With a widening of the trade gap, majorly driven by higher gold imports, CAD/GDP now estimated at 1.5% (earlier 1.1%) for FY25.

Indranil Pan, Deepthi Mathew & Khushi Vakharia

Economics Knowledge Banking

YES Bank

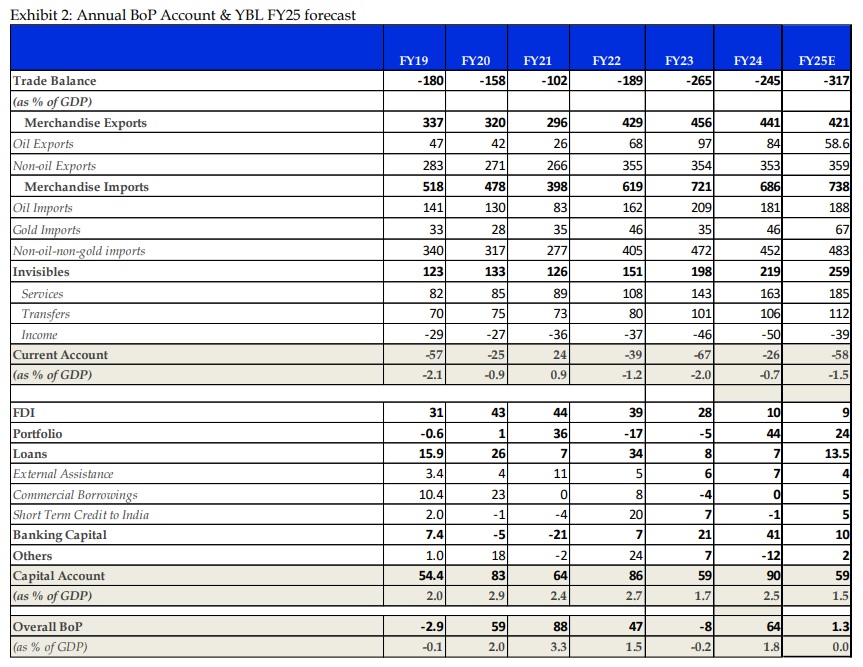

Mumbai, 27 December, 2024: India’s CAD came at USD 11.2 bn (1.2% of GDP) in Q2FY25 vs USD 9.8 bn (1.1% of GDP) in Q1FY25. This was led by a widening of the trade deficit, mostly emerging out of lower exports. On the other hand, invisibles came to USD 64.1 bn (Q1FY25: USD 55.4 bn). On the capital account side, FPI flows came in stronger whereas FDI reported a net outflow of USD 2.2 bn. With a widening of the trade gap, majorly driven by higher gold imports, we now estimate CAD/GDP at 1.5% (earlier 1.1%) for FY25. We see downside risk to our CAD/GDP estimation if gold imports are revised lower. We estimate BoP to register a surplus of USD 1.3 bn in FY25.

CAB remains negative in Q2FY25:

India’s Q2FY25 merchandise trade deficit came at USD 75.4 bn vs USD 65.1 bn in Q1FY25. Merchandise exports declined by 6.5% QoQ, with a fall in oil exports by 15.8% and a drop in the non-oil exports bill by 4.4% QoQ. On the other hand, merchandise imports increased by 1.7% QoQ, with gold imports registering a growth of 84.9% QoQ and non-oil-non-gold imports (NONG) rising by 8.5% QoQ. However, oil imports declined to USD 37.4 bn in Q2FY25 compared to USD 51.5 bn in Q1FY25. Net invisibles were at USD 64.1 bn with net services inflows rising to USD 44.6 bn from USD 39.7 bn in the previous quarter. The net outgo of primary income (interest income) stands at USD 9.5 bn.

Net Capital account surplus doubles at USD 30.5 bn:

Capital account surplus came to USD 30.5 bn in Q2FY25 from USD 14.7 bn in Q1FY25. Loans came in at USD 7.5 bn, higher than USD 5.9 bn in the previous quarter. Short-term credit stands at USD 3.4 bn whereas external assistance rose to USD 2.1 bn from earlier USD 1.4 bn. The net FPI was higher at USD 19.9 bn from USD 0.9 bn in Q1FY25. Net FDI showed outflows at USD 2.2 bn vs USD (+) 6.3 bn in the previous quarter. On the other hand, net banking capital flows expanded to USD 6.1 bn from (-) USD 2.9 bn in Q1FY25, as NRI deposit flows were higher in Q2FY25 at USD 6.2 bn compared to USD 3.2 bn in the same quarter last year.

Higher gold data flows lead us to revise CAD/GDP up to 1.5%:

We revise up our CAD/GDP estimate to 1.5% (from the earlier 1.1%) majorly driven by higher gold imports. Though we expect some normalization in gold imports for the coming months, the trends for the last 8 months gold import bill are expected to gross up for the year at USD 67 bn. The strong growth in ‘services’ and ‘transfers’ would be able to neutralize the negative impact of gold imports on current account balances to an extent. However, we see downside risk to our CAD/GDP estimates if there is any revision to gold imports. As per reports, there is an overestimation due to double counting of gold imports that was realized recently. Newspaper reports put the extent of overestimation of around 30% after system change in July 2024, thus translating to an estimated overestimation by USD 10 bn from August 2024 to November 2024. The government is likely to reconcile the gold import figures, post which our CAD/GDP can once again be lowered to 1.2% for FY25. We see increased risk to capital account and revise down our capital account surplus estimate to USD 59 bn (from the earlier USD 87 bn). We base this view on the following factors: a) FDI flows to remain muted given the concerns in the global demand. In FY25TD, FDI net flows are only at USD 2.1 bn compared to USD 7.7 bn for the same period last year b) we also see increased risk to FPI flows given the uncertainty on the measures that will be initiated by the new Trump administration. Alongside, Fed in its latest policy has indicated that it would reduce the pace of rate cuts with the dot plots indicating only a 50- bps rate cut in CY25 compared to the earlier 100-bps.

With US interest rates remaining higher, some moderation is expected in ECB flows also. With widening of CAD and moderation in capital account surplus, we expect BoP surplus to moderate to USD 1.3 bn in FY25 from USD 64 bn in FY24. The dynamics in the global market changed post the election victory by Mr. Trump in November 2024. Subsequently, the forward guidance by the Fed in its December policy has pushed UST yields and DXY higher. These developments have put depreciation pressure on EME currencies. USD/INR today touched an all-time low 85.80 (driven by maturing NDFs) before closing at 85.53 on likely RBI actions. With FCA coming off to around 9.3 months of import cover, we see the RBI being likely more comfortable in allowing for an orderly depreciation of INR. We expect USD/INR to move in a range of 85.50-86.00 for the rest of FY25.