wholly digital environment. With rising customer volumes and growing expectations for seamless service, we recognised the importance of enhancing digital self-service channels to deliver faster, more efficient support. During the year, we successfully resolved over 1.34 Mn customer queries through our online platforms, including the app and web portal. Thus, reducing the need for manual intervention and enabling faster response times. This has resulted in an increase in customer satisfaction scores, highlighting the impact of our digital-first approach on customer experience. Beyond our digital platforms, we introduced several high-impact customer-focussed initiatives during the year. These included financial literacy camps, aimed at improving accessibility, trust and ease of engagement for our diverse customer base. Together, these initiatives reflect our intent to build a service experience that is inclusive, responsive and built for scale blending technology with trust and reach with relevance.”

Jaykumar Shah, CFO, HDB Financial Services, said: We have been making need-based IT investments over the years. We have been adding new capabilities, cyber security measures, on continuous basis.” He was speaking at the press conference for its IPO on Friday in Mumbai.