For FY25, the trade deficit is estimated at USD 268 bn, higher than USD 245 bn in FY24. CAD/GDP is estimated at 1.1% for FY25

Indranil Pan, Deepthi Mathew & Khushi Vakharia

Economics Knowledge Banking

YES Bank

Mumbai, 15 November, 2024: India’s Trade Deficit for October came at USD 27.14 bn vs USD 20.78 bn in September

driven majorly by higher gold and crude oil imports. Gold imports were at USD 7.1 bn

in October reflective of the higher prices in the global market. Oil imports registered a

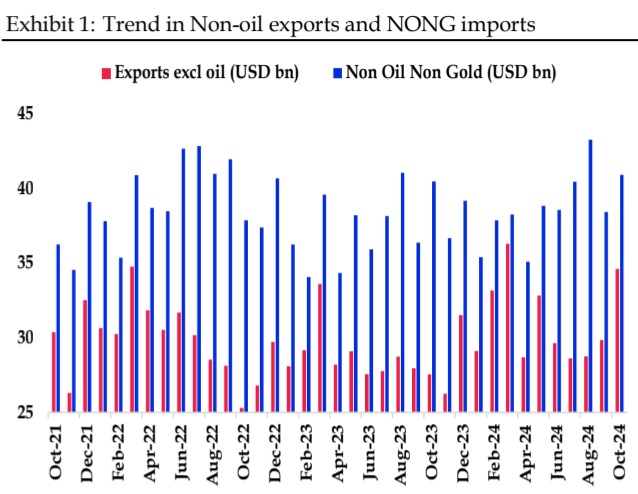

sequential increase of 46% to USD 18.30 bn. NONG imports increased by 6.5% MoM

whereas Non-oil exports grew by 16% MoM. India’s services sector surplus came at USD

17 bn (highest in the series) vs USD 16.1 bn in September. For FY25, we estimate the

trade deficit at USD 268 bn, higher than USD 245 bn in FY24. CAD/GDP is estimated at

1.1% for FY25.

Exports remain steady:

Headline exports at USD 39.2 bn grew by 13.4% MoM, with non-

oil exports higher at 16.0% MoM at USD 34.6 bn. Oil exports declined by 3.2% MoM to USD

4.6 bn in October vs USD 4.7 bn in September 2024. Of the total 31 items, 8 items registered

sequential declines. Within agriculture exports, coffee (-27.2 % MoM) and oil meals (-11.9%

MoM) registered highest sequential dips while oil seeds (69.9% MoM) and rice (51.4%

MoM) registered highest gains. Engineering goods accounting for the highest share in

exports increased by 14% MoM to USD 11.2 bn whereas electronic goods exports jumped

by 65.7% MoM to USD 3.4 bn. Within labor intensive products, handicraft & carpets exports

declined by 5.3% MoM while gems & jewelry exports grew by 15.2% MoM. Plastic &

linoleum exports grew by 2% MoM, lower than 3.7% MoM in September 2024.

Imports register growth both on YoY and MoM basis:

At USD 66.3 bn, imports increased by 19.8% MoM in October 2024. Oil imports rose by 45.9% MoM

to USD 18.3 bn vs USD 12.5 bn in September. Gold imports jumped up by 62.2% MoM to USD 7.1 bn after a 56.3%

MoM decline last month (September: USD 4.4 bn). NONG imports increased by 6.5% MoM

to USD 40.9 bn. In the first seven months of FY25, NONG is at USD 275.6 bn compared to

USD 264.6 bn same period last year. Within the NONG imports, chemical material &

products +13.1% MoM), leather & leather products (+4.1% MoM), wood & wood products

(+7.5% MoM) and machinery& electrical equipment (+2.3 MoM) have registered sequential

growth while machine tools (-0.6% MoM), electronic goods (-1.4% MoM), transport

equipment (-1.3% MoM) have registered sequential declines. Within agricultural goods

imports, vegetable oil (+35.6% MoM), pulses (+40.9% MoM) and fruits & vegetables

(+32.1% MoM) registered a sequential rise.

Services balance improves:

Services exports increased by 4.4% MoM in October 2024 to

USD 34 bn vs USD 32.6 bn in September. For October 2024, services imports were at USD

17 bn (+3.0% MoM), leading to a net services surplus of USD 17.02 bn in October (vs USD

16.07 bn in September). Overall, net services receivables at USD 101.4 bn in Apr-Oct FY25

grew by 12% YoY compared to the same period last year.

CAD/GDP likely at 1.1% in FY25:

Trade deficit widened to USD 27.1 bn in October driven majorly by higher gold and crude oil imports.

Gold prices reached an all-time high of USD 2784/ oz on 30th October weighed by (i) start of rate cutting

by the major central banks (ii) geopolitical tensions, and (iii) uncertainty with regard to US Presidential election.

Post the election results, gold prices reversed some gains trading down by 4% MoM in November

MTD. However, we are not expecting any sharp correction in the gold prices and expect it

to trade in a tight range given the continuing geopolitical tensions. Similarly, crude oil

prices have retraced from the recent high of USD 81 pb touched on 7th October 2024 as the

global demand concerns weigh on the prices. In its recent report, OPEC has revised down

the world oil demand and expects to rise by 1.82 mn bpd in 2024, down from growth of

1.93 mn bpd it expected last month. The upside risk to crude oil prices comes from China

stimulus that has had only muted impact till now on the commodity market. On the other

hand, exports and NONG imports have performed relatively better. However, it needs to

be closely monitored to see if the momentum sustains considering likely growth

moderation in the major economies and tariff measures that will be initiated by the new

Trump administration.

Based on the assumption of USD 80 pb on crude oil prices, trade deficit is expected to

worsen to USD 268 bn in FY25. Correspondingly, CAD is expected at USD 43 bn (1.1% of

GDP). The recent FPI outflows from the equity market brought depreciation pressure on

USD/INR that has been trading nearly steady at sub-84.00 level. We expect the depreciation

pressure to continue and expect USD/INR to reach 85.00-85.25 level by March 2025.