The sequential data on food shows discomfort due rising vegetable prices

Dipanwita Mazumdar,

Economist,

Bank of Baroda

FinTech BizNews Service

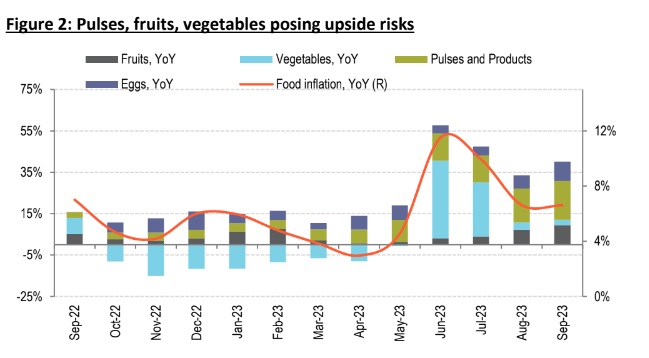

Mumbai, November 13, 2023: CPI print came in slightly higher than our estimate at 4.9% (BoB estimate: 4.7%). This is attributable to stickiness in food inflation. The sequential data on food shows discomfort due rising vegetable prices. The correction in tomato prices and recent surge in onion prices are posing transient shock to inflation. The question is how long it will persist. We believe since it coincide with the Oct-Dec’23 arrival of harvest, prices will be in check. Further Government’s policies such as increasing buffer stock of perishables will provide some temporary relief going forward. Notably, CPI excluding vegetables and pulses is lower at 4.7% in Oct’23.

Comforting core on the other hand would keep headline CPI within RBI’s targeted level. We believe that despite some bumpy ride with regard to food inflation, CPI will slowly crawl towards the 4% target level. Some moderation in demand conditions due to the result of past rate hikes will help in taming inflation. However, RBI will be mindful of the evolution of food trajectory and will be in a ‘wait and watch’ data dependent mode.

CPI inflation edged down slightly

Food has been sticky: CPI inflation came in at 4.9%, slightly higher than our estimate of 4.7%. The print is marginally lower compared to previous month’s level of 5%. Food inflation was sticky at 6.6% in Oct’23. 5 out of 12 broad categories of food inflation witnessed an increase in inflation in Oct’23 compared to Sep’23. Among them, the sharpest increase was visible in case of pulses (18.8% in Oct’23 from 16.3% in Sep’23), fruits (9.3% from 7.3%), and eggs (9.3% from 6.5%). Double digit inflation still persist for cereals and products, pulses and spices. On sequential basis, food inflation has risen by 1.1% in Oct’23 from -2.1% in Sep’23. The sequential increase is not attributable to any seasonal increase as on a seasonally adjusted basis, food inflation has risen by 1.2%, almost at the same level as the unadjusted series. The biggest sequential jump was visible in case of vegetables, attributed to onion price shock. Apart from this, fruits and eggs also posted sequential increase. Going forward, food inflation is clouded by uncertainty. Lower than previous year’s level of Khariff output as also lower reservoir levels till data, pose risk to Rabi sowing. Generally, pro

tein based items also see an upside shoch in this quarter, more of a seasonal nature. Thus, evolution of food inflation holds the key to any future decision by RBI.

Core CPI (excl. food and fuel) has moderated to 4.3%. All broad sub components of core noticed a drop in inflation in Oct’23. Amongst them, the demand driven components such as household goods and services (3.9% in Oct’23 from 4.3% in Sep’23), personal care and effects (7.8% from 8.5%) and clothing and footwear (4.3% from 4.6%) have noticed considerable drop in inflation. Only health inflation remains sticky at 5.9%. The sequential picture shows moderation in personal care and effects and education inflation. However, due to the festival month, clothing and footwear noticed some degree of momentum. Fuel and Light inflation fell by 0.4% in Oct’23 from -0.1% in Sep’23, but on a sequential basis, it has risen by 0.3% from -3.9% in Sep’23, due to rise in Kerosene prices.

Way forward: Despite some bumpy roads, we expect CPI to moderate gradually towards the 4% targeted level. Our forecast for the next two quarters lie below 5%. The key upside risks are the recent spike in onion prices. However, this spike coincide with the Oct-Dec’23 Khariff harvest. But the khariff harvest comprises only a part of production as majority of transplanting is done in Rabi season whose harvest arrives in the market during Mar-May. We expect that with government astute supply management policies such as increasing buffer stock of onions, prices will remain in check. Apart from the transient veggie price shock, what poses an underlying risk is the sub-optimal Khariff output and lower reservoir level which may affect wheat sowing. Cereal inflation has already remained in double digits for 14 months in a row. Going forward, this is a key watchable to overall inflation outlook in the near term. Comfort will be provided from a continuous deceleration in prices of services component. If we look at the demand side story of Indian economy, it is clear that despite some revival, it is not broad based and is concentrated in few pockets. The financial results of India Inc, IIP data for consumer durables and non-durables all point towards the same. Rural demand could also be a concern. Thus demand pull inflation would not be much of a concern as of now, which will keep headline CPI in the targeted level.

(Disclaimer: The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)