Services exports declined by 0.6% MoM to USD 30.2 bn

Indranil Pan & Deepthi Mathew,

Economics Knowledge Banking

YES Bank

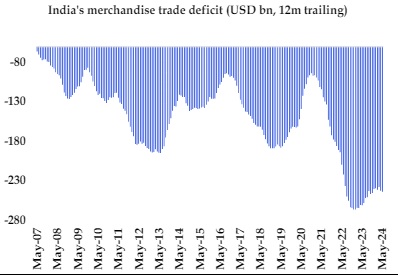

Mumbai, June 17, 2024: India’s Trade Deficit for May 2024 came to USD 23.8 bn vs USD 19.1 bn in April with sequential increases reported in both exports and imports. The widening was mostly on account of the relative strength in imports that increased by 14.4% MoM whereas exports grew by 9.0% MoM. Non-oil exports remained relatively strong at USD 31.4 bn whereas NONG imports came to USD 38.6 bn. Gold imports rose to USD 3.3 bn, reflective of the stickiness in the gold prices. Oil import bill came at a 26-month high of USD 19.9 bn. India’s services sector surplus came at USD 12.9 bn vs USD 13.7 bn in April. For FY25, we estimate the trade deficit at USD 249 bn, higher than USD 240 bn in FY24. CAD/GDP is consequently estimated at 0.5%.

Exports pick up on a MoM and YoY basis:

Headline exports at USD 38.0 bn, increased by 9.0% MoM, with non-oil exports registering a growth of 10.5% MoM to USD 31.4 bn. Oil exports increased by 2.4% MoM to USD 6.8 bn vs USD 6.6 bn in April 2024. Of the total 31 items, 24 items registered sequential increase. Within agriculture exports, tea (7.7% MoM), coffee (35.2% MoM), rice (5.5% MoM) registered sequential increases. Importantly, engineering goods accounting for the highest share in exports increased by 15% MoM to USD 9.9 bn. Labor intensive products such as plastic & linoleum, handicraft and carpets, gems and jewelry exports increased by 13.9% MoM, 19.1% MoM and 22.2% MoM, respectively.

Imports register a strong momentum:

At USD 61.9 bn, imports increased by 14.4% MoM. Oil imports grew by 21.2% MoM to USD 19.9 bn, highest in the last 26 months. Gold imports increased by 7% MoM to USD 3.3 bn, reflective of the higher prices in the global market. Non-oil-non-gold (NONG) increased by 11.9% MoM to USD 38.6 bn. Within the NONG imports, chemical material & products (+4.6% MoM), leather & leather products (+22.4% MoM), organic & inorganic chemicals (+15.2% MoM), machine tools (+11.4% MoM), electronic goods (+1.4% MoM) registered sequential increases whereas project goods registered sequential drop. Within agricultural goods imports, vegetable oil (+8.7% MoM) registered sequential increase whereas pulses (-9.8% MoM) and fruits& vegetables (-11.8% MoM) registered sequential drops.

Services balance worsens on higher imports:

Services exports declined by 0.6% MoM to USD 30.2 bn. Last month’s services export figures were revised higher to USD 30.3 bn from USD 29.6 bn. Though services exports have been a bright spot, we expect them to stabilize going forward. We remain cautious about the performance of the IT sector on account of the lower discretionary tech spending in the major markets. Services imports were at USD 17.3 bn (+3.9% MoM), leading to a net services surplus of USD 12.9 bn in May (USD 13.7 bn in April).

CAD/GDP expected at 0.5% in FY25:

Trade deficit widened to USD 23.8 bn with imports registering a growth of 14% MoM whereas exports grew by 9% MoM in May. The pressure on NONG is likely to continue given the strong domestic growth momentum and pickup in commodity prices. Though crude oil prices have retraced from the peak of USD 91.2 touched in April 2024 (in CY24), it continues to trade in a tight range weighed by the demand/supply dynamics in the global market. Given these developments, we are not expecting crude oil to fall below the USD 75-mark in the near term. India’s greater reliance on Russian oil could help to keep a check on the oil import bill. However, today’ spike in oil import bill could be indicative of India’s narrowing price advantage of importing Russian oil even when the volumes from Russia remain high. Similarly, the pressure on gold import bill may continue as gold prices are proving to be sticky on account of the safe haven demand and expectations of a US rate pivot soon. Exports performed much better than expected in the first two months of FY25. However, it needs to be closely monitored whether the momentum could be sustained going forward considering the lagged impacts of monetary policy tightening and continuing threats from geo-political tensions & geoeconomic fragmentation. Based on the assumption of USD 85 pb on crude oil prices, trade deficit is expected to worsen to USD 249 bn in FY25 (Exhibit 3). Correspondingly, CAD is expected at USD 18 bn (0.5% of GDP). Despite a higher trade deficit, CAD is expected to improve marginally in FY25, drawing support from a likely growth in invisibles.