India’s trade deficit widened to US$ 23.5bn in Jul’24 from US$ 19 bn in Jun’24

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, August 16, 2024: India’s merchandise trade deficit was higher, as imports have risen at a sharper pace than exports

(both on sequential and cumulative basis).

India’s Foreign Trade: FYTD25

The sequential increase in imports is attributable to non-oil non-gold imports, signaling resilient domestic demand.

However, the cumulative picture gives a better picture. The increase in imports on a cumulative basis is led by oil imports,

as prices have increased during the same period and Apr-Jun data also suggests lower discount from Russia. Going forward,

we expect some correction in the trade deficit as some revival in the export cycle cannot be ruled out.

Easier monetary conditions are expected to boost demand conditions globally. On capital account as

well, comfort is already seen in FDI and FII flows. A favourable interest rate differential for India and

comparatively better growth dynamics than major EMs will help in maintaining a stable external

position. Overall, we expect CAD to be in the range of 1-1.5% in FY25. INR will remain rangebound and

with Fed’s rate cut cycle, some appreciation bias will prevail.

Trade performance in Jul’24: India’s trade deficit widened to US$ 23.5bn in Jul’24 from US$ 19 bn in

Jun’24. This inflated deficit is attributable to faster pace of increase in imports which grew by 7.5% in

Jul’24, on YoY basis to US$ 57bn. The increase in imports is led by non-oil non-gold components, which

signals recovery in domestic demand. However, on a seasonally adjusted (SA basis), sequential

increase of imports is much lesser at 1%. Exports on the other hand, fell by 1.5% to US$ 34bn, albeit a

lower base. Even on a SA basis, fall in exports is sharper at -2.7%.

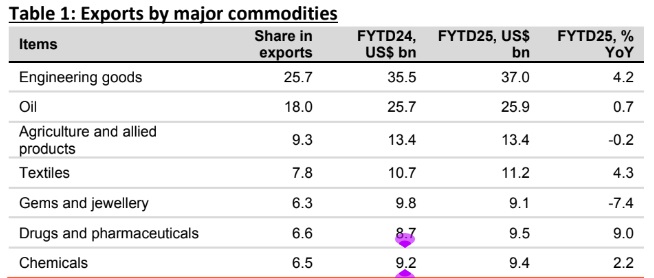

Trade performance in FYTD25: Exports improved by 4.1% in Apr-Jul compared with a decline of 13.1%

in same period of previous year. In terms of commodity wise exports, improvement was led by oil

exports, mainly a price driven phenomenon. Even agriculture exports witnessed momentum, led by

tobacco, coffee, tea and protein-based items. Higher inflationary pressure in cereals has kept a lid on

exports of cereals. Textile exports also picked pace and is likely to witness further growth in the coming

days as some political unrest in Bangladesh may lead to some shift.

Imports on a cumulative basis have picked up at a faster pace than exports by 7.6% versus a decline

of 13.7, seen last year. The increase is attributable to increase in oil imports to US$ 65.3bn compared

to US$ 53.7bn in the corresponding period of pervious year. During the same period, international oil

prices have risen by 8.2%. Further, lower discounts from Russia have also impinged on India’s oil

import bill. During Apr-Jun of FY25, unit value of India’s oil import from Russia is at US$ 609.3/ tonnes

which is higher than US$ 478.9/tonnes seen in the same period of previous year. In fact, the unit value

of oil imports from Iraq is now ~US$ 8/tonnes lower compared to Russia. Ceteris Paribus, if 10% of

Russian oil is shifted to Iraq, ~ US$ 2.5-3bn will be the savings in India’s oil import bill.

Gold imports have moderated perhaps mainly on account of shrinkage in volume as higher prices

during the same period deterred demand. Among major non-oil non-gold imports, electronic goods

have registered double digit growth reflecting some pick up in discretionary spending of consumers.

Imports of pulses have also magnified to support domestic production and keep a lid on inflation.

Outlook: The current run rate of merchandise trade deficit in FYTD25 is higher at US$ 85.6bn

compared to US$ 75.1bn in the same period of last year. If the same run rate is maintained for the

remaining half of the year, there would be some upside risk. However, going ahead, some correction

might be witnessed. Export cycle is expected to revive as Fed hints at embarking on its rate cut cycle

in Sep’24. This in turn will support global growth that is exhibiting some bit of patchiness, especially

China and Eurozone. Softer commodity prices will lend support to imports.

Policy continuity has helped in maintaining momentum of FDI. This is further complemented with

higher FPI flows in the wake of index inclusion. India still has an advantage in terms of interest rate

differential with US and stable growth dynamics compared to major EMs. All this suggests India’s

external position is well cemented. This along with RBI’s efforts to keep rupee afloat suggests that INR

will remain rangebound.

Overall, we expect India’s CAD to be within a range of 1% to 1.5% of GDP in FY25.

Services trade balance: Services exports have increased at a buoyant pace of 9.9% to US$ 117.3bn in

FYTD25. Services imports also increased at a sharper pace of 6.3% to US$ 62.9bn, thus balance

expanded to US$ 54.4bn from US$ 47.6bn. On a sequential basis, there have not been much

momentum in services trade balance.