The consolidated profit after tax of the lender for the half year ended September 30, 2023 is up 40.9% y/y

Total Deposits of HDFC Bank showed a healthy growth of approximately Rs. 1.1 lac crore during the quarter post merger, and were at Rs. 21,72,858 crore as of September 30, 2023, an increase of 29.8% over September 30, 2022. Gross advances of the bank increased by approximately Rs.1.1 lac crore during the quarter post merger, and were at Rs. 23,54,633 crore as of September 30, 2023, an increase of 57.7% over September 30, 2022. The Board of Directors of HDFC Bank Limited approved the Bank’s (Indian GAAP) results for the quarter and half year ended September 30, 2023, at its meeting held in Mumbai on Monday, October 16, 2023. The accounts have been subjected to a 'Limited Review' by the statutory auditors of the Bank.

The Bank’s consolidated net revenue grew by 114.8% to Rs. 66,317 crore for the quarter ended September 30, 2023 from Rs. 30,871 crore for the quarter ended September 30, 2022. The consolidated profit after tax for the quarter ended September 30, 2023 was Rs. 16,811 crore, up 51.1%, over the quarter ended September 30, 2022. Earnings per share for the quarter ended September 30, 2023 was Rs. 22.2 and book value per share as of September 30, 2023 was Rs. 552.5. The consolidated profit after tax for the half year ended September 30, 2023 was Rs. 29,182 crore, up 40.9%, over the half year ended September 30, 2022.

Standalone Financial Results

Profit & Loss Account: The Bank’s net revenue grew by 33.1% to Rs. 38,093 crore for the quarter ended September 30, 2023 from Rs. 28,617 crore for the quarter ended September 30, 2022. Net interest income (interest earned less interest expended) for the quarter ended September 30, 2023 grew by 30.3% to Rs. 27,385 crore from Rs. 21,021 crore for the quarter ended September 30, 2022. Core net interest margin for the quarter was 3.65% on total assets and 3.85% on interest earning assets. After absorbing debt funded cost for additional liquidity and merger management, the reported NIM for the quarter is 3.4% on total assets and 3.6% on interest earning assets. Other income (non-interest revenue) for the quarter ended September 30, 2023 was Rs.10,708 crore as against Rs. 7,596 crore in the corresponding quarter ended September 30, 2022. The four components of other income for the quarter ended September 30, 2023 were fees & commissions of Rs. 6,936 crore (Rs. 5,803 crore in the corresponding quarter of the previous year), foreign exchange & derivatives revenue of Rs. 1,221 crore (Rs.1,082 crore in the corresponding quarter of the previous year), net trading and mark to market gain of Rs 1,041 crore (loss of Rs. 387 crore in the corresponding quarter of the previous year) and miscellaneous income, including recoveries and dividend, of Rs. 1,510 crore (Rs. 1,098 crore in the corresponding quarter of the previous year).

Operating expenses for the quarter ended September 30, 2023 were Rs. 15,399 crore, an increase of 37.2% over Rs. 11,225 crore during the corresponding quarter of the previous year. The cost-to-income ratio for the quarter was at 40.4%. Pre-provision operating profit (PPOP) at Rs.22,694 crore grew by 30.5% over the corresponding quarter of the previous year.

Provisions and contingencies for the quarter ended September 30, 2023 were Rs.2,904 crore as against Rs. 3,240 crore for the quarter ended September 30, 2022.

The total credit cost ratio was at 0.49%, as compared to 0.87% for the quarter ending September 30, 2022. Profit before tax (PBT) for the quarter ended September 30, 2023 was at Rs.19,790 crore. After providing Rs.3,814 crore for taxation, the Bank earned a net profit of Rs. 15,976 crore, an increase of 50.6% over the quarter ended September 30, 2022.

Balance Sheet

As of September 30, 2023 total balance sheet size as of September 30, 2023 was Rs. 34,16,310 crore as against Rs.22,27,893 crore as of September 30, 2022. CASA deposits grew by 7.6% with savings account deposits at Rs.5,69,956 crore and current account deposits at Rs. 2,47,749 crore. Time deposits were at Rs.13,55,153 crore, an increase of 48.3% over the corresponding quarter of the previous year, resulting in CASA deposits comprising 37.6% of total deposits as of September 30, 2023.

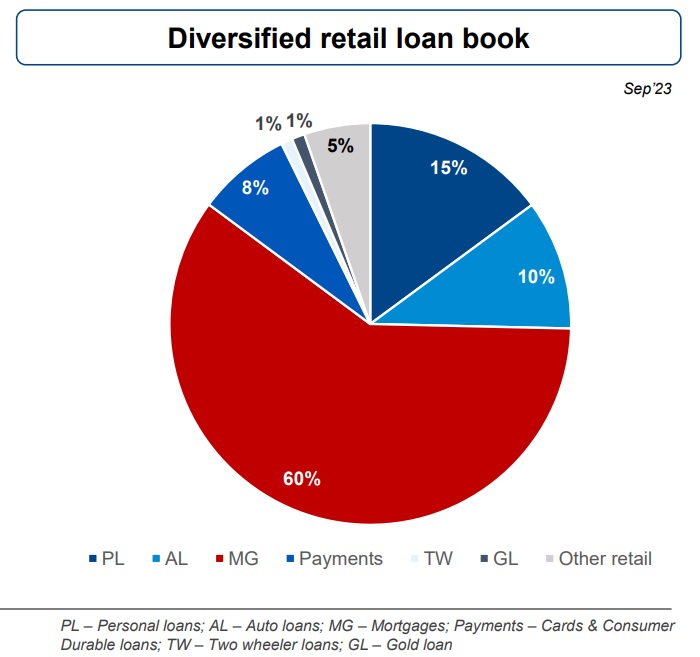

Grossing up for transfers through inter-bank participation certificates and bills rediscounted, advances grew by 60.0% over September 30, 2022. Domestic retail loans grew by 112.1%, commercial and rural banking loans grew by 29.5% and corporate and other wholesale loans (excluding non-individual loans of eHDFC Ltd of approximately Rs. 1,02,800 crore) grew by 7.9%. Overseas advances constituted 1.7% of total advances. Half Year ended September 30, 2023 For the half year ended September 30, 2023, the Bank earned a total income of Rs.1,36,223 crore as against Rs.87,742 crore in the corresponding period of the previous year. Net revenues (net interest income plus other income) for the half year ended September 30, 2023 were Rs. 70,922 crore, as against Rs 54,486 crore for the half year ended September 30, 2022. Profit after tax for the half year ended September 30, 2023 was Rs. 27,928 crore, up by 41.0% over the corresponding half year ended September 30, 2022.