Banks remain the dominant investors in securitization transactions, providing funding for NBFCs to fuel their retail credit growth

Securitization volume has crossed Rs 1 lakh crore (trillion) in the first half of fiscal 2024 (see chart 1 in annexure)— up 35% from Rs75,000 crore in the first half of last fiscal as banks continued to invest in retail assets. The strong credit growth among originating NBFCs also contributed to the use of securitization for raising funds. The volume remained unfazed by the exit of a large housing finance company (HFC) from the securitization space in the second quarter of this fiscal, following its merger with an affiliate bank.

Says Krishnan Sitaraman, Senior Director and Chief Ratings Officer, CRISIL Ratings, “The exit of one of the

largest originators last quarter has been more than made up by other financiers. The overall first-half volume is now trending in line with pre-pandemic levels when the full year fiscal 2020 volume had touched Rs 1.9 lakh crore. The continued momentum in credit growth among NBFCs augurs well for securitization and indicates potential for a decadal high volume this fiscal.”

Shifts In Market Dynamics

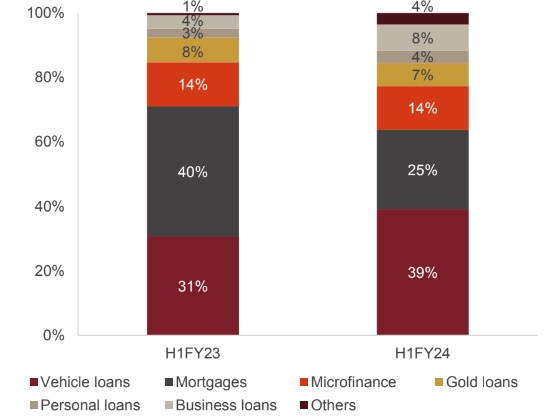

To be sure, the exit of the large HFC has led to some shifts in the market dynamics. The asset class mix has moved in favor of non-mortgage loans and the share of direct assignments (DA) has declined vis-à-vis pass-through-certificates (PTCs). The share of retail mortgage-backed securitizations (MBS), which used to be the dominant asset class, has dropped to 25% in the first half of this fiscal from 40% in the first half of last fiscal.

Vehicle loans (including commercial vehicles, passenger vehicles and two-wheelers) have replaced mortgages as the dominant asset class, with their share in overall volume rising from 31% to 39%. Microfinance loans constituted 14% of volume, in line with the first half of last fiscal.

Among other asset classes, business and personal loan segments saw greater traction with their volume share in the first half increasing to 8% and 4%, respectively, from 4% and 3%, respectively, last fiscal.

In terms of the securitization route, the exit of the HFC has partly impacted DA volume. The share of DAs reduced from 63% to 46% in the first half this fiscal. PTCs are clearly gaining favor across asset classes, accounting for 80% of vehicle loan securitizations and over 60% of personal and business loan securitizations.

Private Banks Invested In DA & PTC

In line with past trends, private banks were the dominant investors, followed by public sector banks and foreign banks. Public sector banks continued to prefer DAs, while private banks invested in a mix of DAs and PTCs and foreign banks invested predominantly in PTCs.

The rising share of PTCs, coupled with the healthy performance of securitized pools, have also led to fresh investment activity by investors such as mutual funds, which had been dormant in the market after the pandemic. The collection track record, structuring flexibility and credit enhancement support offered by PTCs could attract more such investors in the days ahead. Over the last year, PTCs rated by CRISIL Ratings had median monthly collection ratios (MCRs) of 98-100% in secured asset classes and microfinance, and 94-96% in unsecured asset classes.

Says Ajit Velonie, Senior Director, CRISIL Ratings, “Banks continued to be the dominant investors in securitization transactions, providing funding for NBFCs to fuel their retail credit growth. However, other

investors, such as mutual funds and alternative investment funds, are also eyeing securitization to diversify their investments to retail assets with robust performance track record. The market shift towards PTCs could accelerate such investments, given the presence of credit enhancements that increase investor protection and flexibility to customize transactions as per investor requirements. This could also help deepen the market and spur innovation critical for further market development.”