Digital Lending and Smart Credit as Catalysts of Aspiration; Shift from Survival to Success

FinTech BizNews Service

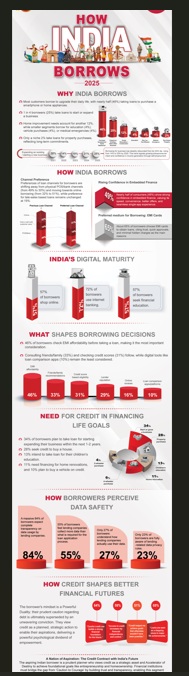

Mumbai, November 27, 2025: Home Credit India, a leading consumer finance company, today released the 7th edition of its flagship annual study, How India Borrows (HIB).The study highlights a profound transformation in the borrowing behavior of India’s lower-middle class, a segment representing nearly two-thirds of the population and often considered the silent drivers of economic growth.

Ashish Tiwari, Chief Marketing Officer, Home Credit India

This year’s study shows a marked transformation in borrowing behaviour and attitudes among this segment - from credit as a safety net for necessity to a catalyst for aspiration and self-reliance. Credit is increasingly being used to elevate living standards, invest in entrepreneurial ventures, and achieve long-term financial goals, reflecting their strategic and forward-looking mindset. The study provides in-depth insights into borrowing behaviour, digital adoption, loan decision drivers, financial aspirations and attitudes, revealing how India’s emerging middle class is leveraging smart credit as a tool to fund their aspirations and turn dreams into reality.

The study surveyed borrowers aged 18–55 years across 17 major cities (Tier 1 & 2), covering diverse income groups and professions. The sample comprised predominantly males, with an average age of 33 years and an average monthly income of Rs34,000.

HIB 7.0 is structured around four thematic pillars that define the concept of smart credit as a catalyst for growth.

“How India Borrows 7.0 study reflects a shift in India’s credit culture - from borrowing for survival to borrowing for success,” says Ashish Tiwari, Chief Marketing Officer, Home Credit India. “Gen Z, Millennials, women, and smaller cities are leading the digital lending revolution, valuing speed, simplicity, and personalisation. Embedded finance is driving frictionless borrowing, where trust, technology, and value converge to redefine how India borrows. The lower middle class is increasingly strategic in its ambitions, using credit as a bridge to entrepreneurship, homeownership, and education. At Home Credit India, we see them as Prudent Planners and Confident Builders. We are committed to empowering our customers with a transparent financial journey that fuels personal progress, national growth, and financial inclusion, making every borrower’s #ZindagiHit.”

Key Insights from HIB 7.0:

Credit: A Catalyst for Aspiration

HIB 7.0 study reveals a defining shift in the purpose and psychology of borrowing: from need-based to purpose-driven. The findings highlight a dual nature of credit: it continues to democratise access to modern living while increasingly fueling entrepreneurial ambition. The evolving credit mix indicates a maturing borrowing mindset, where borrowers are prioritising productivity, digital access, and lifestyle improvement over basic needs spends.

In 2025, the top reason for borrowing remains the purchase of smartphones and home appliances (46%), showcasing the importance of connectivity and comfort in everyday life. However, a notable 25% of borrowers now seek credit for business expansion or start-ups (up from 21% in 2024), marking a significant rise in enterprise-led borrowing and signalling a confident move toward self-sufficiency and capital formation. Other key categories of borrowing demonstrate targeted financial planning and responsible credit use such as, 12% for Home renovation/construction (vs 15% in 2024), 4% for Education loans (stable YoY), 2% for Marriage loans (vs 5% in 2024), and 4% for Vehicle loans (vs 6% in 2024).

Digital Adoption: Fueling Financial Empowerment

Digital adoption has emerged as a central driver of financial empowerment, marking a decisive shift toward a tech-driven credit ecosystem. Women and youth are emerging as the proactive seekers of Smart Credit, driving digital learning and usage. Metros and rising cities are setting new benchmarks in mobile-first finance, and Digital literacy and trust are becoming the essential enablers for the next phase of India’s credit evolution.

The study finds that 65% of borrowers now use mobile banking, highlighting a growing comfort with digital transactions. Mobile banking adoption is led by metros (71%) and the South region (68%). Among cities, Delhi NCR (83%), Kochi (74%), and Chennai (73%) are clear frontrunners, while emerging markets like Bhopal and Chandigarh at 54%, signalling the need for focused literacy initiatives. Millennials (67%) and Gen Z (64%) are the most active users, reflecting their growing confidence in managing finances digitally.

