Likely rate cut by the RBI in Q2FY25

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

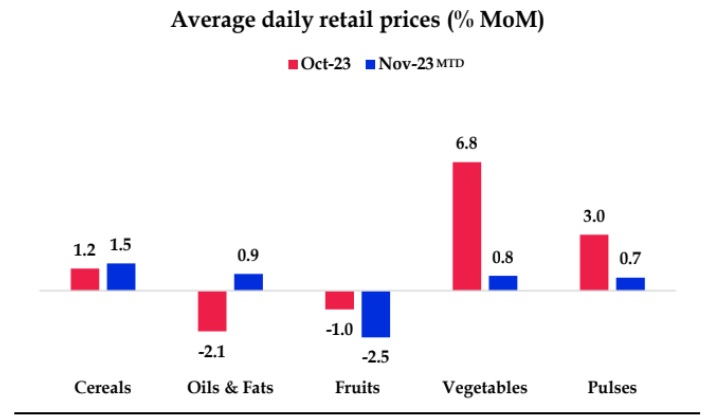

Mumbai, November 13, 2023: CPI eased to 4.9% YoY in October vs 5.0% YoY in September. After two consecutive months of negative growth, food inflation grew by 1.1% MoM mainly driven by the pickup in vegetable prices to 3.4% MoM. Within the food basket, ‘cereals’, ‘pulses’, ‘sugar’ and ‘spices’ prices rose at a moderate pace. Fuel & light inflation grew by 0.3% MoM in October. With waning base effect advantage and with volatility from food items, we expect Headline CPI inflation to drift from here on, rising back to above 5% for the remaining part of the year.

Further, we expect core inflation to continue its downward journey, but at a more moderate pace. Factoring in the above, we see Headline CPI at 5.3%-5.5% for FY24. With the 4% target continuing to elude, RBI is expected to stay on a long pause, keep its stance of “withdrawal of accommodation” unchanged and thus pushing out any rate cut chances into FY25.

Vegetable prices pick up sequentially: After registering negative growth for two consecutive months, food inflation rose by 1.1% MoM in October. The pickup in food inflation was majorly driven by vegetables (+3.4% MoM), pulses & products (+2.5% MoM), cereals & products (+0.8%

MoM) and eggs (+3.4% MoM). Within vegetables, the heavy weights like onion and potato increased by 0.4% MoM and 15.5% MoM, respectively. On the other hand, tomato prices continued to fall at (-)18.6% MoM. To keep the onion prices in check, the government had resorted to various supply side measures including the imposition of minimum export price at USD 800 per metric ton from 29 October 2023 to 31 December 2023. The government has also been conducting buffer stock sale of onions at a subsidized rate. Within cereals, the growth in rice prices has moderated to 0.9% MoM vs 1.6% MoM in September, whereas wheat prices maintained the same momentum at 0.9% MoM. Global rice markets continue to face pressure from El Nino and India’s export ban on broken rice. As per the FAO rice price index, rice prices grew by 24% YoY (-1.4% MoM) in October. Pulses prices grew by 2.5% MoM with ‘arhar’ and ‘gram’ registering growths of 3.8% MoM and 3.2% MoM, respectively. Oils and fats registered a

de-growth of 0.8% MoM. Sugar and spices maintained strong momentum at 1.1% MoM and 1.0% MoM, respectively. On a YoY basis, food inflation was at 6.6% (Sep: 6.6% YoY).

Consolidated fuel inflation declines: On a sequential basis, consolidated fuel inflation

increased by 0.2% MoM. LPG prices after registering a de-growth of 16% MoM in September, registered a flat growth in October. ‘Electricity’ prices also registered a flat growth whereas ‘kerosene’ prices increased by 2.6% MoM. ‘Firewood and Chips’ grew by 0.2% MoM. Petrol prices registered a flat growth whereas diesel prices grew by 0.1% MoM. On a YoY basis, consolidated fuel inflation declined by 0.2%.

Core inflation rose sequentially: RBI Core inflation (ex-food, fuel, PTI) rose by 0.3% MoM in October vs 0.1% MoM in September. Housing prices saw a sequential (and seasonal) increase of 0.9% whereas ‘Clothing and footwear’ prices increased by 0.4% MoM. Miscellaneous components grew by 0.1% MoM in October vs 0.2% MoM last month. Within miscellaneous, ‘HH goods and service’ (+0.2% MoM), ‘Health’ (+0.5% MoM), ‘Transport and Equipment’ (+0.1% MoM), ‘Recreation and Amusement’ (+0.2% MoM) and ‘Personal care and effects’ (+0.1% MoM) registered sequential increases. On the other hand, ‘Education’ registered a flat growth in October. Within ‘Personal care and effects’, gold and silver prices declined by 0.2% MoM and 1.4% MoM, respectively. On a YoY basis, core inflation came to 4.3% (Sep: 4.6% YoY).

Headline CPI drop to 4% to elude as base effect comfort ends and as food prices stay volatile: The pressure on vegetable prices is likely to have subsided with correction in tomato prices. The arrival of winter vegetables in the coming months can also provide further support. The

movement in ‘onion’ prices needs to be closely watched as it could disturb the inflation trajectory going forward. As per the NHB data, onion prices have increased 40% MoM in November MTD. However, we expect onion prices to cool in the coming days with improved supplies.

Another major risk that needs to be closely monitored is the impact of El Nino on rabi crop productions. As per reports, El Nino is likely to peak during November-January, the period in which the rabi sowing takes place. Lower reservoir levels also pose a risk to rabi crops. Our model indicates an average Headline CPI of 5.3%-5.5% for FY24. Importantly, with the waning support from the base effect, we are not expecting any sharp downward correction in inflation in the coming quarters. As the 4% inflation target continues to elude, we see a limited chance of

a repo rate cut by the RBI in FY24. Alongside the evolving inflation dynamics, the global interest rate cycle and trends in INR would be the factors that are likely to be closely watched by the RBI.

We reiterate our view for a likely rate cut by the RBI in Q2FY25.

(Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)