57% of borrowers shop online, with women (66%) surpassing men (55%), highlighting how digital convenience is empowering women to manage household purchases and finances independently. Gen Z (65%) leads online adoption, followed by Millennials (59%), while Gen X (48%) continues to rely on traditional methods, showing a generational shift in digital comfort. Regionally, the East (70%) leads digital commerce, driven by cities like Kolkata (74%) and Patna (68%), followed by the North (57%), West (53%), and South (51%).

Internet banking usage has climbed to 46%, with Gen Z (51%) and Millennials (49%) leading the charge. Cities such as Chennai (59%) and Delhi NCR (53%) record the highest usage, reflecting strong digital trust and maturity. Interestingly, major financial hubs like Mumbai (39%) and Bengaluru (39%) lag, indicating that infrastructure alone does not guarantee adoption, consumer habits and trust play equally critical roles.

While digital penetration is deep, financial literacy remains the next big priority. Over 57% of consumers express interest in learning financial skills from reputed organisations, with women (66%) and Gen Z (65%) showing the strongest enthusiasm. This reflects a growing realisation that financial empowerment depends not just on access, but also on awareness. Regionally, the East (70%), led by Kolkata (74%), again stands out for its proactive learning mindset. Metros and Tier-1 cities also saw a sharp rise by 27 and 21 points respectively, indicating growing consumer intent to strengthen financial confidence alongside digital capability.

Informed Borrowing: Balancing Affordability, Trust, and Value

The study highlights that modern borrowers are becoming more analytical, value-conscious, and trust-driven. Borrowing decisions today reflect a fine balance between affordability, speed, and credibility. Before taking a loan, nearly half (46%) assess EMI feasibility, while 33% consult friends or family, and 31% review their credit scores. Interest rates and total repayment value (46%), quick disbursal (38%), and flexible closure options (37%) remain the top product considerations.

Trust continues to be the cornerstone of credit decisions. Two-thirds (66%) of borrowers prefer credible lenders even at higher EMIs — a sentiment strongest among Millennials, metro and Tier 1 audiences. Interest rate sensitivity is led by Millennials (48%), while men (46%) prioritize EMI affordability and women (46%) rely more on personal advice. Millennials (47%) and Gen X (46%) remain slightly more affordability-driven than Gen Z (43%).

Regional patterns add further nuance. Borrowers in North, West, and East India place greater emphasis on EMI feasibility (49–54%), whereas those in the South focus more on credit scores (50%) and service quality. EMI awareness is highest in Bhopal (63%), Kolkata (57%), and Patna (49%), while reliance on personal networks dominates in Chennai (67%) and Bengaluru (57%). Credit score awareness peaks in Bengaluru (70%) and Chennai (60%), with lender reputation valued most in Chennai (54%), Mumbai (37%), and Lucknow (37%).

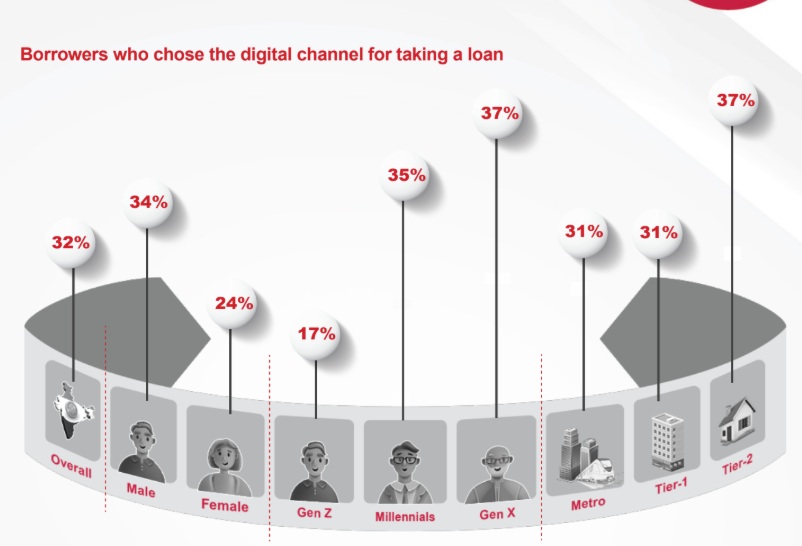

Digital Loan Journey: India’s Shift to Click-First Credit

The study reveals a decisive shift toward digital-first borrowing, driven by convenience, transparency, and accessibility, positioning online lending as the dominant channel for India’s credit future. In 2025, 51% of borrowers preferred taking loans online, marking a 10 percentage-point increase from last year and surpassing POS and bank visits (30%) as the primary mode of borrowing. This trend is strongest among Millennials (54%) and Gen Z (50%), underscoring the comfort and confidence of younger, tech-savvy consumers in navigating digital credit journeys.

Tier 1 cities are now leading India’s digital borrowing wave, signalling the rapid penetration of technology beyond metros. North India leads overall with 59% of borrowers opting for online channels, followed closely by the West, where Pune and Ludhiana each record 64% digital uptake. Chandigarh (42%), Bengaluru (41%), and Ahmedabad (41%) emerge as the top digital-loan cities, while Mumbai (22%), Lucknow (27%), and Jaipur (27%) show slower adoption.

Emerging Lending: The Rise of Embedded Finance and Contextual Credit

Embedded finance and EMI cards are redefining India’s lending ecosystem, making credit more contextual and frictionless. Nearly half (49%) of borrowers show interest in embedded finance solutions integrated within digital ecosystems, an adoption trend led by Gen Z (58%), women (51%), and metro audiences seeking speed, convenience, and seamless integration with e-commerce and lifestyle platforms.

Metro cities (50%) and Tier 2 towns (43%) have seen a notable rise in interest (up 14 and 8 percentage points respectively), showcasing the widening reach of embedded lending. The South zone leads this growth, up 32 points to 49%, with Chennai (55%), Bengaluru (52%), and Hyderabad (50%) topping adoption charts. In the North, Chandigarh (55%) and Lucknow (53%) dominate despite a marginal dip in the latter. The East continues steady progress, led by Ranchi (53%), Patna (51%), and Kolkata (49%), while in the West, Pune (49%), Mumbai (47%), and Ahmedabad (45%) maintain strong interest levels.

EMI cards remain the most widely used lending instrument, preferred by 65% of borrowers, marking a 22-basis-point rise year-on-year.

Credit as an Enabler: From Borrowing for Survival to Borrowing for Success

The most common near-term purposes for borrowing are starting or expanding a business (34%) and buying a home (28%), highlighting India’s dual ambition of economic mobility and home ownership.

Men (35%) are more focused on business expansion, while women (33%) prioritise home buying. Gen Z emerges as the most aspirational cohort, with 35% trying to start a business along with 32% aiming to buy a home. In terms of aiming at home ownership, Gen Z is ahead of both Millennials and Gen X. Metros (32%) show higher intent for home ownership, whereas Tier 1 cities (37%) lean toward entrepreneurship. East India (44%) leads in entrepreneurial ambition, especially Patna (52%) and Ranchi (47%). Among metros, Delhi NCR (37%) stands out for home-buying intent, while Jaipur (42%) and Bengaluru (41%) reflect higher debt caution. Secondary goals include children’s education (13%) and home renovation (11%), while discretionary purposes such as international travel (1%), purchasing 4 wheelers (6%) and 2 wheelers (4%) and lifestyle upgrades (2%) remain limited, reflecting a pragmatic borrowing mindset.

Encouragingly, the perception of credit as a tool of empowerment continues to grow. 51% of respondents say loans have helped them achieve goals otherwise out of reach, with the sentiment strongest in Tier 2 towns (54%) and cities such as Ludhiana (58%), Bhopal (56%), Dehradun (56%), Jaipur (55%), and Patna (52%). Two-thirds (65%) view loans as a stepping stone to major life goals such as education, housing, and entrepreneurship, led by Gen Z (68%) and Tier 1 cities (67%), with Mumbai (70%) topping metros. However, women (42%) are more debt-averse than men (35%), indicating greater financial caution.

Data Privacy: The Transparency Mandate and the Awareness Gap

Data privacy emerges as a crucial concern amid growing digital adoption. 23% of respondents fully understand data privacy rules, a 10-percentage point rise from last year, while 78% have only partial or no awareness of how lending companies handle their data. Cities such as Ludhiana, Bengaluru, Ranchi, Kochi, and Hyderabad emerge as leading hubs for heightened privacy expectations.